Avalanche‘s (AVAX) burn rate showed a sharp increase last week, accelerating the rate at which tokens were removed from circulation. According to analysis of Avascan data, approximately 31,650 AVAX tokens were burned in the last seven days, with more than half of that amount burned on February 24 alone.

Burn Rate Surge in AVAX

The reported increase followed a period of stability where the daily burn rate was between 1,000 and 1,300 tokens. As a result, more than half of all tokens burned in the last 30 days occurred last week. Data obtained from the Avalanche explorer indicated that the rise in the burn rate followed a similar increase in network transactions. Current data suggests that Avalanche may be burning all revenue generated from transaction fees.

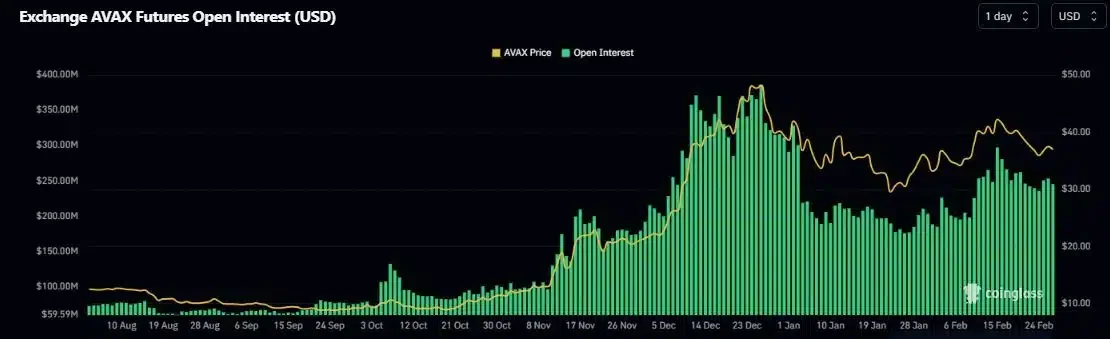

This could mean that the higher the network activity, the higher the fees and, consequently, the higher the amount of AVAX that will be burned. Generally, the burning activity can be interpreted as a bullish event due to the resulting supply constriction. However, last week’s increase failed to create upward pressure on AVAX. According to Coinglass data, open interest (OI) in AVAX futures fell by 18% over the last 10 days.

Expectations for an AVAX Uptrend

During the same period, the AVAX long/short ratio failed to surpass 1, which could indicate a dominance of bearish leveraged investors. Experts believe that examining AVAX’s daily chart provides interesting information about its next moves. The Relative Strength Index (RSI) tested the neutral level of 50 as resistance and retreated. Successfully surpassing this level could indicate an uptrend for AVAX in the coming days.

The Moving Average Convergence Divergence (MACD) line was below the signal line, which could indicate a pullback. However, experts believe that a bullish crossover appears reasonable and could be followed by a continued uptrend for AVAX. According to the 21milyon.com website, the ninth-largest cryptocurrency experienced a loss of 8.46% last week at the time of writing. The price drop in AVAX affected speculative interest in the token.