Leading crypto analysis platform Santiment has reported that Bitcoin (BTC), the largest cryptocurrency, could experience a sharp rise depending on the movement of the US Dollar Index (DXY), a major macro indicator.

Investors Should Keep a Close Eye on DXY

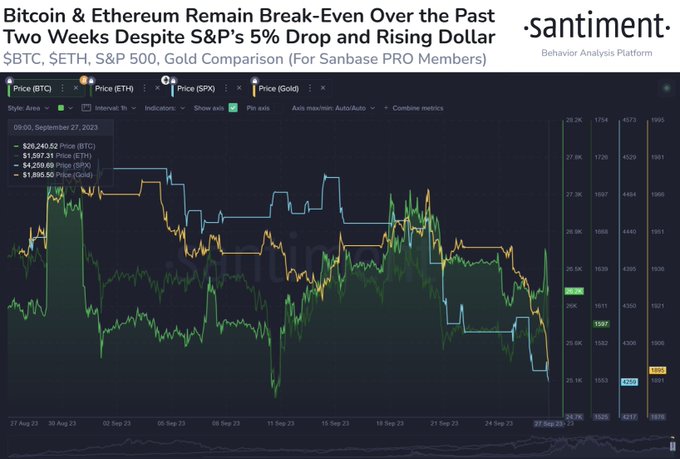

Santiment noted that DXY has reached its highest level in the past 10 months, causing a decline in the cryptocurrency market and the S&P 500 stock index.

According to Santiment, while the S&P 500 index dropped by 5% during the same period, Bitcoin remained flat for the past two weeks. The crypto analysis platform suggests that this could indicate a potential breakthrough when DXY stabilizes.

At the time of writing this article, DXY was at 105.7, while the largest cryptocurrency, BTC, was trading at $27,051. DXY reached its highest level in the past 10 months, at 106.839 on September 27. Since then, DXY has shown signs of retracement.

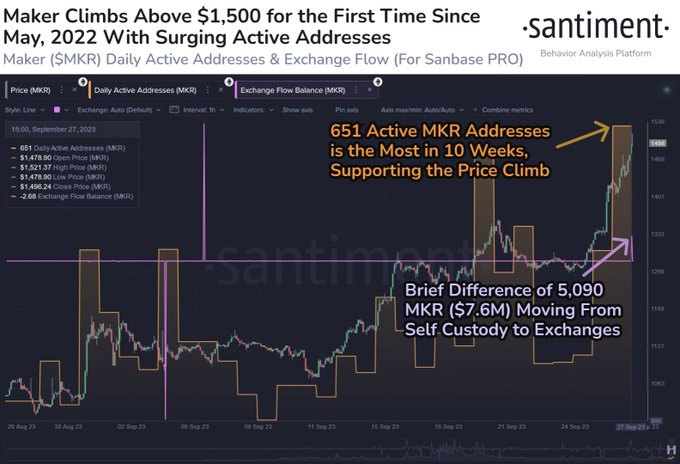

“Temporary Peak” Warning for Maker (MKR)

Santiment, which turned its attention to the altcoin market, highlighted the caution that should be exercised regarding MKR, the native asset of the decentralized finance (DeFi) project Maker Protocol, as it reached its highest level in the past 16 months with a rise of over 40% in less than two weeks:

The flow of MKR to cryptocurrency exchanges suggests that the price may have reached at least a temporary peak, cautioning investors to be careful.

Santiment shed light on the memecoin market as well, stating that meme coins like Dogecoin (DOGE) have seen a decrease in general investor interest since the local peak of the cryptocurrency market in mid-July. DOGE, in particular, has the lowest investor interest rate since 2020.