Popular meme token Shiba Inu (SHIB) experienced a notable increase in whale activity. According to data from the cryptocurrency analytics platform IntoTheBlock, the volume of large transactions over $100,000 increased by 295%. Here are the reports from crypto analytics companies!

Whale Activity in SHIB

The increase in whale activity indicates that large SHIB holders or whales are actively buying or selling large amounts of cryptocurrency. According to IntoTheBlock’s data, the large transaction volume, representing a 295% increase in the last 24 hours, consisted of 4.95 trillion SHIB worth $95.57 million.

The volume of the Shiba Inu network is higher not only in terms of the amount of SHIB tokens traded but also in terms of the amount transferred on the blockchain. According to 21milyon.com data, SHIB fell by 10.44% to $0.0000181 in the last 24 hours, and the trading volume increased by 156% in the specified time frame. However, the recent increase in large transaction volume could be a strategic move by whales to create a price floor aimed at stabilizing SHIB prices and preventing further declines.

Support Level in SHIB

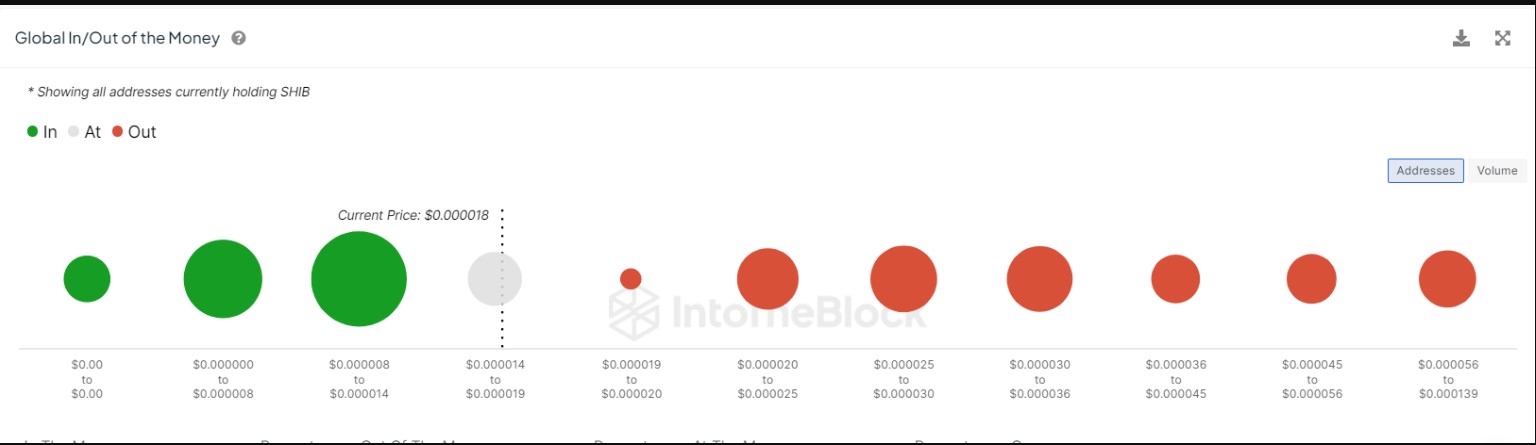

This is significant because Shiba Inu has reached a critical threshold where a large number of investors have purchased a significant amount of SHIB. According to IntoTheBlock data, 501.18 trillion SHIB were bought at an average price of $0.000016 by 80,950 addresses in the $0.000014 to $0.000019 range. Support levels are key price points where buying interest is strong enough to prevent further declines.

In this case, the 501 trillion SHIB range is particularly important due to the significant volume involved. If the whale-driven increase in large transaction volume defends the 501 trillion SHIB range, it could prevent further price drops and potentially lead to a recovery. This would be a positive sign for the SHIB price and indicate strong foundational support. Conversely, if the support level cannot be maintained, SHIB may experience further declines. This scenario would likely cause investors to seek new support levels in the $0.000008 to $0.000014 range, leading to a longer period of price fluctuation.

Türkçe

Türkçe Español

Español