Important information started to surface in the past minutes. The SEC’s 13F reports, covering the world’s giant companies, have turned the entire cryptocurrency world’s attention to this point.

What are 13F Reports?

The SEC’s 13F reports can be defined as documents requested by the United States Securities and Exchange Commission (SEC) that include the securities portfolios of investment management firms covering quarterly periods.

The feature of the reports is that they provide information about the stocks and other securities held by large investment management firms (e.g., hedge funds, investment advisors, pension funds) with assets above a certain amount.

The specified amount is managing at least $100 million in US securities, which imposes an obligation on the mentioned companies. These reports are shared within the first 45 days after the end of each quarter.

13F Report and Cryptocurrencies

The size of ETF purchases made by companies that published the 13F report after Bitcoin ETFs came into play on January 10 has also started to emerge. So far, the investments made by 3 different companies have been reflected in the market.

The first of these was the investment by CITADEL ADVISORS LLC. The company disclosed the amount of spot Bitcoin ETFs it held:

Bitwise Bitcoin ETF: 140,371 shares ($5.433761M)

Fidelity Wise Origin Bitcoin: 211,058 shares ($13.098259M)

Invesco Galaxy Bitcoin ETF: 43,828 shares ($3.112226M)

Ishares Bitcoin: 440,709 shares ($17.835493M)

Additionally, the US-based fund company Boothbay also revealed that it had a massive spot Bitcoin ETF investment. The report presented by the company was as follows:

BlackRock Bitcoin ETF: $149,803,752 (3,701,600 shares)

Fidelity Bitcoin ETF: $105,502,000 (1,700,000 shares)

Grayscale BTC: $69,487,000 (1,100,000 shares)

Bitwise Bitcoin ETF: $52,258,500 (1,350,000 shares)

Moreover, Millennium Management also announced that it held $2 billion worth of Bitcoin ETF assets, attracting all the attention.

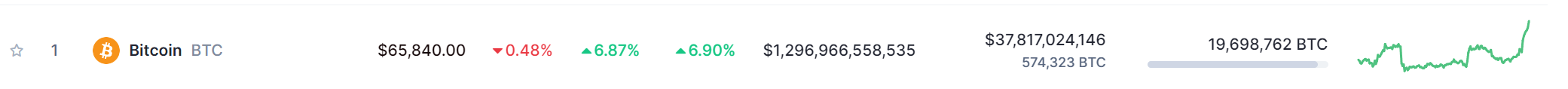

In the future, depending on the news about which companies hold what size of investments, a noticeable growth in Bitcoin price could also be among the expectations. As of the time of writing, the Bitcoin price continues to trade at $65,840, which appears to have emerged after an approximately 7% increase.