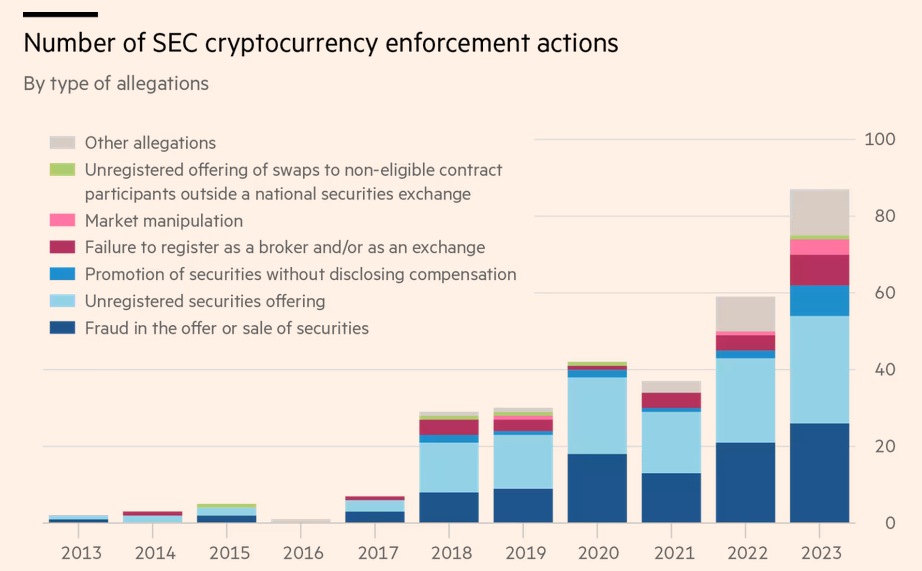

Last June, the announcement of lawsuits by the US Securities and Exchange Commission (SEC) against crypto exchanges Binance and Coinbase triggered a swift and severe reaction in the market. Investors withdrew approximately $800 million in assets from Binance in one day, while Coinbase lost more than a fifth of its market value within a week following the news. These events clearly demonstrated the volatility of the crypto market and the impact of regulatory concerns.

SEC Continues to Pressure Crypto Industry

The SEC’s pressure on the crypto industry continues unabated, with Robinhood being the latest target. The retail broker announced last week that it received a “Wells notice” from the SEC, which is a warning indicating the intent to initiate legal proceedings. Companies are given the opportunity to respond to Wells notices and defend their compliance with the law.

However, despite this news, investors were largely unaffected. Robinhood’s shares barely moved. The calm observed in the market is notable. Since Gary Gensler took over as chairman in 2021, the SEC has been intensifying its actions against crypto companies, launching an average of two cases per month.

These efforts are largely focused on the argument that nearly all cryptocurrencies should be considered securities. Consequently, crypto exchanges are acting like unregistered brokers and dealing with unregistered securities. However, exchanges argue that cryptocurrencies should be considered commodities.

Gensler’s Term Ends in 2026

Despite the intensity of legal proceedings and the collapse of FTX in late 2022, Bitcoin is progressing towards a new peak this year, recovering from its losses. Shares of Coinbase and Robinhood have tripled over the last 12 months, doubling their values. The approval of spot Bitcoin ETFs earlier this year has increased stock sensitivity.

However, investors might also believe that the top regulator on Wall Street will end this situation. Crypto enthusiast Donald Trump is running for a return to the White House. The outcomes of legal battles could take years. Additionally, Gensler’s term will end in 2026.

Increase in Robinhood Revenues

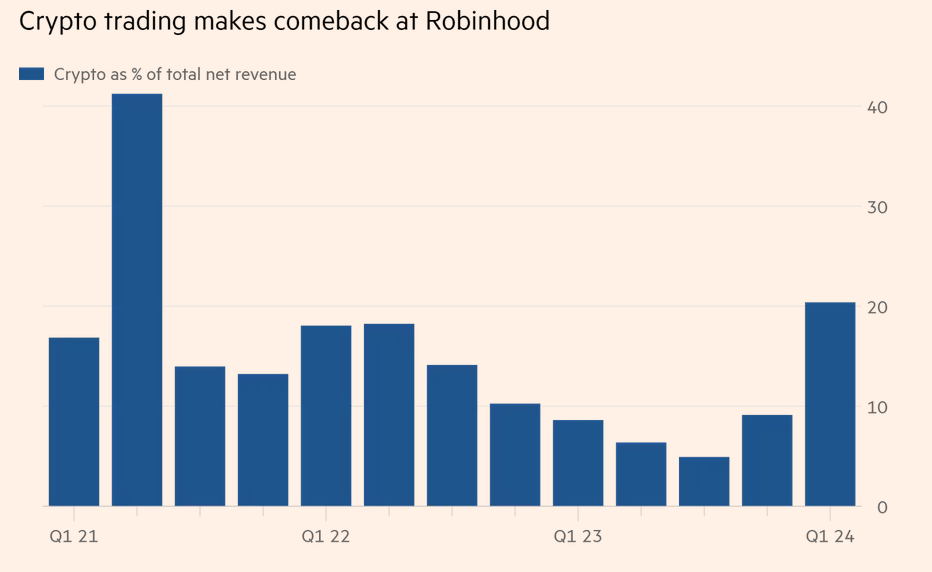

Investors should consider the legal risks in the rapidly growing crypto market a bit more. Recently, cryptocurrency trading has become a significant source of revenue for platforms like Robinhood. This week, particularly, stands out with record revenues achieved over a three-month period.

Crypto trading accounted for 20% of Robinhood’s total revenue in the first quarter, reaching a volume of $126 million. This figure represents a significant increase compared to the same period last year, rising from 8.6% to 20% of net revenue. Additionally, it surpassed revenue generated from stock trading, drawing attention. This increase in crypto trading also helped reach approximately 13.7 million active users, the highest level in nearly two years.

Türkçe

Türkçe Español

Español