Cryptocurrency market companies have been under intense scrutiny by the SEC, which has faced a significant defeat in 2023. Last year, the SEC initiated numerous crypto investigations, including lawsuits against the two largest crypto exchanges by volume. Many of these investigations were concerned with crimes stemming from the perspective of SEC officials rather than fraud.

SEC Admits Defeat

A US Court has sanctioned the SEC for acting with “bad faith” in its case against Debt Box, highlighting the agency’s loss of credibility and biased actions. This incident has long occupied headlines and was cited as an example of the institution’s discriminatory behavior.

We now see that at least in this case, the SEC’s actions were certified as dependent on the “perspective of its administrators” rather than justice and rules. This is unacceptable for an institution like the SEC and validates some of the criticisms directed at it.

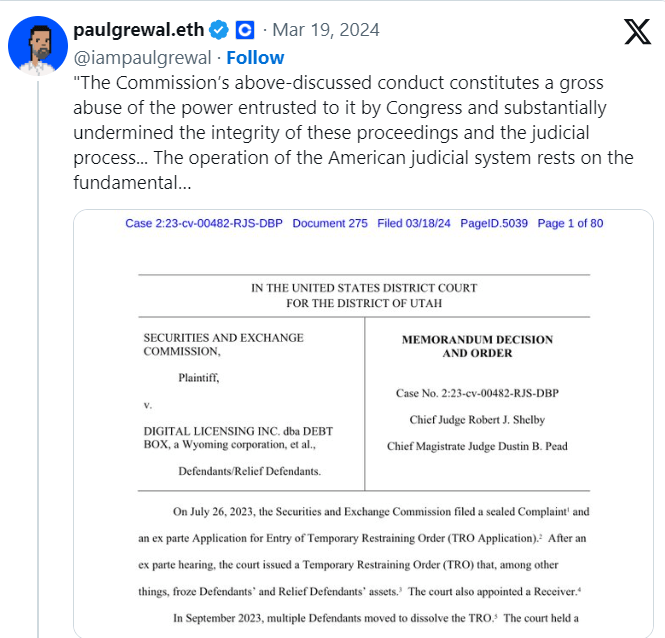

Initially, the SEC sought to dismiss the case unconditionally, but this request was denied by Judge Robert J. Shelby in a motion on March 18. Judge Shelby stated:

“The Commission’s behavior discussed above constitutes a gross misuse of the authority entrusted to it by Congress and has significantly damaged the integrity of these proceedings and the judicial process. The functioning of the American judicial system is predicated on the fundamental proposition that every party that comes before the court is bound by and adheres to the same set of rules.”

What Will Be the Impact on Cryptocurrencies?

Judge Shelby revisited his initial decision and ruled that the SEC had misrepresented evidence. The alleged transfer of $720,000 abroad and other evidence were deceptive. This could become a significant weapon for the ongoing Coinbase and Binance cases.

If exchange lawyers can effectively use this ruling, which proves the SEC acted with bias and undermined its credibility, the cases initiated by the agency could be dismissed.

Indeed, SEC commissioners Peirce and Uyeda recently stated that their agency has been trying to kill companies by creating a blind spot instead of setting clear rules on crypto. Given that the SEC’s lawsuits against exchanges involve ambiguously defined altcoins claimed to be securities, we might see market-favorable decisions.

Türkçe

Türkçe Español

Español