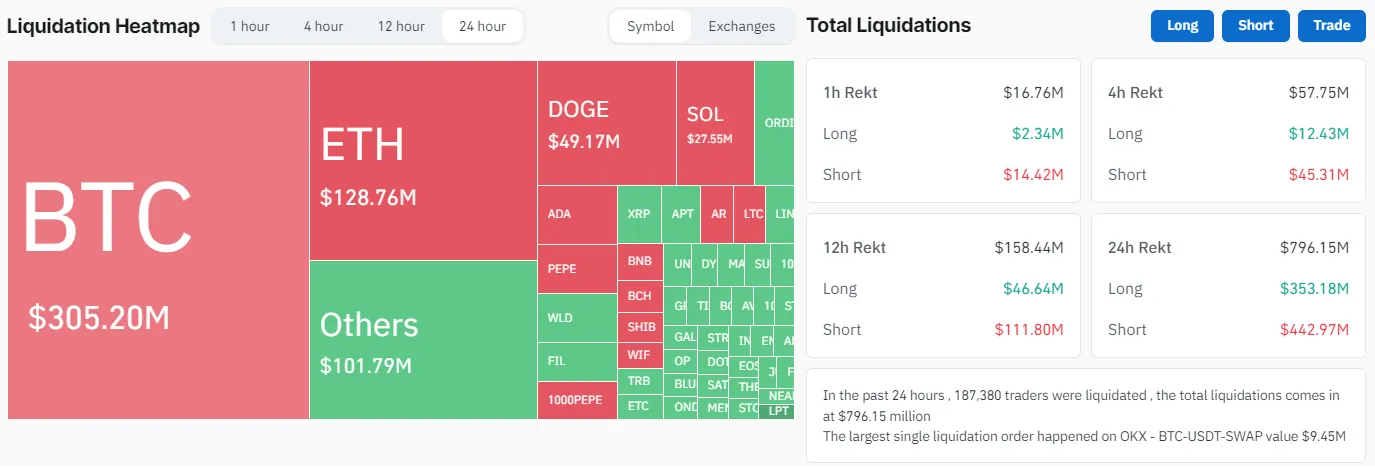

Bitcoin price suddenly retracted from the $64,000 level to $58,700 yesterday. The extraordinary fluctuations in the crypto market over the last 24 hours have led to serious liquidations among traders. A total of $800 million worth of positions were wiped out. This figure has been recorded as the largest daily liquidation event since August 2023. Let’s take a look at the liquidation figures.

Liquidations Follow Sharp Price Movements in Bitcoin

According to Coinglass data, this liquidation event represents the highest daily liquidation amount ever seen in the history of the crypto market. Significant increases in the values of major cryptocurrencies such as Bitcoin and altcoins like Ethereum were the trigger for this event.

As the flagship cryptocurrency Bitcoin reached around $64,000 and Ethereum around $3,500, leveraged investors suffered significant losses due to sudden price fluctuations. This led to the occurrence of the $800 million liquidation.

This incident, the largest liquidation event since August 18, 2023, occurred following news of Elon Musk’s SpaceX selling some of its Bitcoin assets. Normally, liquidations affect either long or short positions, but in this case, both positions were nearly equally impacted. At the time of writing, the Bitcoin price is at $62,784.

Coinbase Outages Come to the Fore

Service outages at major crypto exchanges like Coinbase are also being pointed out as a trigger for the event. Users were unable to access their accounts or make transactions during critical price movements. This created panic in the market, further intensifying the movements.

The Coinbase team responded quickly, assuring users that their assets were safe and that they were working to resolve the issue. However, it is evident that the incident has caused unrest in the market.

I believe there are lessons to be learned from this extraordinary liquidation event in the crypto market. In my opinion, it once again shows that traders need to manage their risks more carefully. Developing hedging strategies against volatility and being prepared for short-term price movements can prevent major losses in such situations. But one fact remains: yesterday’s volatility caught leveraged traders off guard.