Shiba Inu, self-described as the “Dogecoin killer,” is currently facing a technical tug-of-war, with bears pushing the price down while bulls cling to glimmers of hope. Analysts are examining the meme coin’s chart patterns and on-chain data to predict its next move.

Descending Triangle Formation

Recently, a descending triangle formation has appeared on SHIB’s 3-day chart. This pattern typically indicates a potential price drop as the asset’s price gets squeezed between approaching support and resistance lines. Thus, the critical question for SHIB holders is whether the price will break below the support level and continue the downtrend, or defy gravity and initiate an upward trend by breaking above the triangle.

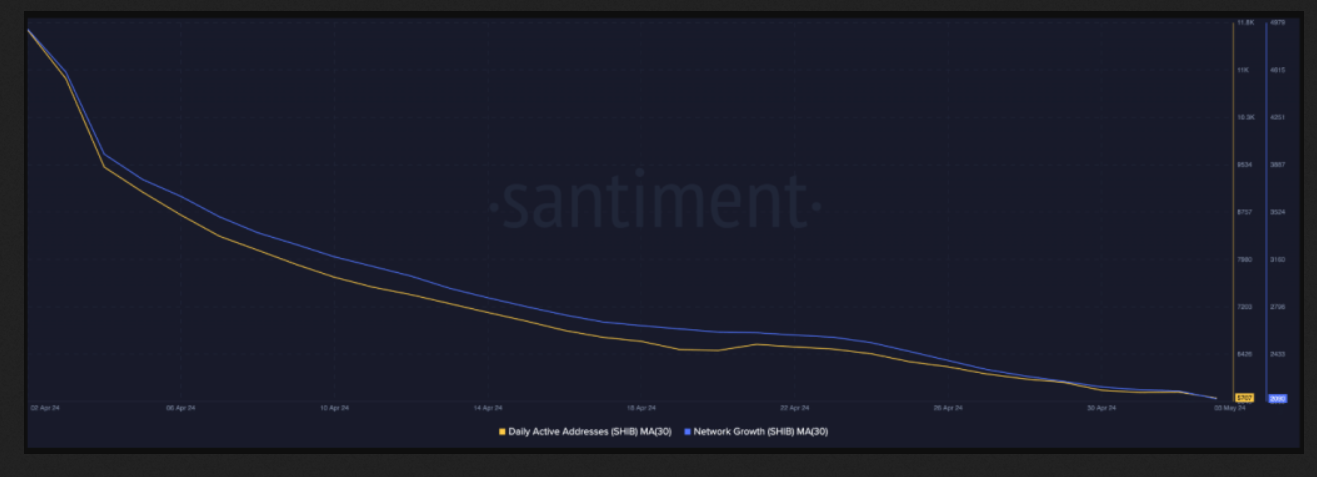

It’s important to note some recent data indicating SHIB’s downward trend. For example, data from Santiment shows that the number of daily active SHIB addresses has dropped by more than 50% last month. This suggests a contraction in the user base and a potential decrease in transaction volume, which could put downward pressure on the price. Recent developments could raise concerns about SHIB’s future performance.

New Investors Hesitant About SHIB

New investors joining the SHIB party are experiencing morale drops due to sharp declines. According to chain data, there has been a 51% decrease in the number of new SHIB wallet addresses created daily. This situation raises concerns that the lack of fresh capital entering the market could increase selling pressure.

Another concerning factor is SHIB’s Market Value to Realized Value (MVRV) ratio. This metric compares the current market price to the average purchase price of all SHIB tokens. Currently, SHIB’s MVRV ratio is near 38%. This high ratio indicates that the asset is overvalued and could encourage current holders to realize profits, thereby increasing selling pressure.

However, despite the downward trend, there appears to be a glimmer of hope for SHIB. The coin’s overall sentiment has recently shifted positively. This indicates an improvement in market perception. This newfound optimism could challenge the effects of the descending trend, signaling potential for a price breakout.

Could Rising Sentiment Boost SHIB’s Value Potential?

If the positive momentum continues, analysts foresee a potential increase in SHIB’s value, possibly reaching a price level of $0.00003. This new level could be a pleasing development for investors recently subjected to price drops.

However, considering factors like Fibonacci correction levels and bearish pressure, SHIB’s price could see a decline of about 15%, potentially bringing it down to $0.000018. This provides more reason for SHIB investors to start worrying as it highlights the potential effects of the downtrend.

Türkçe

Türkçe Español

Español