Solana investors experienced a $15 million liquidation in the last day. Altcoin buyers and sellers continue to consolidate between $162 and $125, struggling for dominance since April. One reason Solana couldn’t sustain a strong upward momentum is the lack of market activity since the decline in the first week of August.

What’s Happening on the Solana Front?

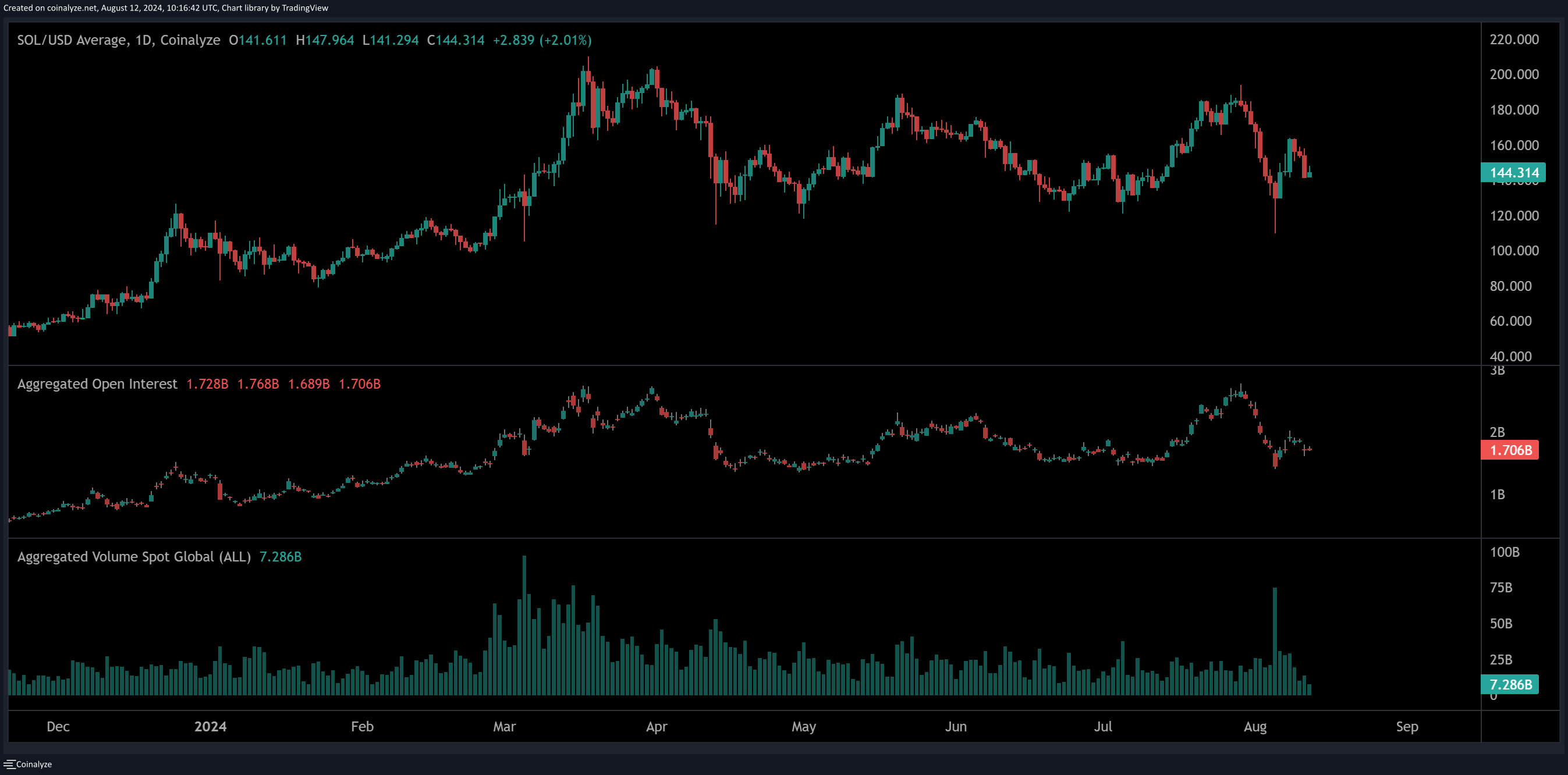

SOL price quickly rose above $125, while futures and perpetual open interest (OI) saw a significant increase this month. Since August 1, open interest has dropped from $2.47 billion to $1.7 billion, a 32% decrease.

Although the drop in OI could be seen as bullish, indicating the futures market has recovered from the liquidation process, SOL investors remained cautious even after a 25% rise to $165. During this rise, OI only increased by $200 million.

Solana’s total spot volumes also showed a lack of urgency. On August 5, SOL spot volumes witnessed a global trading volume of $74 billion, the third-largest activity in 2024. Currently, the spot volume has dropped to $7.5 billion. The recent gap in spot volumes showed that minimal trading activity was the reason for its 25% recovery from $110. Therefore, low liquidity was cited as another reason for SOL’s 10% drop in the last two days.

SOL Chart Analysis

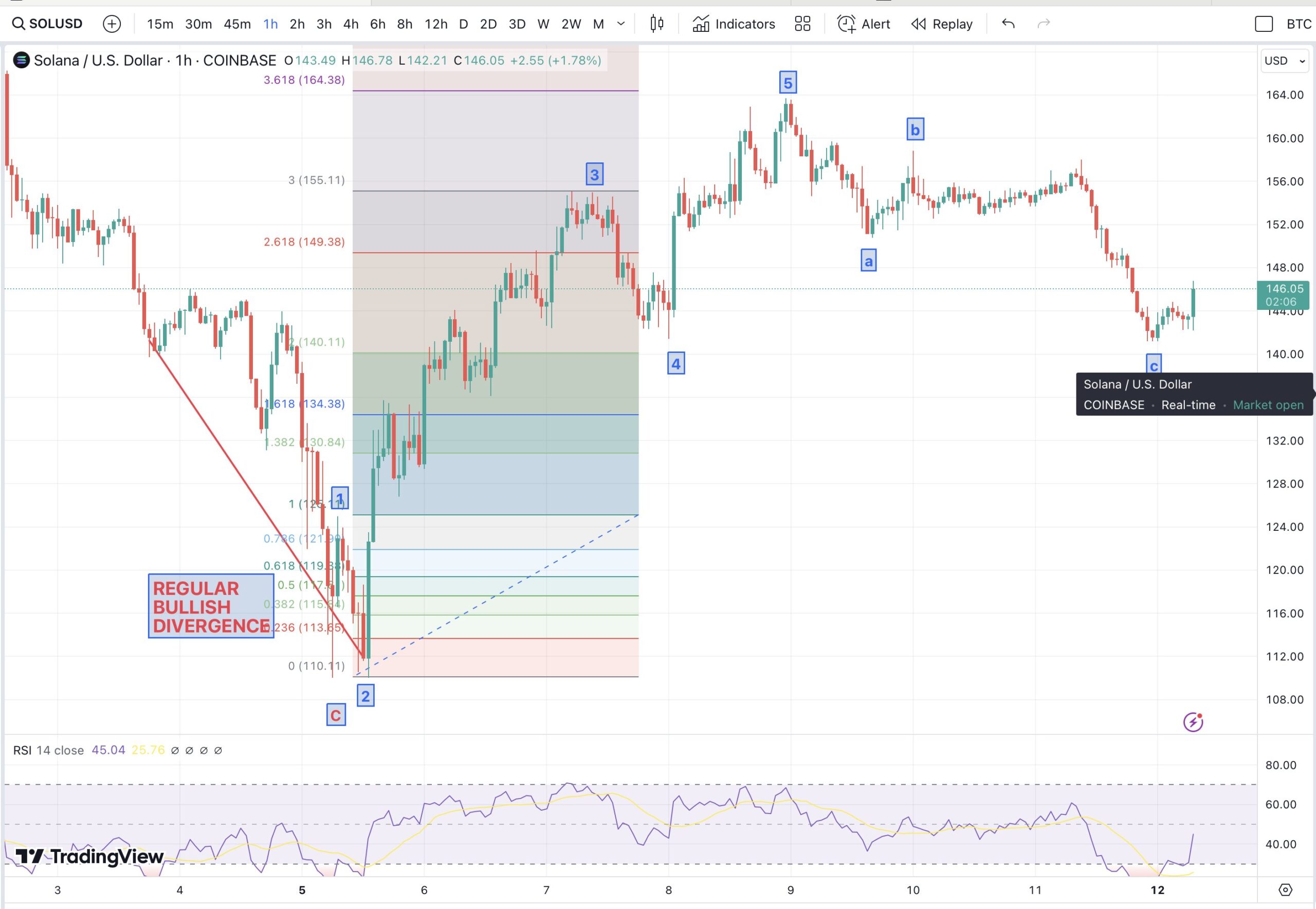

Solana’s price movement remained sideways while an analyst believed SOL price could be preparing for a big week above $190. Evai.io CEO Matthew Dixon claimed that the altcoin saw a nice and clear five-wave upward movement after the weekend correction period.

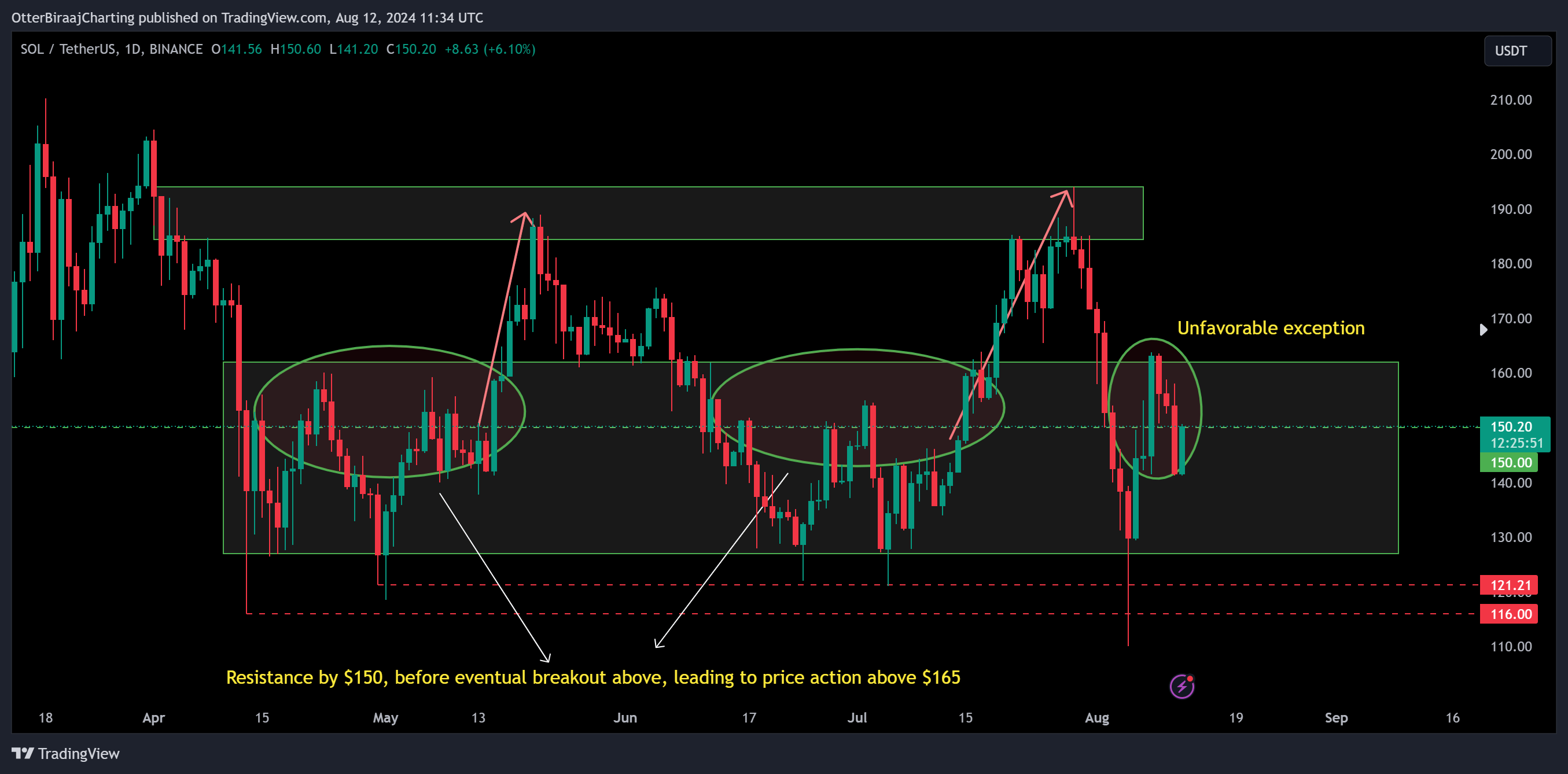

Since the 35% correction in April 2024, the SOL/USD pair consolidated between $162 and $127 for 82 out of 121 days. This corresponds to a 66% time frame since the second quarter, and the $150 level played a significant role.

When SOL urgently surpassed $150, the altcoin could recover and rise above the high range of $162. As seen in the chart, this happened several times, but its last recovery above $150 couldn’t push it above $162. Although this is a negative exception in the last 121 days, SOL once again shows its intention to close above $150.

Türkçe

Türkçe Español

Español