Last Monday, a 5-hour outage in the Solana (SOL) network, which raised significant concerns, led to a heated debate among those doubting the network’s future and ecosystem.

Current State of Solana

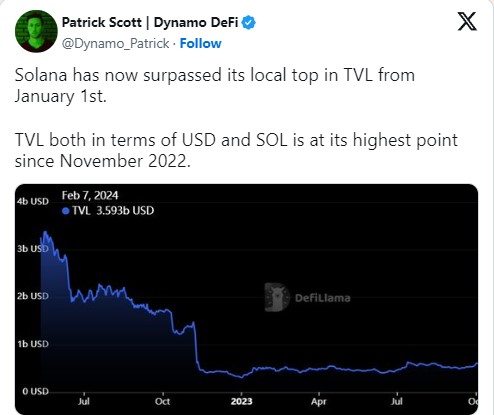

Despite the skepticism that has emerged, the Solana ecosystem appears to maintain its resilience and continues to evolve. Recent data shows that since January 1st, Solana has surpassed its previous total value locked (TVL) record.

According to the latest review, the TVL measurement, both in USD and SOL, has reached its highest level since November 2022, demonstrating strong performance despite recent challenges.

This increase in TVL and the broken record not only contribute to the positive outlook of the network’s financial strength but also position Solana for potential growth and expansion.

Comments on Solana and Its Social Status

Despite the growth in TVL, the general sentiment around Solana seems to continue its decline. This situation reveals ongoing negative comments in the social sphere about the network.

The negative atmosphere could have significant effects on investors with high expectations for Solana. The pessimistic view may lead investors to be cautious on the platform, potentially reducing investments and prompting the withdrawal of existing funds.

Moreover, the drop in trust among users due to adverse conditions could deter new users from joining the ecosystem and cause existing users to question their participation.

On the other hand, weakening community support and reluctance among developers to use Solana could harm its vibrant ecosystem and negatively impact its ability to incentivize developers.

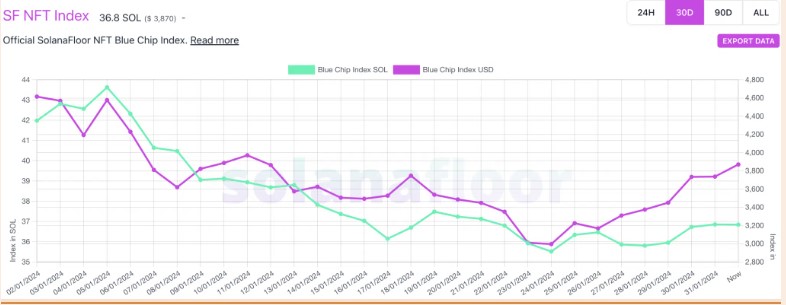

The decline in sentiment also had a negative effect on Solana’s NFT sales. This resulted in a significant drop in the value of blue-chip collections on Solana last month.

Additionally, during this period, there was a noticeable decrease in the floor prices of NFTs. A decline in interest in NFTs, one of the cornerstones of Solana, could lead to more adverse conditions and pave the way for a negative outlook on SOL’s price.

Despite all this, there was a noticeable increase in SOL’s price. Parallel to the rise in Bitcoin, SOL saw an increase of over 3% at the time of writing, with the price finding buyers at $109.64. The trading volume also increased by 25% during this period, rising to $2.9 billion.

Türkçe

Türkçe Español

Español