As this article was prepared, the Bitcoin  $94,699 price approached the $66,000 mark, while the drop in altcoins remains disappointing. Experts discuss whether the newly listed SCR Coin on the Binance exchange presents a buying opportunity. What do market data suggest about the future of cryptocurrencies? Today, we will examine various experts’ opinions.

$94,699 price approached the $66,000 mark, while the drop in altcoins remains disappointing. Experts discuss whether the newly listed SCR Coin on the Binance exchange presents a buying opportunity. What do market data suggest about the future of cryptocurrencies? Today, we will examine various experts’ opinions.

Is it Worth Buying SCR Coin?

Altcoin Sherpa has recently focused on the newly listed SCR Coin on the Binance exchange. The number of newly listed altcoins is increasing daily, far surpassing the figures from 2021. However, the market capitalization of all cryptocurrencies remains at low levels, resulting in reduced liquidity for many older altcoins.

Following its listing, SCR Coin experienced a decline and is searching for new lows. The reason for this drop, according to analysts, is due to overvaluation that leads to rapid abandonment of these altcoins.

“New Binance coins used to be actively traded for profit, but current valuations are excessive. Addressing the disconnect between private and public valuations may reveal some changes. When valuations are perceived as excessively high, individual users—your strongest supporters—find little incentive, leading to market declines.”

Where Are Cryptocurrencies Headed?

Today’s evaluations indicate that Bitcoin’s price, which has not surpassed $67,000, may face further declines. Currently, Bitcoin has dipped below $66,000. The U.S. economy is not performing well, as housing sales have significantly decreased to levels not seen in 14 years.

The proportion of first-time homebuyers has fallen to 26%, the lowest on record. The median sale price in September increased by 3% year-over-year to $404,500. At the current rate, housing stock could deplete within four months, posing inflation challenges. A stagnating housing market could negatively impact both the U.S. economy and cryptocurrencies.

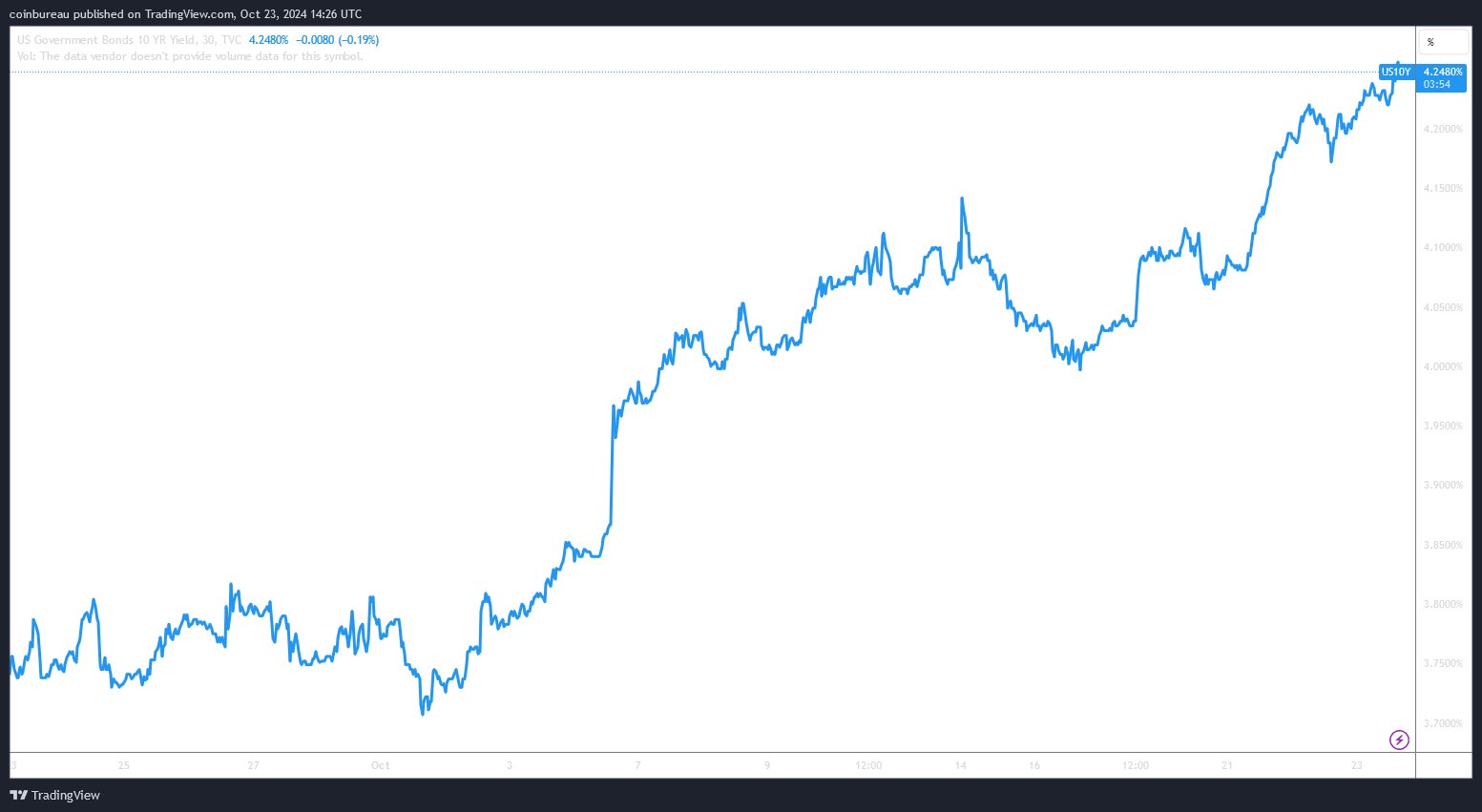

Recently, Paul Tudor Jones remarked, “All roads lead to inflation.” Ten-year Treasury yields have reached their highest levels since July. Nic wrote in his latest analysis:

“The market appears concerned about long-term persistent inflation caused by record debt levels. Paul Tudor Jones is correct—all roads lead to inflation.”

Türkçe

Türkçe Español

Español