In the past 50 days, Shiba Coin has experienced significant losses, similar to other cryptocurrencies. The price has dropped by 35%. Bitcoin, at the time of writing this article, continues to stay below $27,000. The weakness in BTC price is concerning for altcoins.

Shiba Coin (SHIB)

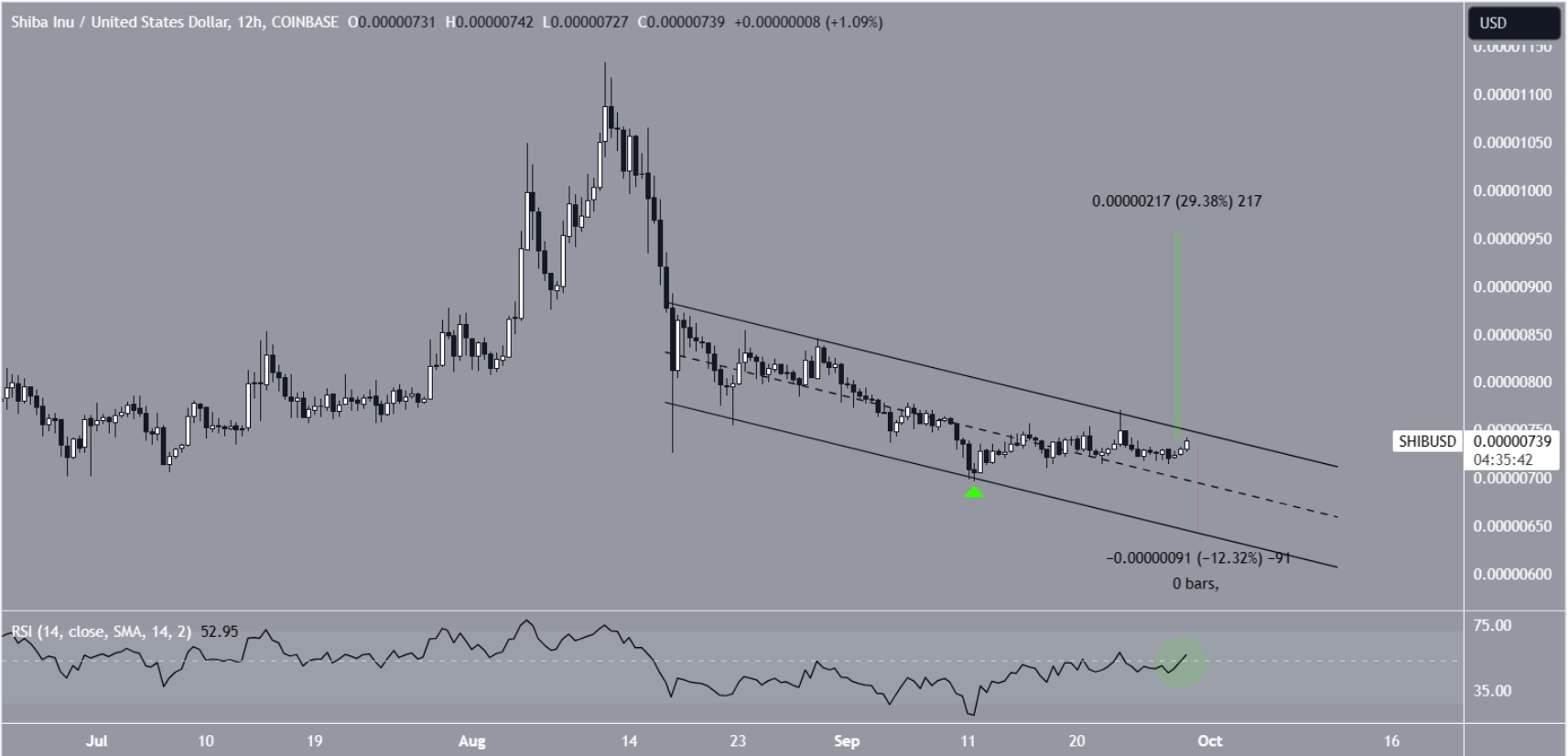

The second largest meme coin is fluctuating between $0.0000060 and $0.0000080 in the long-term range. In the short term, SHIB price is trading within a corrective formation. Macro data today was favorable for cryptocurrencies, and the upcoming ETH futures ETFs could bring positivity to the market. However, there is not enough demand in the spot markets despite these factors. This lack of demand is strengthening the resistances.

Technically, Shiba Coin continues its downward trend. The price, rejected by a declining resistance trendline in July, has fueled the ongoing downward movement. Breaking below the important horizontal support area of $0.0000080 has made it easier for sellers.

Shiba Coin Price Prediction

The negativity on the weekly chart has turned $0.0000080 into a resistance. The weekly RSI supports the downward trend, and the overall market sentiment indicates that bears are in control. However, the 12-hour chart offers some hope for bulls, albeit small. The main reason for this is that the price is trading at the upper part of a descending parallel channel. These channels usually contain corrective movements, meaning a final breakout is possible.

If the expected breakout occurs and the price surpasses the upper trendline of the channel, it could reach the long-term descending resistance line at $0.0000095, resulting in a 30% price increase. However, if the price moves in the opposite direction, it could lead to a rapid decline from the ceiling line. At the same time, the bullish scenario would be invalidated.

In the bearish scenario, we could see the price drop to $0.0000065. Since this area is a support trendline, closing below it could open the door to deeper lows.

Weekends are generally periods of low volume, and considering the lack of interest on the spot side, it is likely that volatility will increase in the downward direction. If Bitcoin does not make a significant positive divergence and surpass $30,000, experts predict that the price will drop to the range of $22,000-$20,000.

Türkçe

Türkçe Español

Español