Crypto currency investors continue to prepare for the bull market expected to start following the potential spot Bitcoin ETF approval. In this direction, investors are chasing opportunities, accumulating altcoins they expect to yield high returns. The on-chain data provider Spot On Chain recently highlighted the trading activities of a smart investor class of crypto currency investors.

Smart Investor Sells RNDR and Buys $1.5 Million Worth of LDO

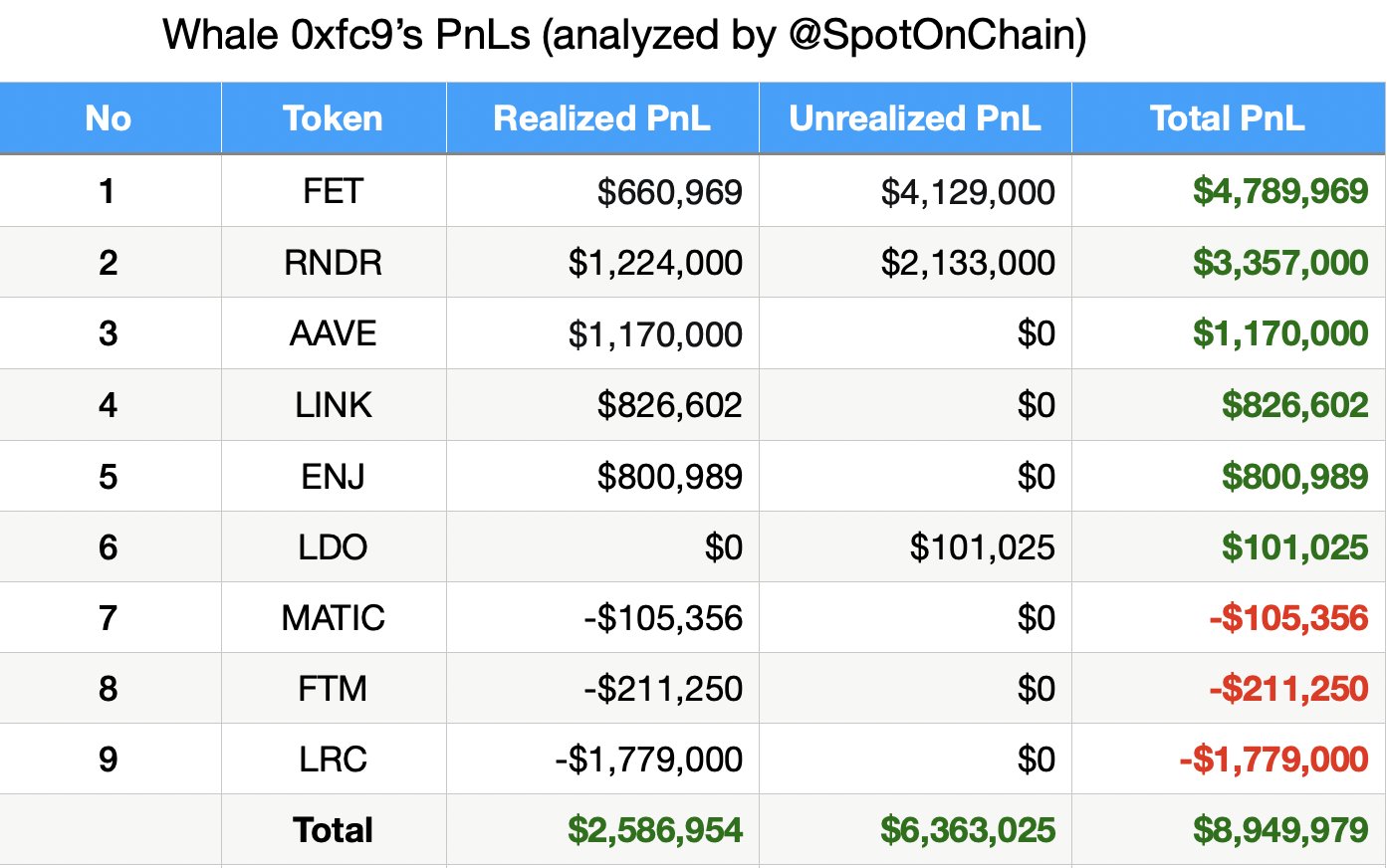

The on-chain data provider Spot On Chain reported that a smart investor class crypto currency investor, owning a wallet address starting with 0xfc9…, who has made a total profit of $8.95 million, sold Render (RNDR) and bought Lido DAO (LDO) through the Coinbase exchange amidst sharp price movements in the market. The data indicates that the smart investor deposited 750,000 RNDR worth $3.01 million at a price of $4.01 each to Coinbase and then withdrew 450,000 LDO worth $1.5 million at $3.33 each.

During this move, while the price of RNDR dropped by about 10% in the last 24 hours, the more than 5% rise in LDO price highlights the strategic depth of the smart investor’s move.

A deeper look into the smart investor’s wallet shows that they traded 9 altcoins including FET, AAVE, ENJ, LINK, RNDR, LDO, FTM, LRC, and MATIC, and made a profit from 6 of them. This indicates a winning rate of 66.7% for the investor.

Being a “Smart Investor” in the Crypto Currency Market

In the crypto currency market, the term “smart investor” generally refers to an investor who is conscious, research-oriented, strategic, and capable of managing risks when investing in cryptocurrencies. Smart investors tend to follow market trends, use methods such as fundamental and technical analysis to evaluate assets, and diversify their portfolios.

Smart investors conduct in-depth research about potential investments. They make efforts to understand the technological foundations of projects, team members, objectives, and competitive advantages. As the crypto currency market is highly volatile, smart investors tend to understand and successfully manage risks. They try to reduce risk by diversifying their portfolios and assess the risk-return ratio before investing.

Türkçe

Türkçe Español

Español