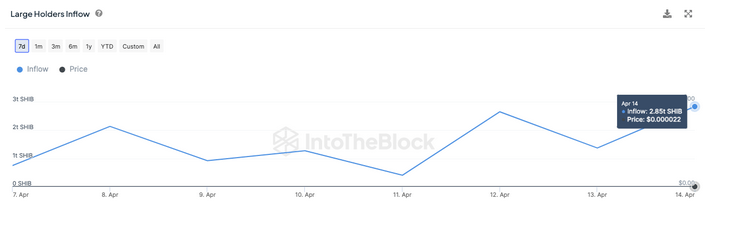

Shiba Inu (SHIB) whale activities have seen a tremendous increase, causing concern among investors. Cryptocurrency Shiba Inu’s (SHIB) major holders have significantly increased their assets, causing major movements within the chain. According to data from IntoTheBlock, these major players have surprisingly accumulated 2.85 trillion tokens in the last 24 hours.

What Does This Increase in Token Accumulation Mean?

This notable increase is explained by the Big Holders Entry metric, which soared by 208% compared to the previous day, reaching a massive figure of 1.37 trillion tokens. This influx added an estimated value of $66.98 million to these crypto whales’ wallets.

However, the situation becomes more complicated as it turns out that a significant exit occurred alongside this increase. During the same period, these deep-pocketed SHIB investors disposed of more than three trillion tokens. This major sale resulted in a net decrease of 150 billion Shiba Inu tokens over the last 24 hours.

This trend is highlighted by the Big Holders Exit metric, which showed an increase of over 300% during the same timeframe, indicating a higher exit rate compared to entries. Consequently, the Big Holders Net Flow indicator has dropped into negative territory, signaling potential turbulence for the popular cryptocurrency. The SHIB price was trading at $0.00002342 at the time of writing.

Latest Developments in the Cryptocurrency World

Solana developers have started testing solutions to deal with congestion and increasing network errors. The update is not yet available on the main Solana network, giving developers a chance to test innovations.

Robert Kiyosaki agrees with Kathy Wood‘s prediction, stating that he expects Bitcoin‘s market value to reach $2.3 million by 2030 as forecasted by ARK Invest. Kiyosaki also mentioned that he does not trust Wall Street financial products and prefers to buy crypto BTC through exchange-traded funds rather than the spot market.

Finally, CryptoQuant explained that the rapid decline in the current cryptocurrency market was necessary to reset investors’ unrealized profits. This situation is often interpreted as a bottom signal in bull markets. MicroStrategy’s founder Michael Saylor also emphasized that “chaos is good for Bitcoin.”

Türkçe

Türkçe Español

Español