According to the latest data from the Solana Foundation, the Solana (SOL) ecosystem now highlights over 2,500 active developers monthly. In a report dated January 9, assessing core network metrics throughout 2023, Solana claimed that its network had between 2,500 and 3,000 active developers each month over the past year.

Developer Reports on Solana

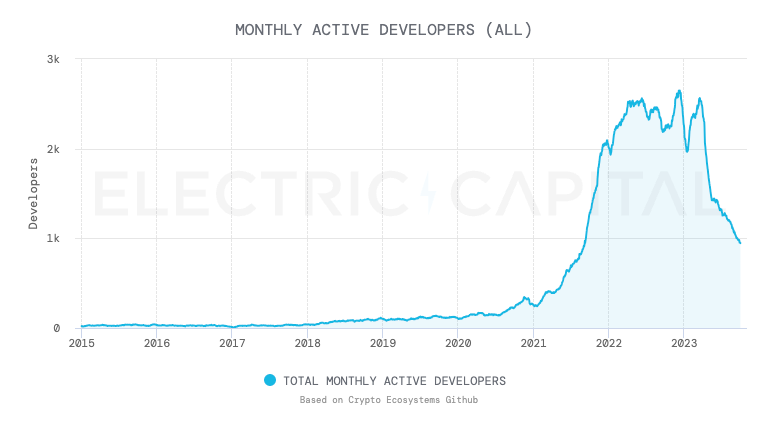

Data taken from Electric Capital’s blockchain development tracker, the Developer Report, shows that Solana’s developer count dropped from an all-time high of 2,634 on December 22, 2022, to just 946 by October 1, 2023. The Developer Report references data from GitHub to create data points on blockchain developer activities.

However, the statistics only go up to October 1. An Electric Capital spokesperson indicated that the data for the fourth quarter would be updated in the coming week. Statements made by the Solana Foundation, however, clarified that the measurement only accounted for developers contributing to public sources, with the following statement:

Maintaining a consistent number of developers is an important indicator of a healthy ecosystem, as it shows the ability to attract and retain new talent.

Solana Performance

On the other hand, the total monthly active developer count for Ethereum dropped by 22% from its peak number of 7,433 on June 16, 2022, to 5,769 on October 1, 2023, according to Electric Capital data. Additionally, developer retention on Solana increased by 50% over the last three months. This coincided with an ongoing explosion of activity on the Solana network, as well as an upward price movement of the native Solana token.

Solana witnessed a significant price increase of 500% between October and December. This surge, fueled by a craze for SOL-based meme tokens, led to Solana briefly surpassing Binance Coin (BNB) in market value, becoming the fourth-largest cryptocurrency on December 22. Just a few days later, on December 26, it reached its annual high of $122. The network also saw a significant increase in activity, which for a brief period in the same month, led to a reversal of Ethereum’s 24-hour DEX volumes.

Türkçe

Türkçe Español

Español