When Spot Bitcoin ETFs were approved, the whole world held its breath and began to predict where the market would go. On January 10, 2024, although the price experienced a sharp rise in the first hours of trading, it later plummeted, disrupting the entire market. By March, everything had reversed, and Bitcoin had repeatedly hit new all-time highs. Following this process, attention turned to Spot Ethereum ETFs.

Current Status of Ethereum ETFs

Before the week of May 23, there was great uncertainty about spot Ethereum ETFs. After news was suddenly announced by leading ETF analysts, expectations soared, and all eyes turned to the approval.

The analysts’ prediction came true on May 23, and the SEC gave its initial approval, moving the process to the completion of S-1 documents. Recently, this phase was also completed, and it was stated that trading would begin on July 23.

Chicago Options Exchange confirmed this in a recent announcement. CBOE stated that 21Shares, Fidelity, Vaneck, Invesco & Galaxy spot Ethereum ETFs would begin trading on Tuesday, July 23, 2024.

What is the Price of Ethereum?

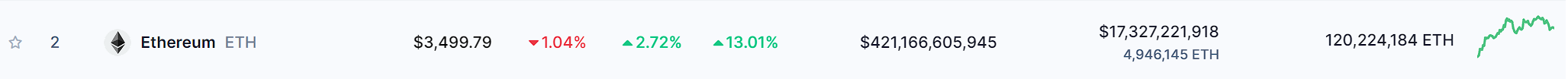

Following this announcement, attention turned to the price of Ethereum. Bitcoin’s price reaching $67,000 after a month also pushed Ethereum’s price upward. Ethereum is trading at $3,499 after a 2.72% increase in the last 24 hours.

Although Ethereum’s price has risen by 13% in the last 7 days, it saw a 1% decline in the last hour, which can be considered a minor pullback.

Following the price increase, Ethereum’s market cap has once again surpassed $420 billion. On the other hand, Ethereum’s 24-hour trading volume is at $17.4 billion after a 12.6% increase, indicating growing interest.

Türkçe

Türkçe Español

Español