Following the failure of bulls to break the $0.000009 resistance level, the price momentum of Shiba Inu (SHIB) has decreased this week. On-chain analysis sheds light on critical data points that could determine the future price movement of SHIB.

Double-Digit Gains for Shiba Inu (SHIB)

With the weakening of the bullish momentum, the price of Shiba Inu has entered a consolidation phase this week. Will the second-largest meme token by market value be able to break and recover from this point? In the last week of October, SHIB price recorded double-digit gains as the bullish trend in the Bitcoin (BTC) market spread to meme token markets. However, on-chain data analysis indicates that since Shiba Inu rejected $0.000008 on October 24, whales have reduced their trading activities.

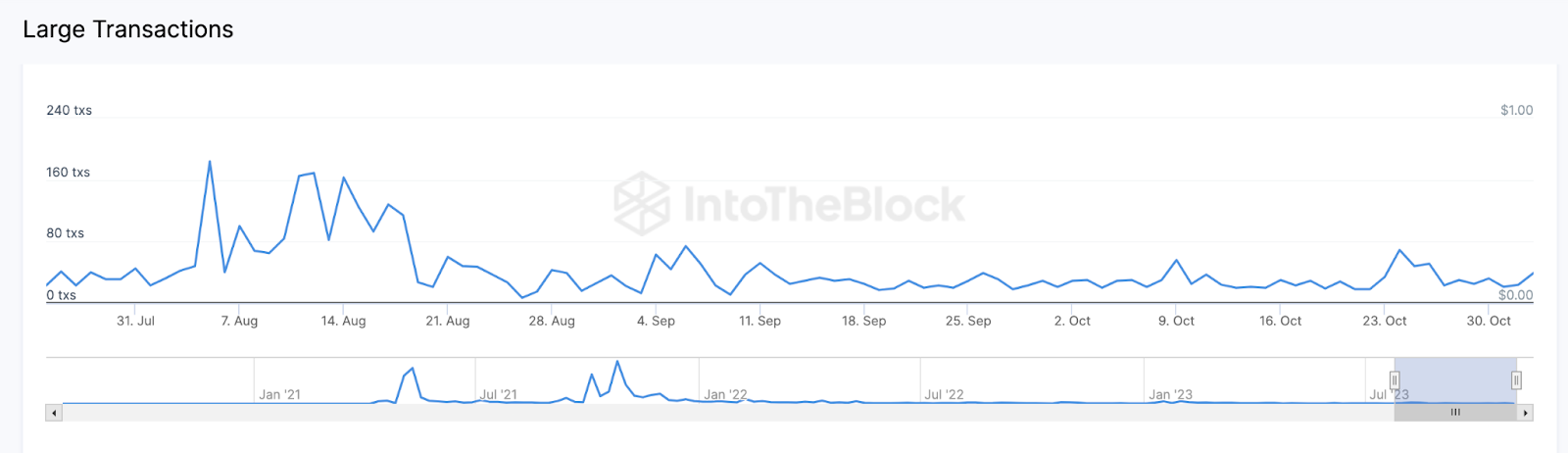

According to the analytics platform IntoTheBlock, Shiba Inu whales reached the highest level in two months with 69 large transactions on October 24. However, as of November 2, this number has gradually decreased by 44% to 39 whale transactions. The daily transactions metric can provide the total daily value of transactions exceeding $100,000. Generally, a sharp drop in whale transactions is often perceived as a bearish signal.

Critical Data for SHIB

This situation is an indication of increasing indifference among major institutional investors. More importantly, this situation can push strategic individual investors to take a negative stance as well. If this situation becomes valid, SHIB token may face low market demand in the coming days. Order books are another vital on-chain chart that indicates weakening demand in SHIB spot markets at the current position.

As indicated in the charts, SHIB investors have placed active sell orders for 6.5 trillion tokens. Additionally, there is a significant buy order of 6 trillion SHIB listed on 10 cryptocurrency exchanges at the current position. Order books of exchanges can show a snapshot of the total active market orders for a token.

In general, when demand is low, many sellers may have to lower their prices to compete. Therefore, the combination of a decrease in whale trading activity and weakening market demand could trigger a downward movement in SHIB prices in the coming days.