Long-term investor interest in altcoins is crucial for their price performance and future prospects. If a certain percentage of investors avoid selling over an extended period, it indicates that supply pressure on the sell-side will remain weak, allowing for potential real peaks during bullish phases. This is the case for Dogecoin‘s competitor.

Shiba Inu (SHIB)

Data provided by IntoTheBlock reveals a trend among Shiba Coin investors that has been ongoing for about a year. There have been gradual increases during bull markets, and investors’ appetite for the 2024-2025 rally season has grown. IntoTheBlock data tells us that the average holding period for Shiba Inu has extended to two years.

Since last year, the SHIB price has increased by over 92%. However, this increase followed significant declines. The price is still roughly 75% below its peak. According to current data, 58% of investors are in a profitable position, yet 75% have been holding their assets for over a year.

Additionally, there have been significant increases in the amount of Shiba Inu tokens burned. Shibburn reported a daily burn rate increase of 25.92%, with 798.31 million tokens burned over the past week. However, when looking at the total circulating supply, these figures are not likely to have a significant impact on the price.

Long-term investors remain hopeful about the Shiba team’s ventures in areas like metaverse, NFT, and DeFi, although these trials have not yet reached sufficient user numbers. Moreover, activity on the Shibarium network cannot compare to levels during the testnet period.

Shiba Coin Price Forecast

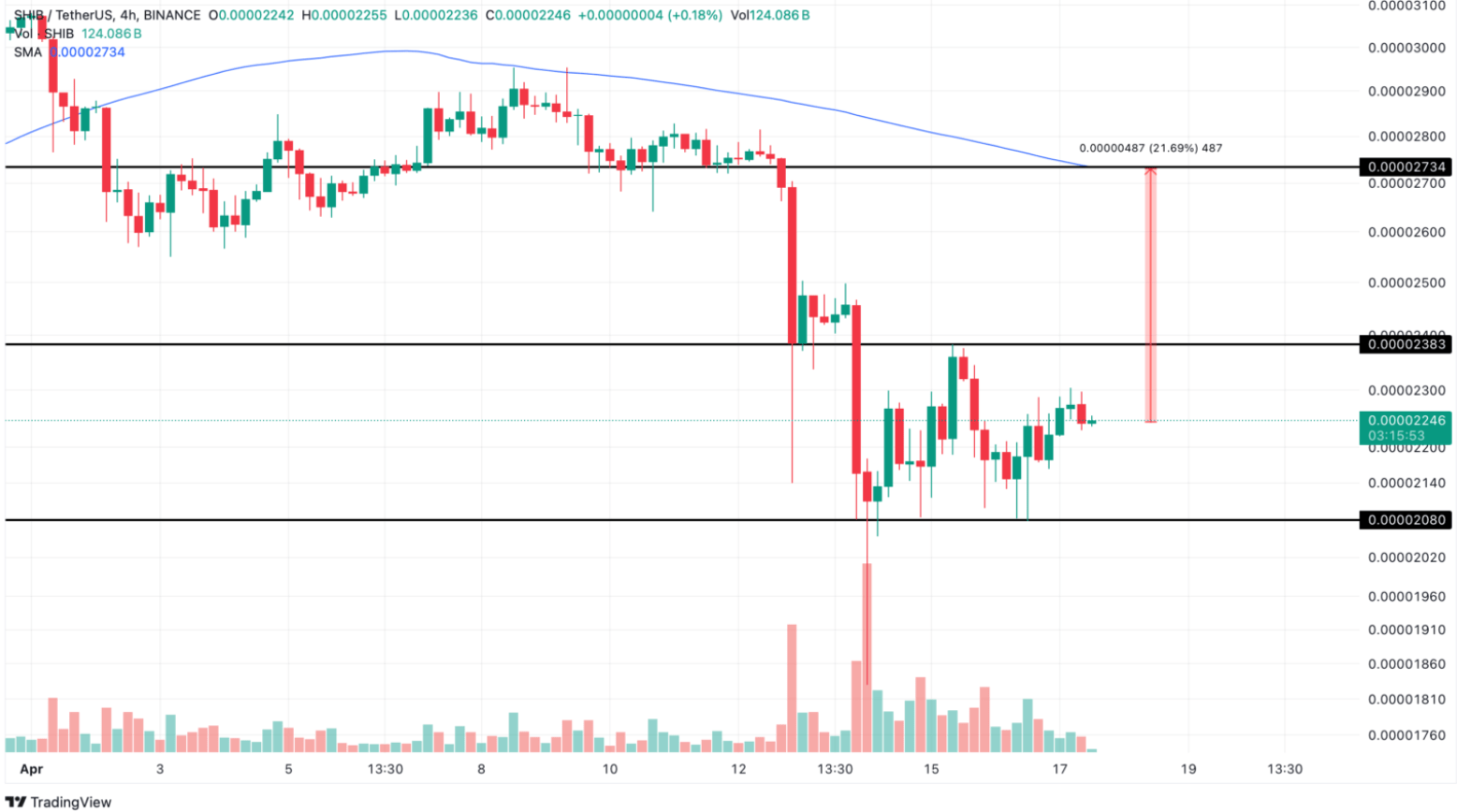

Shiba Coin’s price has experienced a loss of over 50% since reaching its peak on March 5. Sales affecting Bitcoin‘s price up to $60,600 significantly shook the altcoin markets. Currently, SHIB is finding buyers below the resistance level at $0.00002383. If the price breaks through this resistance, it could quickly rally to $0.00002734.

Looking at the downside, continued closings below this resistance could lead the price to retreat to the support level at $0.0000208. A move towards either extreme will likely be enabled by a forthcoming break in BTC’s price, which is currently just over $62,000.

Türkçe

Türkçe Español

Español