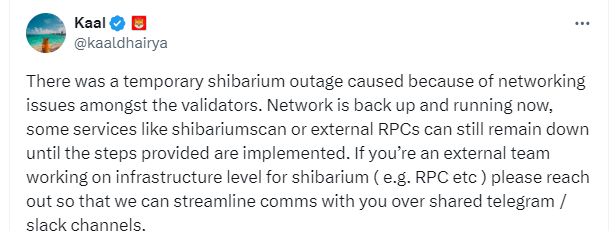

Cryptocurrency Shiba Inu recently made headlines with an update. The developer of Shiba Inu, Kaal Dhairya, recently confirmed that a temporary disruption affecting the Shibarium network has been resolved. This disruption was caused by network issues among validators and had temporarily affected services within the Shiba Inu ecosystem, especially the Layer-2 Blockchain solution Shibarium.

Shibarium Network Operational

Kaal detailed the cause and resolution of the issue, emphasizing that despite a temporary Shibarium disruption due to validator network issues, the network is now operational again. However, he noted that some auxiliary services like Shibariumscan or external Remote Procedure Calls might face disruptions until further remedial steps are completed.

Kaal stressed the importance of improving communication and facilitating operations, highlighting the need for collaboration among infrastructure teams. He specifically recommended maintaining close coordination with the Shibarium team and strengthening communication with external teams working at the infrastructure level.

Current Status of Shiba Inu’s Price

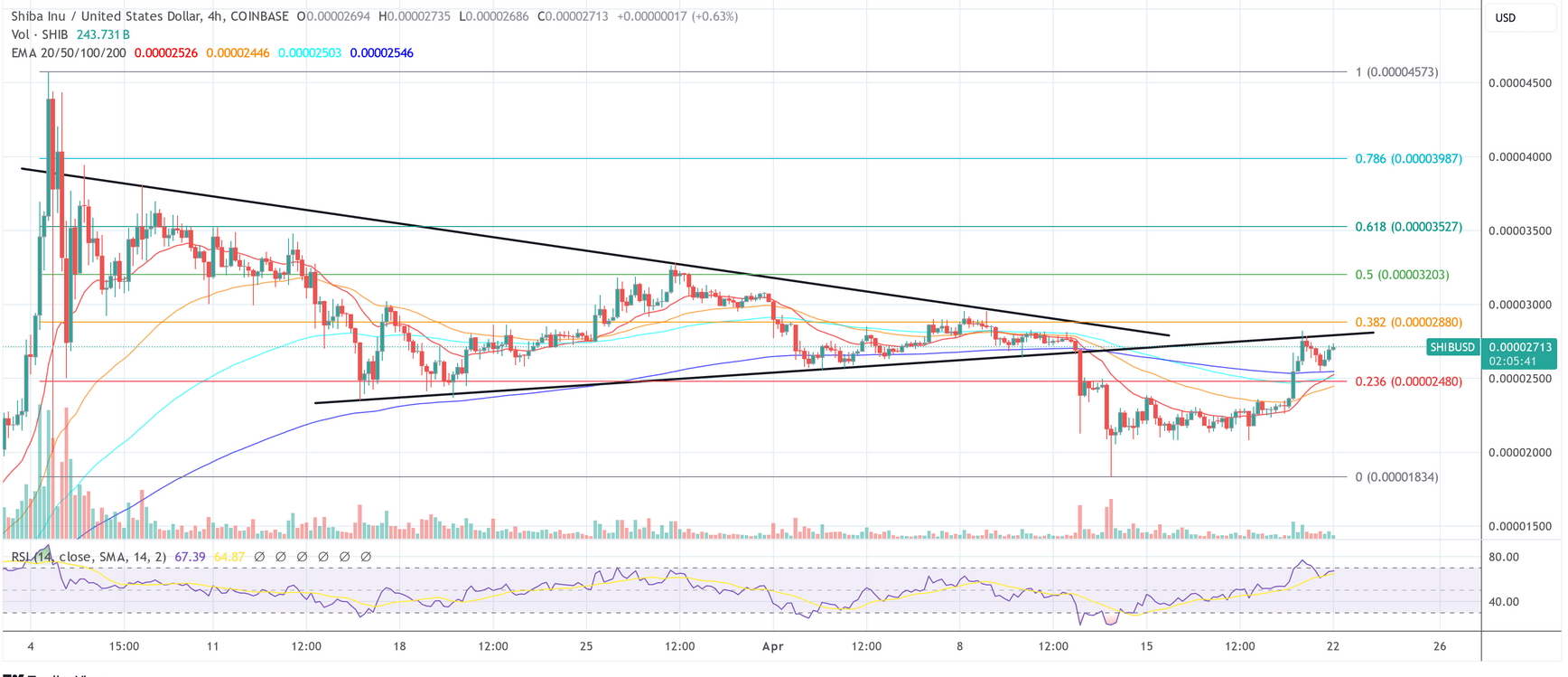

Despite significant events like the Shibarium disruption, the four-hour chart of the SHIB/USD pair clearly shows a symmetrical triangle formation affecting the asset’s movement.

At first glance, while expecting a direct upward trend, we observed the price breaking downward through the triangle, typically indicating the start of a downtrend. However, SHIB quickly found significant support at the 100-day EMA and is currently testing the lower trend line of the triangle.

Currently, the price has risen above the 0.236 Fibonacci retracement level at $0.00002472, also trading above all EMAs on the four-hour chart. The 200 EMA (blue line) is attempting to rise above the extended trend line (black) and is now serving as a significant support.

A stable breakthrough above this level could invalidate the previous downtrend, positioning SHIB for a potential upward movement. However, volume activity indicates a more moderate trading environment, lacking the aggressive increases typically associated with decisive breakthroughs.

Uncertainty in SHIB’s Direction

This situation may indicate that the market has not yet decided on a direction, and investors are waiting for more confirmation before establishing a clear trend. Lastly, the RSI is at 67, just below the overbought threshold, suggesting the market has avoided excessive expansion and there is room for upward movement.

If SHIB struggles to rise above the extended lower trend line, fluctuations could intensify in the near future, potentially leading to rallies towards the 0.382 ($0.00002867), 0.5 ($0.00003203), and 0.618 ($0.00003527) Fibonacci levels.

Türkçe

Türkçe Español

Español