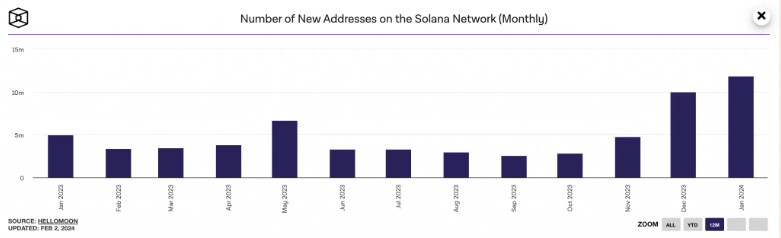

The Block shared data indicating that the leading Layer-1 (L1) network Solana (SOL) has achieved a historic success in new user numbers, with the count of unique addresses created on the network reaching an all-time high as of January.

Comments on Solana (SOL)

According to the data provider, the number of new addresses created on the Solana network in the last 31 days reached a total of 11.81 million. The network also experienced incredible growth in December, with 10 million new addresses created during that period. Nevertheless, the events of January pointed to an 18% growth, bringing the all-time high (ATH).

The figures that emerged in January marked the highest number since May 2022, when 11.72 million new addresses were created.

The data that emerged this month is thought to be caused by a new airdrop event on the Solana network, named Jupiter (JUP).

In this event, described as the largest airdrop on the Solana network, it was reported that Jupiter Exchange conducted an airdrop of 622 million JUP tokens (worth $3.6 billion) to over 440,000 addresses on January 31st.

On the other hand, on the day of the airdrop, the number of daily active addresses on the Solana network reached the highest levels of all time.

The Impact and Potential Future of Solana

Although January indicated incredible growth for the Solana network, some sectors, such as the NFT sector, did not seem to benefit from this growth. According to data provided by CryptoSlam, there appears to be a decline in Solana NFT sales volume for now.

Information from the data provider reveals that the NFT sales volume in January, considering the $365 million volume in December, saw a 35% decrease to $239 million, indicating a significant drop.

CryptoSlam data shows that in December, 6.5 million NFT sales transactions were completed on Solana. By the end of January, this number had fallen by 31%.

Another positive development is the slight growth recorded in January in Solana’s Decentralized Finance (DeFi) vertical. According to DefiLlama data, the network’s total value locked (TVL) saw an 11% increase in January.

To clarify, the network’s TVL rose from $1.41 billion on January 1st to $1.6 billion by January 31st after a 30-day period.

Türkçe

Türkçe Español

Español