The cryptocurrency ecosystem has seen significant developments in the last 24 hours. Accordingly, investors in the NFT ecosystem are expecting a price increase following the Bitcoin‘s halving event. Spot Bitcoin exchange-traded funds (ETFs) marked a day with a record $10 billion trading volume. Meanwhile, Bitcoin surpassed $69,000 for the first time since 2021, reaching its highest level ever.

Notable Statement on the NFT Market

Professionals working in the NFT space believe that the upcoming Bitcoin halving event will not only affect crypto assets but could also positively impact the NFT ecosystem. Oscar Franklin Tan, the finance manager at Atlas Development contributing to the NFT platform Enjin, expressed optimism about a price increase in NFTs following Bitcoin’s halving event. Tan stated:

“Prices and volumes will eventually increase as part of the known cycle after the halving event. As NFTs are established segments of ecosystems, the interest from Bitcoin will spread to altcoins and NFTs as well.”

According to Tan, the halving event could positively influence the adoption of NFTs as new collections or marketplaces focused on NFT collections may emerge.

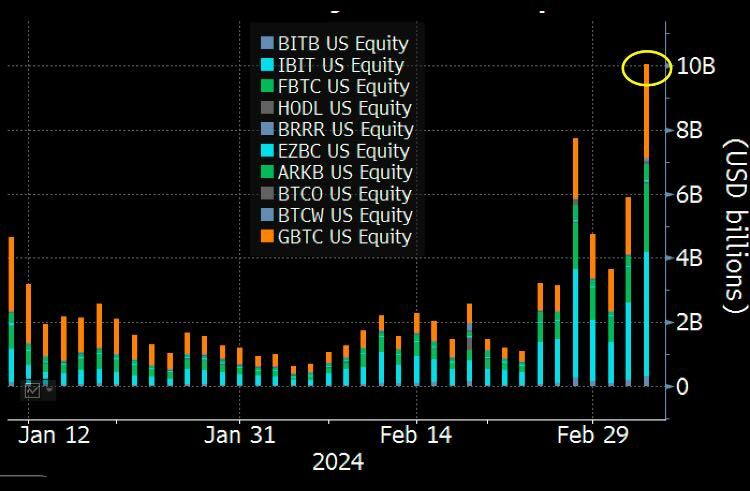

ETF Funds Continue to Break Records

United States-based spot Bitcoin ETF funds experienced a record trading volume day of $10 billion on March 5th following Bitcoin’s peak at an all-time high. The ETFs surpassed the previous volume day of $7.7 billion recorded on February 28th by $2.3 billion. Sharing the figures, Bloomberg ETF analyst Eric Balchunas commented in a March 5th post:

“These are crazy numbers for ETF funds in less than two months.”

According to figures shared by Bitcoin analyst Alessandro Ottaviani, BlackRock’s ETF fund saw the highest volume with $3.7 billion, while Grayscale and Fidelity recorded $2.8 billion and $2 billion, respectively. Google Finance data showed that BlackRock and Fidelity’s ETF funds dropped by about 8.6% during the trading day, while other spot Bitcoin ETF funds also recorded similar price drops as Bitcoin reached a new peak above $69,200 before falling below $60,000 after five hours with a drop of over 14%.

Bitcoin Hits a New All-Time High

Bitcoin briefly traded above $69,200 on March 5th, reaching its highest price to date and capping off two months of gains following the approval of spot Bitcoin ETF funds in the US. The largest cryptocurrency reached an all-time high 846 days after its previous peak in 2021. The Bitcoin rally also enabled a 348% gain from its dip level around $15,400.

Moreover, Bitcoin set new highs for the first time before the four-yearly halving event, a significant historical price factor for the crypto asset. Despite the excitement, Bitcoin’s price quickly reversed on March 5th, falling to levels below $64,000.

Türkçe

Türkçe Español

Español