Shiba Inu (SHIB) witnessed a significant increase in transactions after its Shibarium launch on August 16. As a result, developers had to deal with scalability issues to support the traffic. Recently, it has been re-launched on the layer-2 mainnet.

Shortly after its relaunch, Shibarium received a lot of attention, as evident from its latest statistics. However, SHIB was still hesitant to increase its price, but Bone Shiba Swap (BONE) recorded double-digit gains.

FUD Surrounding Shibarium

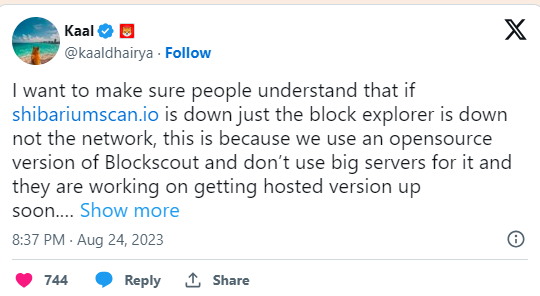

There were numerous rumors on social media regarding Shiba Inu’s Shibarium. Most of the misunderstandings were related to the collapse of Shibarium. In reality, Shibarium serves as a collapsed block explorer, not the network itself.

This is because Shibarium uses an open-source version of Blockscout and does not use large servers for it. At the time of writing, the average block time of the network was five seconds and the total transactions exceeded 109,000. The wallet addresses of the network also surpassed the promising threshold of 47,000.

BONE in the Spotlight of Shiba Inu

The launch of the network also helped its performance. This can be seen from the data of LunarCrush, which shows that mentions of Shiba Inu on social media increased by over 140% in the last 24 hours.

BONE, which has many benefits in Shibarium, also took advantage of the advantages. According to CoinMarketCap, the price of BONE increased by over 11% in the last 24 hours. At the time of writing, it was trading at $1.39 with a market capitalization of $318 million.

The good news was that the rally was supported by an increase in trading volume. The positive sentiment surrounding the token also reflected investors’ confidence during this period. Furthermore, the rally may have continued due to the high buying pressure on BONE.

While the supply on exchanges sharply decreased, the supply outside of exchanges proved to be under buying pressure, as of the time of writing. The MACD of Shiba Inu ecosystem’s token, BONE, indicated a bullish crossover that could help maintain the upward trend. However, several market indicators turned bearish. In particular, the Relative Strength Index (RSI) followed a sideways path. Additionally, BONE’s Chaikin Money Flow (CMF) remained below the zero-neutral mark, which favored the sellers.