With the approval of the Ethereum ETF, altcoin investors are now eyeing new ETF approvals, and there is an ongoing process. Already, two ETF issuers have applied for a SOL SPOT ETF. The move to apply for Solana right after Ethereum is motivating for the Solana community. So, is there a chance of approval?

Will Solana ETF Be Approved?

ETH approval has nullified many of the SEC’s rejection excuses on paper. The courage of ETF issuers applying for SOL Coin stems from this. However, giants like BlackRock and Fidelity prefer to stay back on this matter. It is uncertain how the SEC will approach SOL Coin, and challenges are already emerging.

We can summarize the stringent regulatory requirements for SOL ETF in bullet points.

- Regulatory Compliance: Regulatory hurdles must be overcome for SOL ETF approval, and the SEC has previously classified it as a security, complicating the process. Unlike ETH, which had uncertainty, the SEC has not definitively stamped it as a security or investment contract. Solana must show serious compliance with existing financial regulations, unlike BTC and ETH. Clear solutions must be provided for anti-money laundering and know-your-customer requirements within the network.

- Investor Demand: Although the SEC will give the approval, market maturity for the ETF is closely monitored. Institutional and individual interest must be proven with volume, active wallet numbers, and sufficient liquidity depth.

- Custody Solutions: Custodians need to take special steps to manage SOL assets.

- Liquidity: High liquidity is essential for every ETF.

- Transparency and Reporting: Regular and accurate reporting and network development work must be conducted.

Solana (SOL) ETF Potential

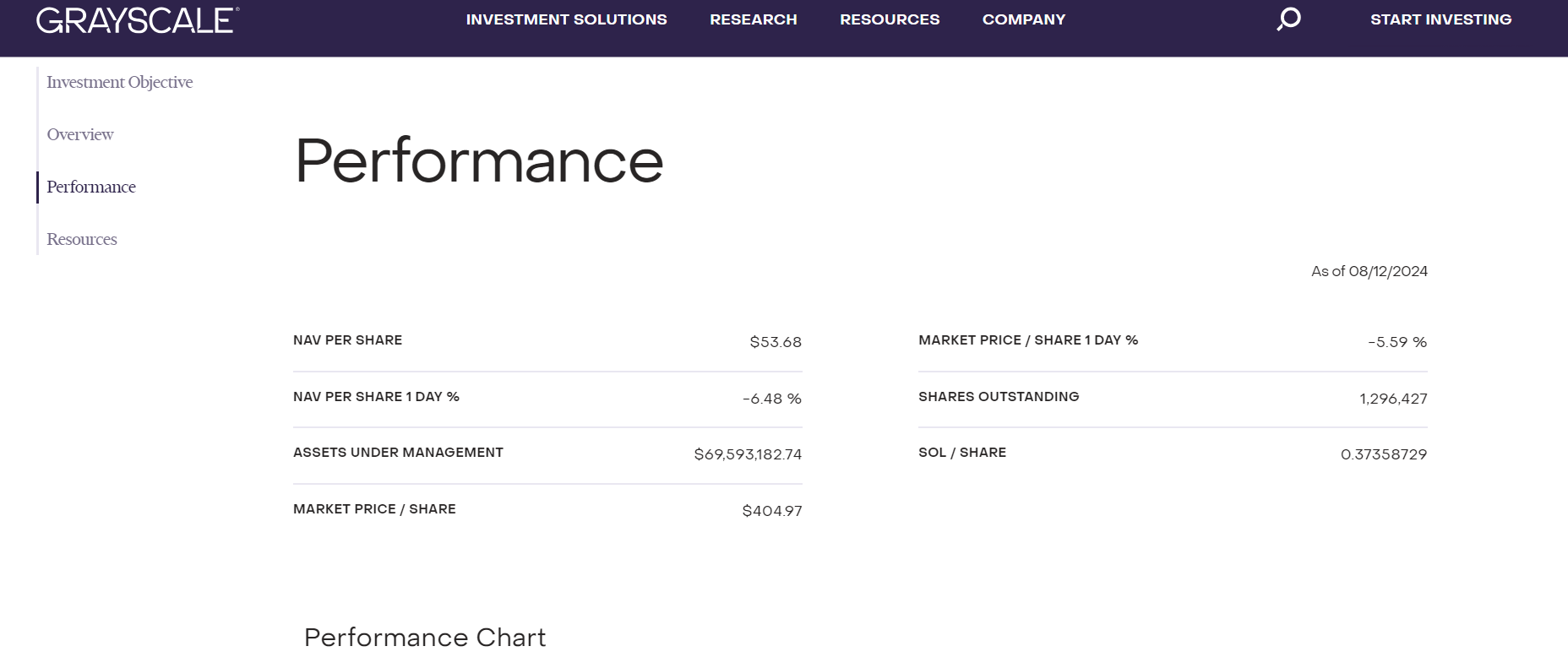

Grayscale Investments CEO Michael Sonnenshein is one of the most eager names on this issue. The company, which already has a trust for SOL Coin, would gain more if it gets ETF approval. With 1.2 million active users monthly, the Solana network is a more cost-effective and attractive network than Ethereum, according to the CEO, who defends this potential and also states;

“There is a continued appetite among investors to invest in Solana.”

SOL ETF has already received its first approval in Brazil, and QR Asset’s application has received preliminary approval. However, B3 approval is also needed for it to be officially operational in the country. In Europe, ETPs linked to SOL Coin and alternatives in Canada suggest that a consensus with regulators is possible, and the SEC might approve it as well.

Türkçe

Türkçe Español

Español