Markets took a big hit over the last two days due to legal attacks by the Securities and Exchange Commission (SEC), resulting in double-digit losses for investors. So far, the SEC has declared 37 altcoins to be securities, a number that has risen to over 50. Is there a hint as to which altcoins the SEC will not sue? Indeed, there is.

Safe Cryptocurrencies

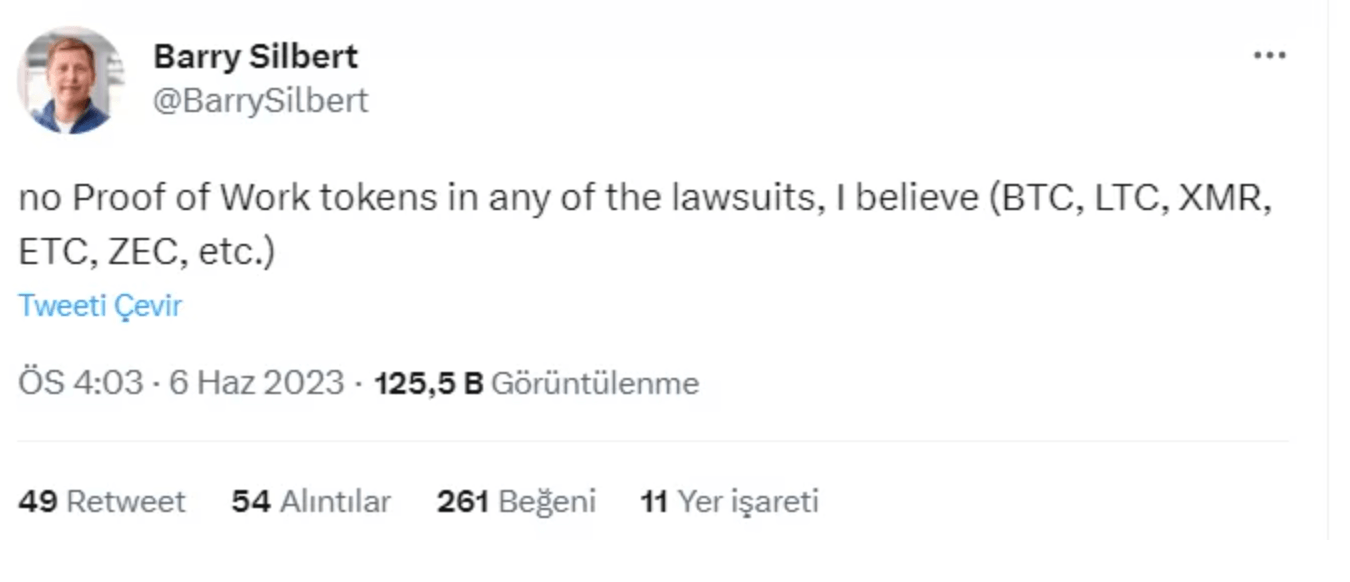

A few minutes ago, DCG founder Barry Silbert stated that PoW tokens (BTC, LTC, XMR, ETC, ZEC, etc.) are not involved in any SEC lawsuit. The SEC had previously classified SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI as securities while suing the Binance exchange.

While suing Coinbase, the SEC identified SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO tokens as securities. The agency, which had previously made this decision for 37 altcoins, including FIL Coin, is rapidly increasing the count. So where will it stop? Gensler says almost all of the 20,000 altcoins are securities or investment contracts.

However, there is no uncertainty regarding Bitcoin  $91,967. The SEC and the CFTC already agree that BTC is not a security. There is a dispute about ETH because last year Gensler said the PoS transition might have converted ETH into a security.

$91,967. The SEC and the CFTC already agree that BTC is not a security. There is a dispute about ETH because last year Gensler said the PoS transition might have converted ETH into a security.

As PoW-based altcoins are generally obtained by the investor through mining, they are considered decentralized. We may see mass lawsuits for most tokens that have done ICOs in the future. However, if Silbert is right, BTC and others can breathe easy.

Let’s open a small parenthesis: privacy-focused altcoins are under serious pressure from the US Department of Justice, even if they are PoW-based, the pressure on them seems to continue.

DCG on the Verge of Bankruptcy

Is it safe? DCG founder Silbert says they have not and will not incur the wrath of the SEC. The DCG executive, who must keep crypto alive to survive, is in a very difficult situation. Revenues have dropped significantly due to bear markets, and its subsidiary Genesis could not complete the bankruptcy process. Why did it go bankrupt? DCG could not pay its $600 million debt to its subsidiary Genesis. So, Silbert is praying every night for the cryptocurrency markets to rise.

These statements he made may also be intended to attract interest in Trusts indexed to the price of PoW-based cryptos offered through Grayscale.