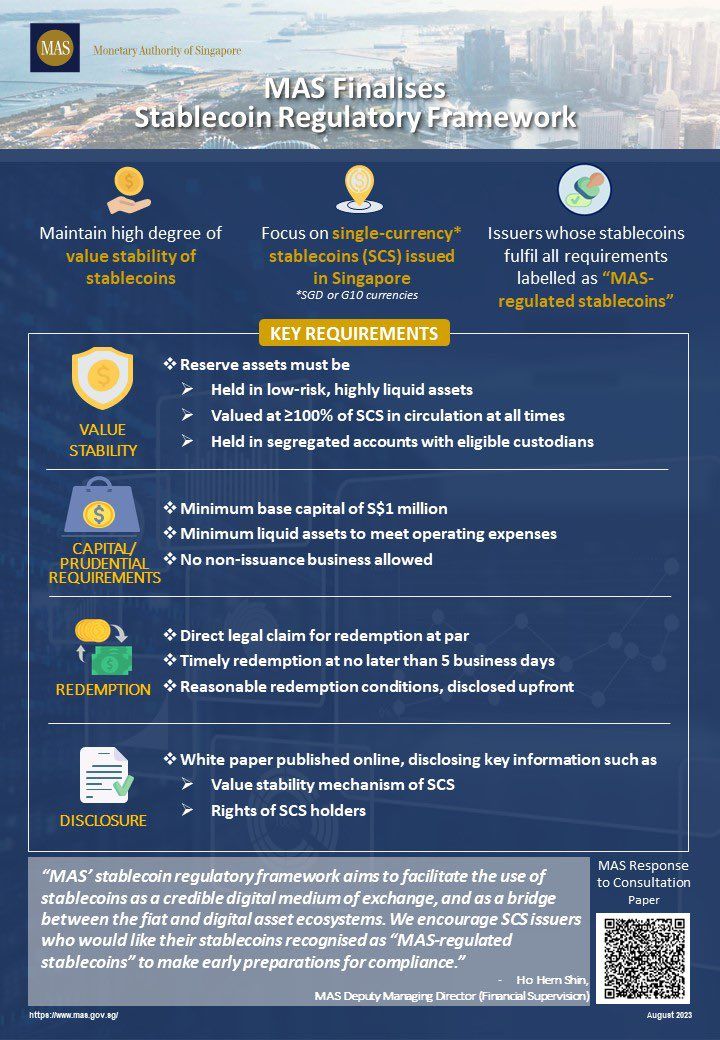

The Monetary Authority of Singapore (MAS) has introduced new rules regarding the stability, capitalization, redemption, and transparency of stablecoins. In this context, MAS has presented a new regulatory framework to maintain and enhance the stability of single-currency stablecoins.

Regulatory Framework Covers Single-Currency Stablecoins

The regulatory framework presented by MAS will apply to non-bank issuers of single-currency stablecoins that are pegged to the Singapore dollar or any fiat currency of G10 countries with a circulation value exceeding SGD 5 million. The central bank will classify these cryptocurrencies as regulated stablecoins under MAS.

For the regulatory framework to come into effect, MAS needs to engage in legislative consultations before the Singapore Parliament votes to approve the changes.

Single-currency stablecoins will fall under the category of cryptocurrencies indexed to traditional assets like national currencies. Currently, Singapore has only one regulated stablecoin, and with the implementation of the regulatory framework, it is expected that the number of regulated stablecoins in the country will increase. A MAS official commented, “When these stablecoins, which are offered to maintain such value stability, are well-regulated, they can serve as a reliable exchange medium to support innovation, including the purchase and sale of digital currencies ‘on-chain’.”

Singapore and Cryptocurrency Regulations

With increasing participation in the cryptocurrency world, governments continue to move willingly towards regulating the cryptocurrency market. The stablecoin market, currently valued at around $125 billion, is expected to rapidly grow in the next decade. In fact, a research report published by Bernstein earlier this month reveals that the global stablecoin market is projected to grow 22 times in just the next five years, reaching $2.8 trillion. Therefore, leading economies such as Singapore and the United States are making efforts to regulate stablecoins.

Companies creating, issuing, and under the supervision of MAS for stablecoins must comply with certain rules. These rules include maintaining the stability of the stablecoin’s value, allocating sufficient funds for redemption requests, and reporting audit findings to users. The rules also stipulate that these companies must hold a coin consisting of highly secure assets of equal value to all the stablecoins they produce. Additionally, there must be a minimum amount of funds reserved, either exceeding SGD 1 million or half of the annual operating expenses.

Türkçe

Türkçe Español

Español