Crypto markets are nearing the end of a challenging April. But has the danger passed? The outlook remains uncertain with upcoming Federal Reserve messages, keeping investor concerns alive. In fact, recent data suggests that anxiety has increased.

Shiba Inu (SHIB)

As we can see from the red candles on the daily chart, Shiba Coin investors are not having a good time. The meme coin, showing no signs of an uptrend, is heavily affected by the ongoing general market negativity. Interest from whale groups and other investors is weak, and supportive projects like Shibarium continue to decline.

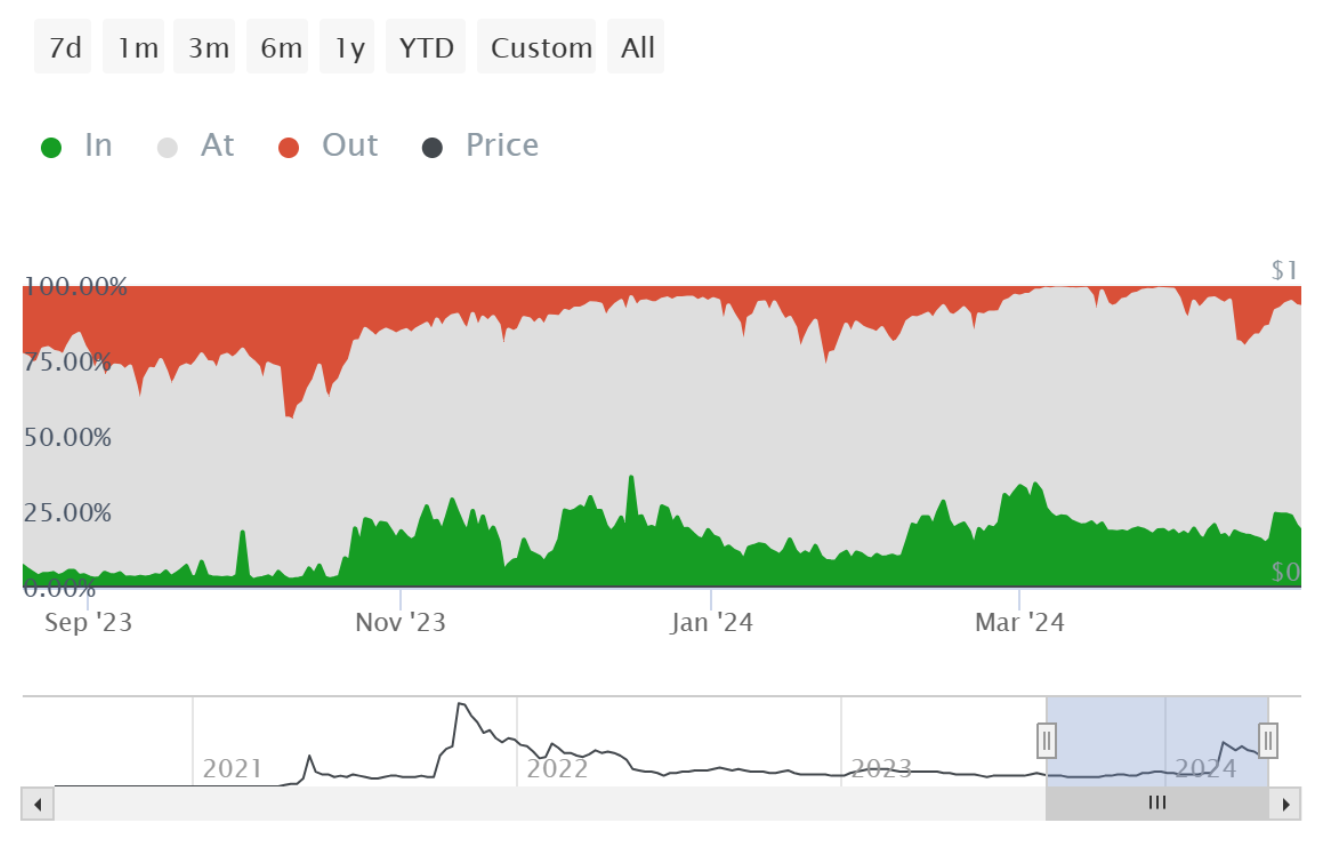

Currently, about 21% of investors transacting on the network are profitable. If a large portion of the assets moved on the network belongs to investors at a loss, several conclusions can be drawn.

- Investors at a loss tend to sell their current balances.

- The motivation behind the selling trend is the lack of expected short-term positive price fluctuations. If the rate of investors turning to selling trends increases like today, further declines are expected to continue for a while.

- Investors are reducing their risks as they expect BTC‘s post-halving downturn period to last longer than expected, possibly for months.

- Seeing the selling trend of investors at a loss, others will lose their appetite for risk at lower levels, likely deepening the losses.

Shiba Coin Predictions

The second largest meme coin, which has been moving in a decreasing channel for a month and a half, is priced at $0.0000247 at the time of writing. Shiba Coin bulls, unable to surpass the upper trend line, may have resigned themselves to a steady decline. Considering investor behavior and general market sentiment along with macroeconomic risks, we might again experience days when the lower trend line is tested as support.

If the expected scenario occurs, Shiba Coin’s price could drop to $0.00002039 entering May or at the beginning of May. Lower levels might also be seen below this.

However, bulls might attempt a bounce at the $0.00002268 support depending on the current market situation. And if the mentioned risks ease, it could rise again. In a scenario where the upper trend line is surpassed, the key resistance at $0.00002835 will be targeted.