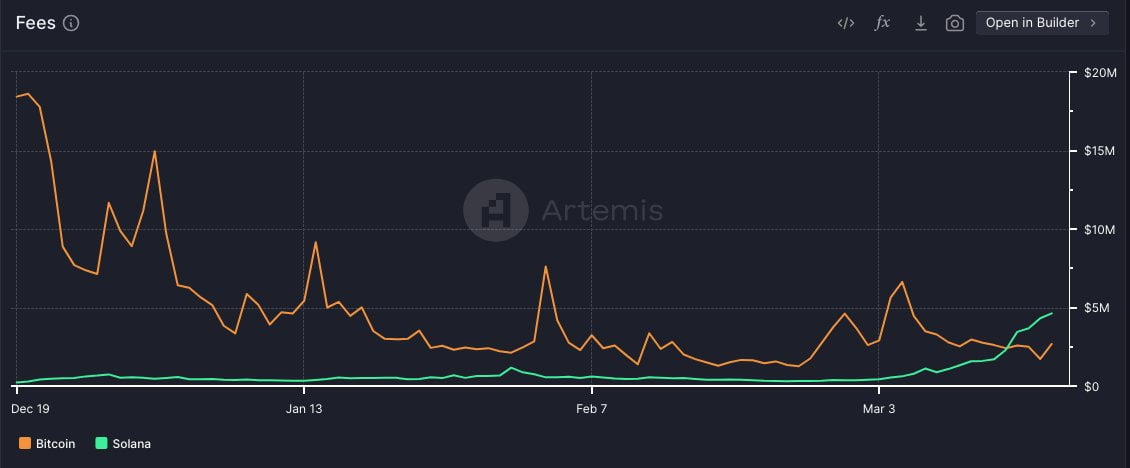

Solana (SOL) has surpassed various altcoins in terms of events and transactions taking place on the network. The cryptocurrency network has also begun to show growth in other areas. The data obtained indicates that Solana can compete with Bitcoin (BTC) in terms of fees collected on the network.

SOL’s Artemis Reports

According to Artemis’ data analysis, Solana is outperforming Bitcoin in terms of fees generated for validators. The high fees earned by Solana validators indicate an increase in network activity, which could suggest an increase in the platform’s adoption and usage. The rising activity not only demonstrates Solana’s scalability but also highlights its efficiency in processing transactions and executing smart contracts.

The ability to generate higher fees increases the interest of validators in Solana. These data also strengthen network security and decentralized governance. As Solana continues to outpace Bitcoin in fee generation, it solidifies its competitive position and underscores its potential as a leading blockchain platform that attracts more developers, projects, and users. While high fees indicate increased network activity, some investors worry that Solana’s rapid growth may be unsustainable or indicative of speculative behavior.

Interest in Solana Staking

Investors also have concerns about whether the scalability and technical challenges of the cryptocurrency network can sustain continuous growth. In addition to validator fees, there has been an observed increase in interest in Solana staking. Analysis of Dune Analytics data revealed an increase in TVL (Total Value Locked) through LST (Liquid Staking Tokens). The growing participation in staking strengthens the network’s security and decentralized structure by locking in more SOL tokens as collateral.

This increased security helps maintain the integrity of transactions and could boost confidence in the Solana protocol. Additionally, staking SOL tokens allows holders to earn rewards. This promotes a culture of long-term investment and can help reduce the circulating supply. These factors could lead to a more stable token price over time.

Türkçe

Türkçe Español

Español