When it comes to meme coins in the cryptocurrency market, Shiba Inu often comes to mind alongside DOGE for investors. The buzz this Saturday morning was due to a significant increase in the burn rate from the previous week. The transfer of 42.05 million SHIB to the burn wallet caught attention, showing the Shiba crypto community’s efforts to enhance SHIB’s tokenomics.

42 Million SHIB Burned

As these burning processes continue at full speed, Shiba Inu coin maintains a positive outlook, mirroring the increase in the burn rate. This modest yet positive uptrend sheds light on the substantial support from the meme coin community.

According to analyses, many cryptocurrency analysts maintain their optimism regarding SHIB’s short-term price outlook. It was also observed that Shiba Inu had started a gradual upward price movement as of the time of writing.

According to a post by Shibburn, which tracks the burns of Shiba Inu, 42.05 million SHIB were sent to a dead wallet on February 24th. Following the burn transaction, there was a 55.17% increase in the daily burn rate and a 113.62% increase on a weekly basis.

The rising burn rates seem to be reinforcing the SHIB community’s bullish expectations. It’s important to remember that 410.70 trillion SHIB have been burned from the initial supply by the community. Nevertheless, the current circulating supply still stands at 581.44 trillion SHIB.

There was also a new development in the SHIB ecosystem by SHEboshi. The SHEboshi DN404 test token was launched and sold out within hours, exciting the community.

Shiba Inu Price Jumps

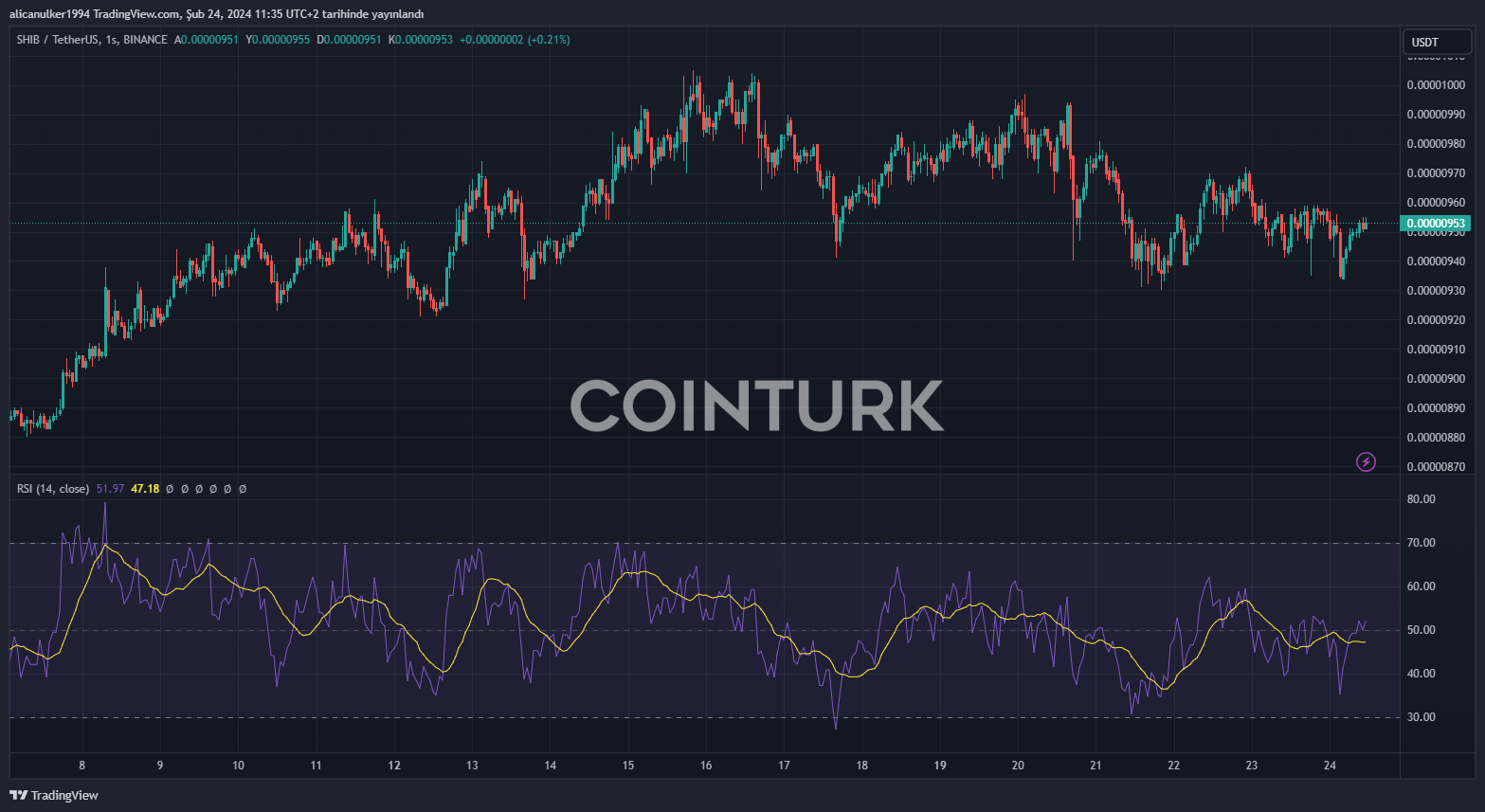

As of the time of writing, Shiba Inu’s price saw an increase of 0.28% in the last 24 hours, trading at $0.00000953. This jump reflects the community’s latest developments, including the increase in the burn rate and the instant sell-out of SHEboshi.

The upward performance seen last month may have set the stage for a significant price increase for SHIB in rising market conditions. The token had shown a notable rise after surpassing the $0.000010 level on February 16th, but had fallen again in line with the market.

Türkçe

Türkçe Español

Español