Shibaswap Bone’s (BONE) price increased by about 20% in a week when many major cryptocurrencies struggled. The renewed activity on the Shibarium Layer 2 blockchain seems to have boosted BONE, which functions as a gas token on the network. After the initial failure, Shibarium was successfully relaunched this week and is currently operating smoothly.

Shibarium Back in Action

Shibarium serves as an Ethereum layer-2 blockchain built to support operations in the Shiba Inu ecosystem. However, during its initial launch on August 17th, the new network faced congestion. Due to the increase in activity, many investors noticed that their funds were stuck in the bridge contract.

Unable to cope with the influx of new users, Shibarium developers had to suspend operations. In the following days, they worked on strengthening their ability to handle higher traffic volumes. After updating the blockchain on August 24th, the developers relaunched Shibarium, and the frozen funds started to reach their intended destinations.

Current State of Shibaswap Bone

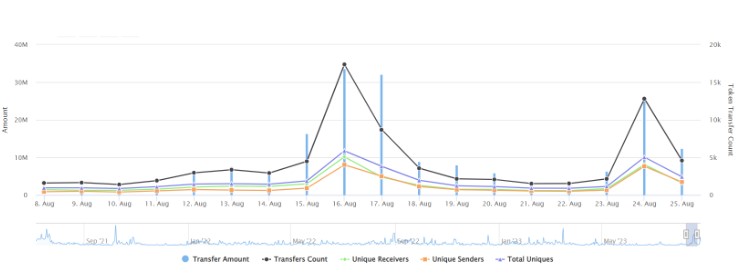

Following the successful reopening of the Shibarium network, BONE transfers rose to approximately 13,000 on August 24th. Data shows an increase in new addresses and daily active addresses as well.

According to Etherscan, there are currently over 90,000 crypto wallets holding the token. Meanwhile, BONE, the native token of Shibaswap decentralized exchange, defied the downward trend that has been suppressing the crypto market throughout the week and gained 20% in value within 24 hours.

Over the past seven days, BONE’s value has increased by over 18%, surpassing the losses experienced during Shibarium’s unsuccessful launch. Meanwhile, major cryptocurrencies, including Bitcoin and Ethereum, are trading more than 10% below their prices from last month. On the other hand, after its recent strong performance, BONE’s monthly change took it in the opposite direction.

While BONE has followed the overall market trend, equivalent gains were not observed in the Shiba Inu ecosystem. Last week, SHIB experienced a 3.67% loss in value, performing lower compared to BTC and ETH. The third component of the triple token scheme, LEASH, showed better performance with a 4.27% price increase during the same period.

Türkçe

Türkçe Español

Español