Crypto currency world witnessed a striking development today. Two democratic senators are intent on not standing by idly. They stated that more crypto ETFs should not be approved. If the SEC heeds the concerns expressed in the senators’ letters, the likelihood of approval for the Spot Ethereum ETF might decrease.

Spot Ethereum Approval May Be in Jeopardy

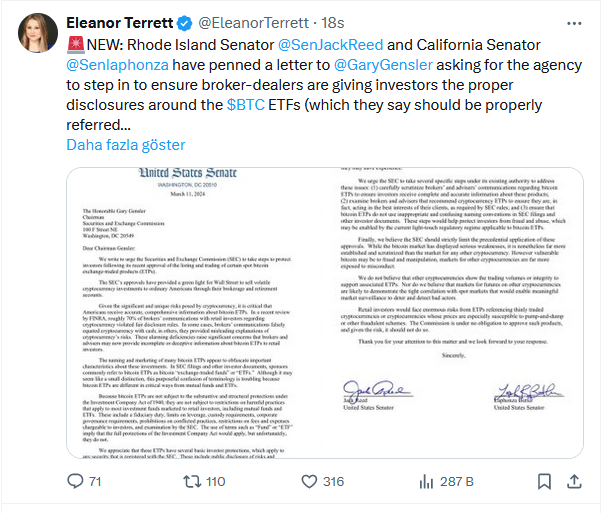

Democratic senators Jack Reed and Laphonza Butler sent a detailed letter to Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), urging him not to grant further approvals. The senators argue that approving crypto ETFs is a misguided move.

Bitcoin (BTC) price-tracking crypto ETFs were launched in the U.S. in January and this move triggered a bull run in the crypto market. The SEC’s Bitcoin ETF approval allowed many reputable investment firms, including BlackRock, Fidelity, and Ark21Shares, to provide their clients access to the most popular crypto asset.

Less than two months after their launch, these ETFs became one of the main catalysts for the price of Bitcoin, which reached an all-time high of $73,770 on Thursday.

Senators Believe SEC Made a Mistake

Jack Reed and Laphonza Butler stated that the SEC made a mistake by greenlighting crypto ETFs. In a letter dated March 11, Reed and Butler outlined various reasons why crypto ETFs pose a threat to the financial well-being of individual investors.

They also accused brokers of violating fair disclosure rules by intentionally concealing important information and using naming and marketing that seems to hide significant features of these investments.

Low Chance of Approval for Spot Ethereum ETFs

This letter comes at a time when reputable firms such as BlackRock, Franklin Templeton, VanEck are awaiting a decision from the SEC on eight spot Ethereum (ETH) ETFs by the end of May. ETF analyst Eric Balchunas, in an article at X, noted that the success of the Bitcoin ETF has disappointed top Democrats, leading to a pessimistic view regarding the approval chances of spot ETH ETFs.

The senators also mentioned that the SEC should slow down in approving other crypto ETFs. The letter stated that “although the Bitcoin market has shown serious weakness, it is still much more established and carefully scrutinized than other cryptocurrency markets.”

Reed and Butler also expressed their concerns that ETPs representing cryptocurrencies with low trading volumes would expose individual investors to high risks.

Türkçe

Türkçe Español

Español