One of the standout performers in this cycle has been Solana  $175, which surged from below $10 to nearly $300. The issuance of meme coins on the network, coupled with support statements for U.S.-based initiatives, contributed significantly to this rise. Furthermore, the rampant liquidity from numerous fraudulent tokens on the network fueled substantial gains. However, there are now alarming signs. So, what is the situation on the ETHBTC front?

$175, which surged from below $10 to nearly $300. The issuance of meme coins on the network, coupled with support statements for U.S.-based initiatives, contributed significantly to this rise. Furthermore, the rampant liquidity from numerous fraudulent tokens on the network fueled substantial gains. However, there are now alarming signs. So, what is the situation on the ETHBTC front?

Solana Signals Warning Signs

Bitcoin (BTC)  $108,311 is hovering around the $82,300 mark, while altcoins are predominantly in the red today. As Monday progresses, there has been no consensus announcement from Trump, which does not bode well and could trigger another round of selling in stocks. If movement does not increase in the coming hours and Bitcoin remains strong, it would be quite surprising, suggesting a distinct separation from the stock market.

$108,311 is hovering around the $82,300 mark, while altcoins are predominantly in the red today. As Monday progresses, there has been no consensus announcement from Trump, which does not bode well and could trigger another round of selling in stocks. If movement does not increase in the coming hours and Bitcoin remains strong, it would be quite surprising, suggesting a distinct separation from the stock market.

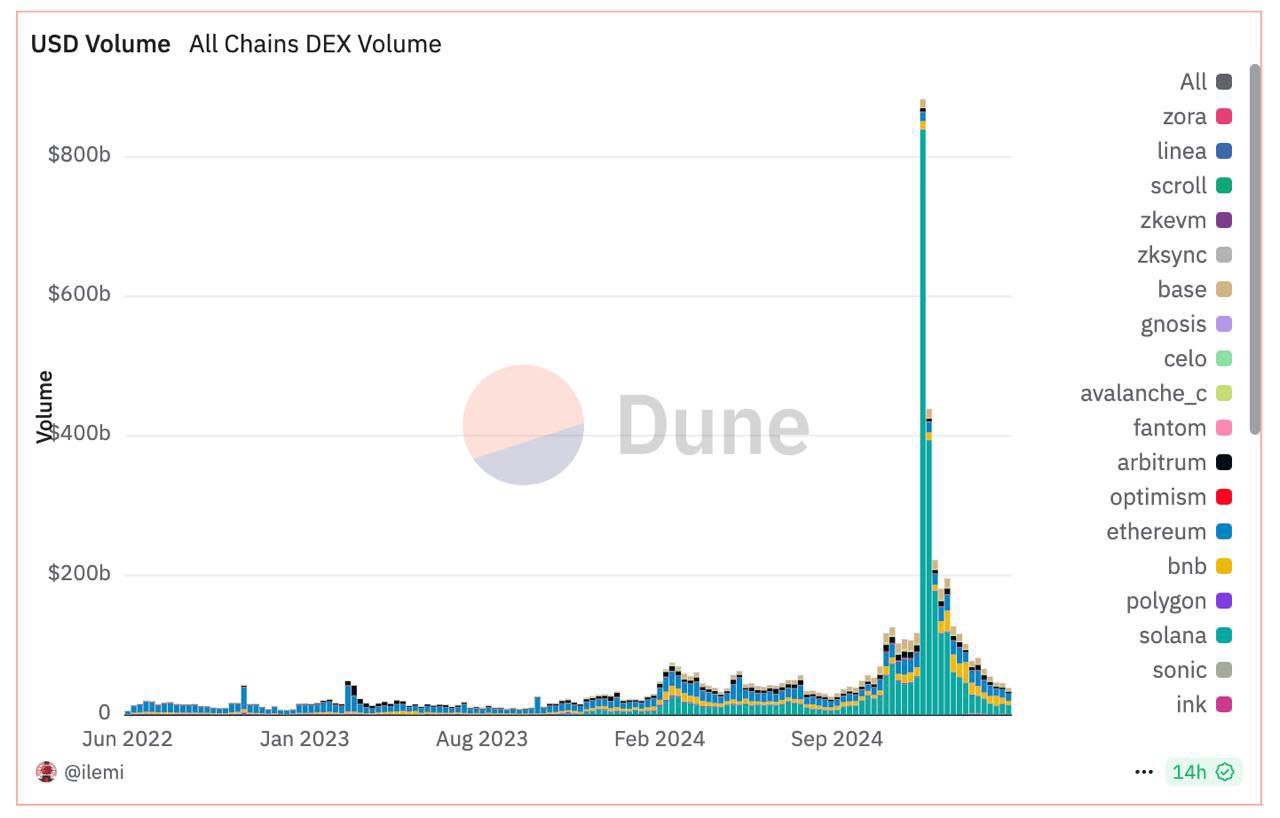

Kyle highlighted the Solana network in his latest market assessment. The state of metrics on the network is as crucial as the price itself. The losses seen here are noteworthy until a price meltdown occurs.

“The DEX volume is not just cooling; it is outright declining. Once the king of on-chain activity, Solana has seen DEX volume plummet from $838 billion in December to just $13 billion by the end of March.

This is not a dip. This is a complete collapse.”

The price of SOL Coin is currently hovering near the $112 support level. The weakness in the network casts a shadow over any potential recovery.

ETHBTC Chart and Predictions

Bitcoin is starting to target levels below $82,000, and Poppe described the current ETHBTC chart as “catastrophic.” It is essential to see a bottom here, as the ongoing decline must come to an end. Those discussing a bear market scenario aim for at least another six months of this weakness, which could be particularly detrimental for altcoins.

“The ETH/BTC chart is disastrous.

However, if we encounter buying pressure out of nowhere in the coming days, this bullish divergence could become valid.”

DaanCrypto is drawing attention to an impending significant movement.

“As BTC volatility continues to decrease, the $VIX (Volatility Index) for stocks closed at its highest level since the Covid Crash in 2020. This is quite an unusual situation, and due to this suppression, I am very confident there will be a significant movement for crypto next week. Whether it goes up or down depends on whether stocks find a bottom early in the week.”

Türkçe

Türkçe Español

Español