Cryptocurrencies entered a new path last year with the emergence of ETF expectations, leading to a period culminating in the approval of Bitcoin ETFs. On January 10, spot Bitcoin ETFs began trading, and the cryptocurrency world evolved significantly. During this period, record entries into ETFs were observed on the first day, and in the following months, BTC reached its all-time high before the halving. Now, with only days left for spot Ethereum ETFs to start trading, an important statement from an SEC official has drawn all attention.

Spot Bitcoin and Ethereum ETFs

The excitement in the cryptocurrency world continues with spot Bitcoin ETFs first starting to trade, followed by spot Ethereum ETFs. While discussions continue on where ETFs might go, an important statement was made by SEC official Haster Pierce regarding staking, a fundamental feature of cryptocurrencies.

Haster Pierce commented on the matter as follows:

I think definitely something like staking or any feature of the product… these are always open to reassessment from my perspective.

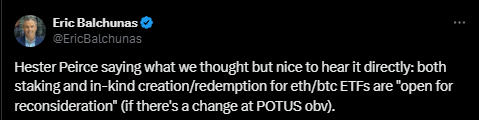

Renowned ETF analyst Eric Balchunas also made the following statement:

Hester Peirce said what we were thinking, but it’s nice to hear it directly: both staking and in-kind creation/redemption for eth/btc ETFs are “open to reassessment” (obv if there’s a change in POTUS).

Current Bitcoin and Ethereum Prices

Considering that the staking feature has not been warmly received so far, it would not be wrong to think that such a statement from an institution official could hold significant importance for the market and the future of cryptocurrencies. With spot Ethereum ETFs expected to start trading on July 23, how the future will shape up remains a topic of curiosity.

As of the time of writing, Bitcoin is seen trading just below $65,000, at $64,750, while Ethereum, ahead of the eagerly awaited spot Ethereum ETFs, continues to find buyers at $3,454 after a 2% rise in the last 24 hours.

Türkçe

Türkçe Español

Español