The popular smart contract platform Solana-based meme token Bonk (BONK) lost 29% of its value last week as its futures open positions fell to the lowest level in 30 days. Since its launch, the meme token has been met with intense interest and has been one of the most depreciated altcoins over the past week.

Deep Dive into BONK’s Decline

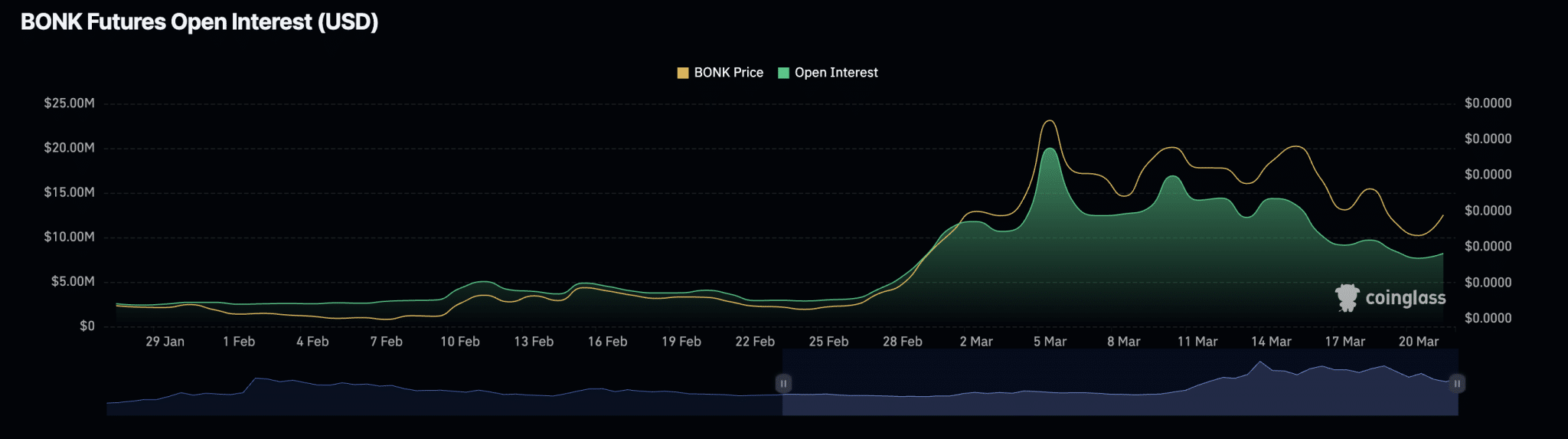

The price drop of the altcoin is said to stem from the futures open positions retreating to the lowest level within a month. According to data from Coinglass, BONK’s open positions started a decline on March 5 and have since retracted by 60%. A decrease in a token’s open interest could indicate a reduction in investor interest or participation in the derivative market for that token. This could often be a result of changes in investor sentiment and increased profit-taking or loss mitigation efforts.

Last week, as the excitement around meme tokens began to wane, their values also experienced a decline. BONK’s weighted sentiment turned negative on March 16 and has since reported values below zero. A negative weighted sentiment can indicate a prevailing bearish trend among market participants and often leads to further declines in a token’s value. Experts analyzing BONK’s price performance have noted that basic technical indicators confirm the bearish trend.

Technical Indicators for BONK

For example, the meme token’s Aroon Down Line was observed at 85.71% on the 24-hour chart. This indicator is used to determine the strength of a trend in a cryptocurrency‘s price movement and potential trend reversal points. An Aroon Down line close to 100 can indicate that the bearish trend in the market is strong and that the most recent low level was reached relatively recently.

Additionally, BONK’s Chaikin Money Flow (CMF) was at -0.03 at the time of writing. A CMF value below zero can be a sign of weakness in the market. It may indicate a decrease in liquidity flow and often leads to a continuous decline in a token’s value. Furthermore, BONK’s Relative Strength Index (RSI) revealed a decrease in demand for the meme token among spot market participants. With the RSI at 48.04, it could signal that investors prefer selling their tokens rather than buying more.

Türkçe

Türkçe Español

Español