The Securities and Exchange Commission is holding another closed-door meeting with Ripple on August 1, as the market hopes for a possible resolution of the legal battle between the two entities. However, the cryptocurrency market continues to trend downward, and XRP’s price and trading volume have declined in the last 24 hours.

What’s Happening on the XRP Front?

At the time of writing, XRP was trading at $0.60, with the altcoin’s price dropping 6% in the last 24 hours. During this period, trading volume decreased by 27%, reaching a total of $27 million. The SEC had previously met with the crypto payment company on July 25. While the outcome of that meeting is still unknown, today’s meeting includes an additional item to be discussed from the July 25 Closed Meeting: the establishment and resolution of precautionary measures.

This has led market participants to speculate whether a resolution is near. Bitget Research Chief Analyst Ryan Lee commented on the matter:

“Possible settlement options for the Ripple case will be discussed at this meeting. Ripple Labs’ founder said a legal settlement could be announced soon. If an official settlement plan is released, it could positively affect XRP’s price movements.”

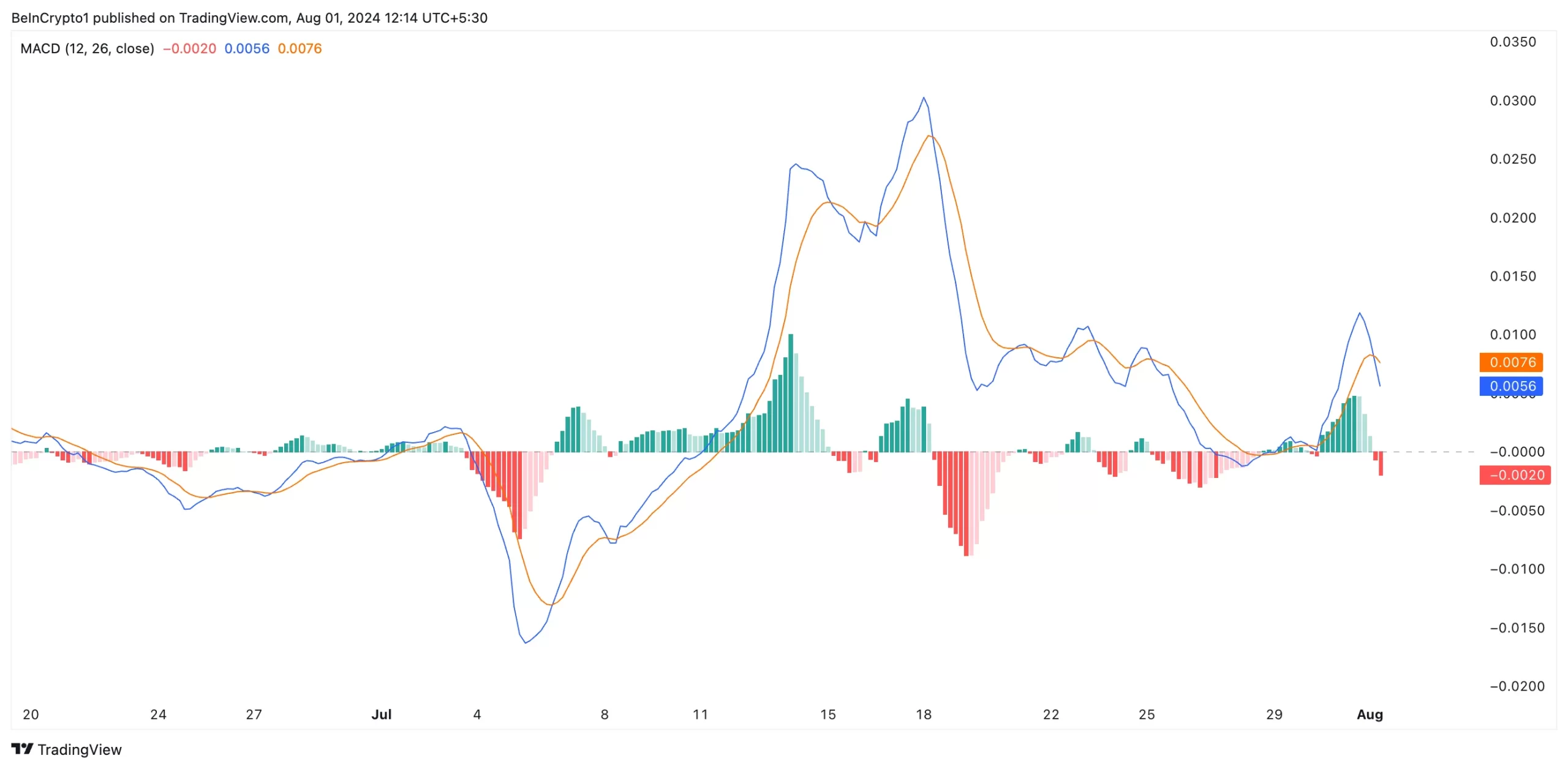

However, evaluating XRP’s price movements on a 4-hour chart shows an increase in the downward trend as the market awaits the outcome of this critical meeting. Readings from the MACD indicator show the MACD line (blue) crossing below the signal line (orange).

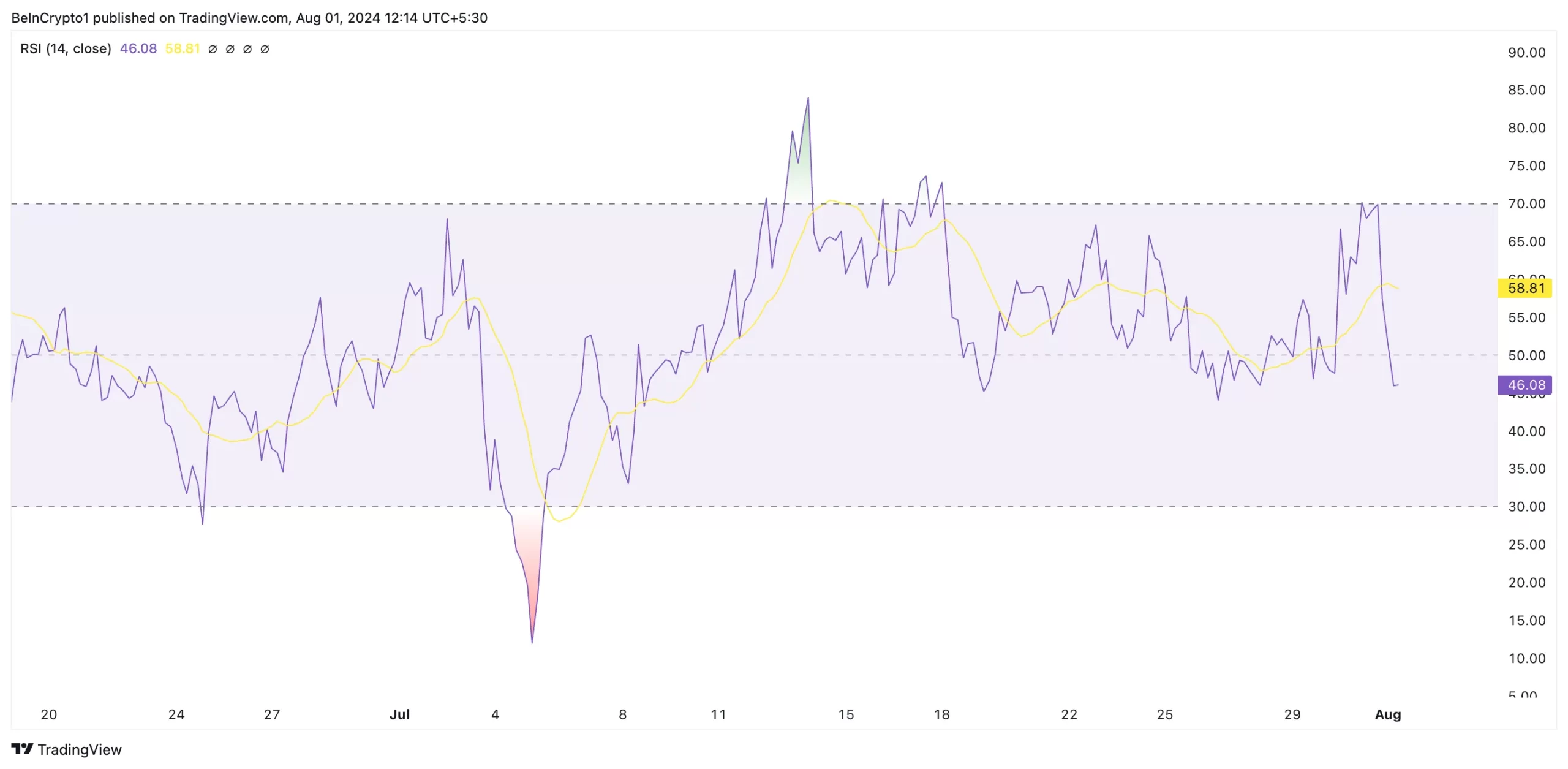

Investors use this indicator to gauge price trends, momentum, and potential trading opportunities in the market. When an asset’s MACD data is set this way, it indicates a bearish trend, showing that selling activity outweighs buying momentum. Additionally, the altcoin’s Relative Strength Index (RSI) is at 46.08, currently below the 50-neutral line and trending downward. This indicator measures overbought and oversold market conditions of an asset.

XRP Chart Analysis

XRP’s futures market also witnessed a decline in trading activities over the last 24 hours. According to Coinglass, futures trading volume fell by 18%, and open interest dropped by 10% during this period. Open interest refers to the total number of outstanding futures contracts, such as options or futures, that have not yet been settled.

When it drops, investors close their positions without opening new ones. This is a sign of a bearish trend, reflecting a lack of confidence in potential positive price movements. According to Lee, the outcome of the meeting with the SEC will significantly impact the token’s price movement. If the outcome is positive, the token’s price could rise to $0.75 in August. On the other hand, if a favorable decision is not reached, it could fall to the $0.50 price range.

Türkçe

Türkçe Español

Español