In 2024, Solana witnessed significant growth largely due to increased activities in the meme coin and decentralized finance (DeFi) sectors. This surge was clearly visible in the notable increases in the network’s stablecoin market value and total value locked (TVL). While these metrics indicate an active and expanding ecosystem, the question arises: Are these factors alone sufficient for the price movement of Solana’s cryptocurrency SOL?

Recent Metrics for Solana

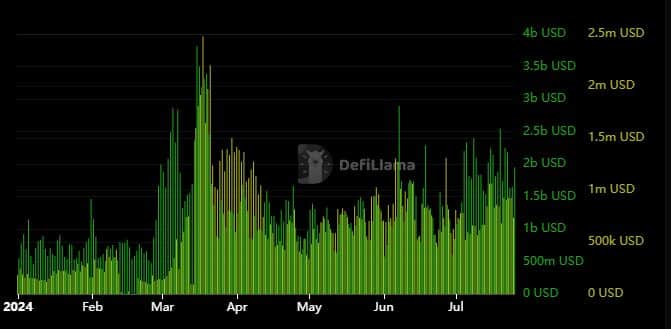

As reported by DeFiLlama, Solana’s TVL and stablecoin market value experienced significant growth this year. At the start of 2024, the TVL was $1.396 billion, and the stablecoin market value was $1.83 billion. By mid-year, these figures had increased significantly, with the stablecoin market value reaching $3.22 billion and the TVL climbing to $5.29 billion. Although these figures are still below their historical peaks, they indicate a positive trend.

The increase in TVL, combined with the decrease in stablecoin market value, indicates growing confidence among investors. This suggests that funds are being directed from stablecoins to Solana’s DeFi ecosystem, potentially increasing demand for SOL. If this trend continues, it could support a potential upward trend, making SOL more resilient to price declines.

Network Activity for Solana

Despite some fluctuations, including a recent shift into the overbought zone, SOL has shown signs of recovery and upward momentum. Recently, it broke above a descending resistance level, a technical indicator that could signal more upward movement. This bullish confidence, if it continues, could lead to a significant price breakout for SOL.

Solana’s network activities, including on-chain volume and revenue, saw a slowdown between March and April. However, since May, these metrics have shown signs of recovery. This increase in network activities aligns with broader observations of a growing ecosystem, which could further support the rise in SOL’s price.

Limitations of Network Activity as a Sole Indicator

While network activity, including TVL and stablecoin market value, provides valuable insights into the health and growth of the Solana ecosystem, it is important to note that it is not the sole determinant of SOL’s price.

External market factors, broader economic conditions, and investor sentiment play critical roles in determining price movements. Therefore, while positive trends in network activities are encouraging, SOL’s price trajectory should be evaluated alongside other market indicators for a comprehensive view. At the time of writing, Solana’s price is around $186.

Türkçe

Türkçe Español

Español