Cryptocurrencies have been a contentious area for the Securities and Exchange Commission (SEC), which has faced criticism for its reluctance to establish clear rules. The SEC’s stance has been challenged in Congress, by crypto companies, in courts, and everywhere in between. Even judges have been seen mocking the SEC on this issue. Now, two SEC members are harshly criticizing their own agency, saying “we are doing it wrong.”

SEC Members Speak Out on Crypto Enforcement

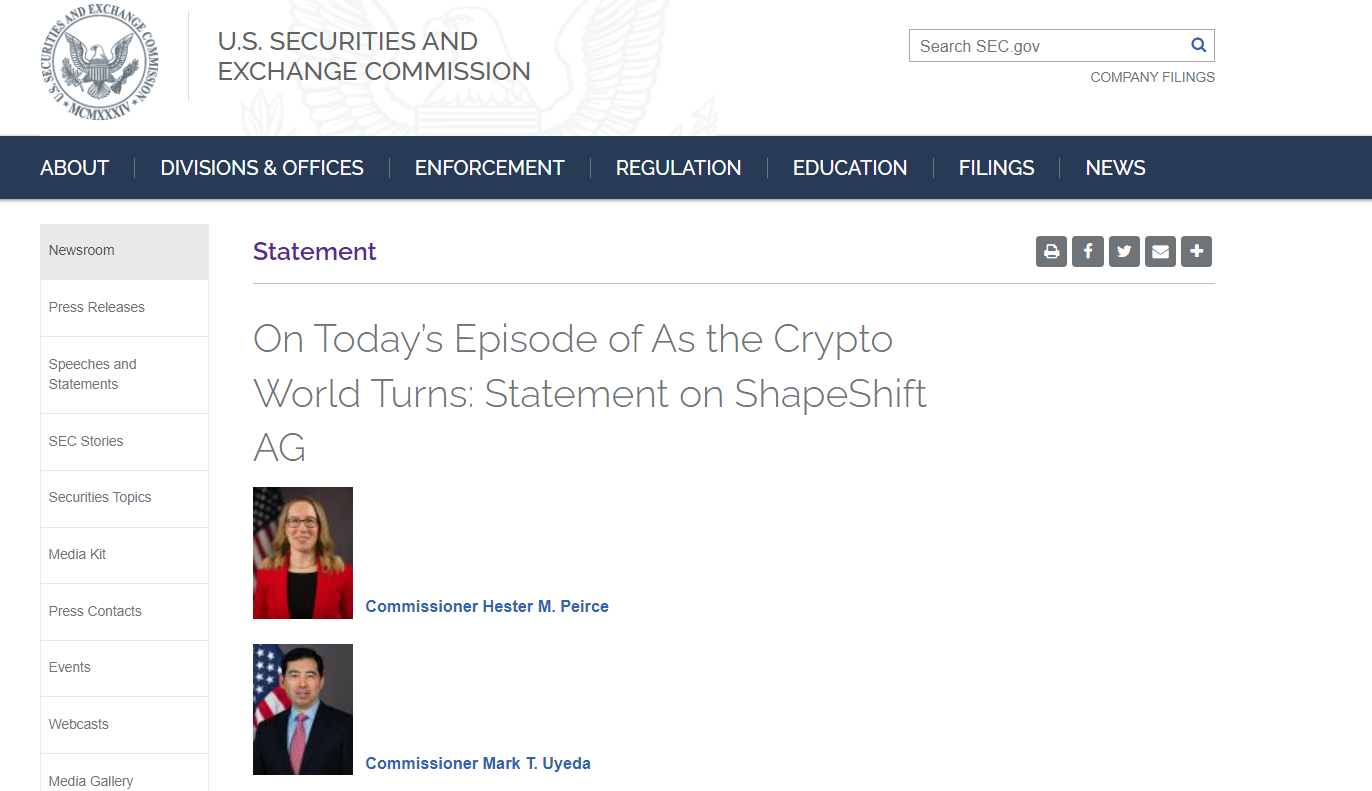

An article recently published features SEC members Peirce and Uyeda discussing the enforcement action taken against ShapeShift. Focusing on the SEC’s persistent failure to fulfill its role in crypto regulation, these two members, who are relatively more favorable towards crypto, are saying it’s time to take action. Peirce has been vocal about this for years.

“The Commission’s enforcement action against ShapeShift is the latest manifestation of the Commission’s poorly designed crypto policy. ShapeShift AG established an online platform in August 2014 to facilitate the trading of crypto assets. ShapeShift was selling from its own inventory, thus acting as a counterparty for both buyers and sellers, and generating revenue from the spread between the cost of acquiring a crypto asset and the price at which it sold the asset. ShapeShift operated in this manner for over six years before announcing a change in its business model in January 2021. Customers would no longer be able to trade crypto assets directly on the platform, and ShapeShift would no longer act as a counterparty in any customer transaction.”

The SEC found that this company violated Section 15(a) of the Securities Exchange Act of 1934, as it should have registered as a securities dealer. The Securities Exchange Act defines a dealer as “any person engaged in the business of buying and selling securities for his own account, through a broker or otherwise.” According to the Commission, ShapeShift fits this definition because “the crypto assets offered by ShapeShift are, in the SEC’s view, investment contracts and thus securities.”

However, the Commission’s Order fails to identify which crypto assets are investment contracts and provides no explanation for its conclusion. In summary, ShapeShift is in trouble because the Commission claims, without explanation, that an undefined portion of the 79 crypto assets traded between 2014 and 2021 are investment contracts.”

This enforcement action demonstrates just how terrible the Commission’s approach to crypto regulation is. ShapeShift still doesn’t know which altcoin is considered a security today. Moreover, no crypto company operating in the US region knows this. The SEC’s attitude seems to be fighting to end the crypto business in the region. There are invisible rules to comply with, and you could be in trouble for your business even after 10 years.

We are talking about such an absurd situation that “the SEC is against the SEC.” Two members have virtually rebelled against this situation in their recently published article.

The SEC and the Crypto Conundrum

To illustrate how foolish the process is, Peirce and Uyeda shared a hypothetical dialogue. The conversation between the SEC and ShapeShift is staged, resulting in the following fictional exchange.

- ShapeShift: Hello, I want to register as a dealer.

- SEC: Why?

- ShapeShift: Because I think some assets I plan to trade might be considered securities by the SEC at some point.

- SEC: Which ones?

- ShapeShift: I’m not sure because I really don’t understand the criteria you use to determine whether a token sale is a securities transaction and, if so, whether the token subject to the investment contract remains a security in secondary market transactions.

- SEC: If you don’t know whether you’re conducting a securities transaction, you can’t register. And by the way, if some of the assets you’re trading are not securities, you can’t register either.

- ShapeShift: Can you help us understand which assets are considered securities?

- SEC: No. We suggest you read our 2017 DAO report, so everything will be clear to you. You can also look at our enforcement actions if you want.

- ShapeShift: I’ve read it and you’re talking about enforcement actions. I have questions.

- SEC: Hire a lawyer.

- ShapeShift: I did, and the lawyer has even more questions.

- SEC: Sorry, we can’t be of more help than we already are. We do not provide legal advice.

Türkçe

Türkçe Español

Español