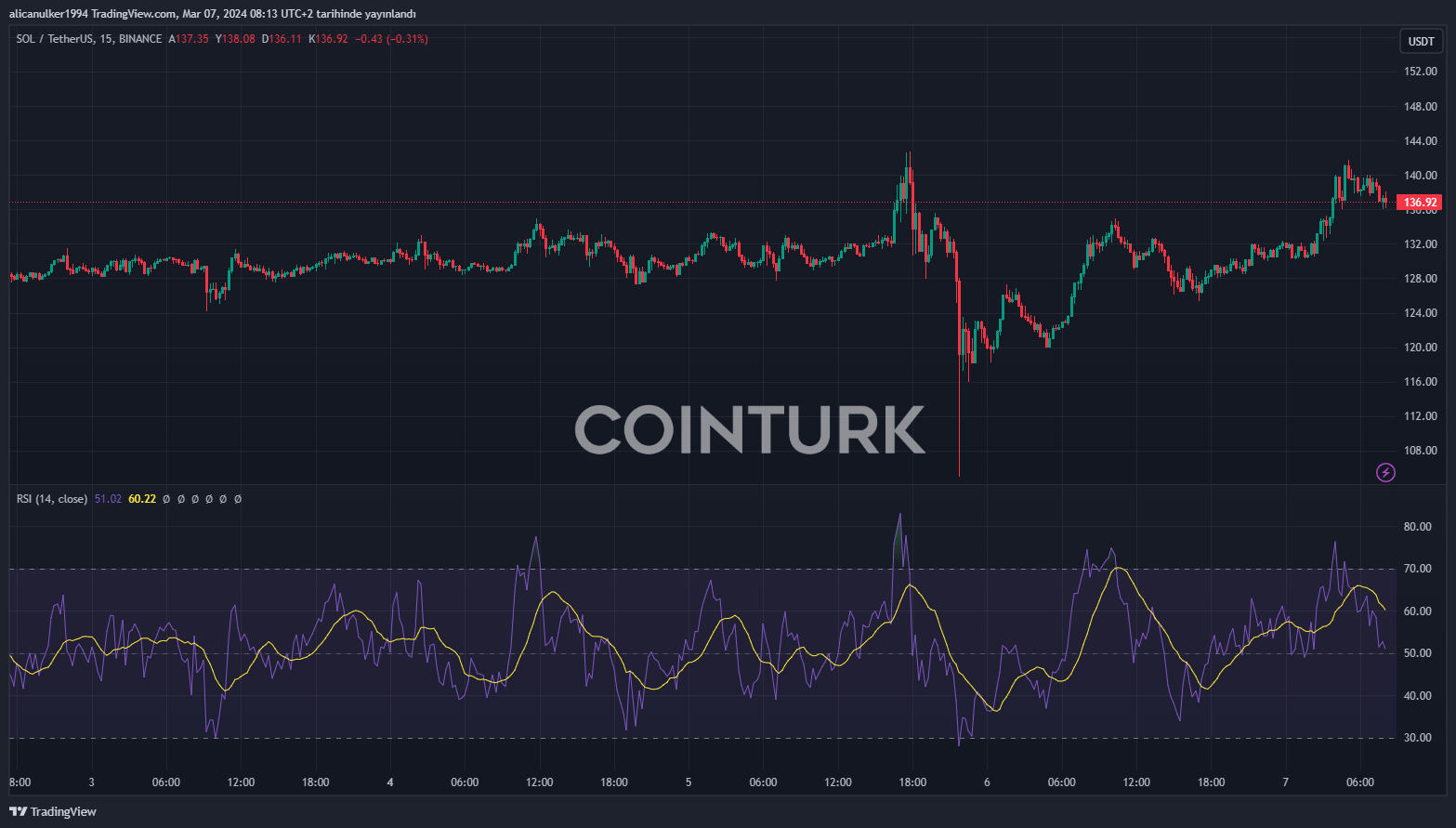

After a brief price retracement, Solana (SOL) once again surpassed the critical resistance of $140 but later pulled back. As of writing, SOL has experienced a 7% increase to a market value of $61.4 billion and is trading at $136, despite the high number of transactions causing disruptions in the Solana network.

Solana Network Congestion Issues

According to the latest data provided by DeFiLlama, between March 3 and March 6, there was a notable increase in the transaction volume of Decentralized Exchanges (DEX) on the Solana network, which seemed to have caught the attention of all investors.

During this period, the transaction volume remained above $2 billion for four consecutive days, with a record $2.85 billion volume on March 5 marking the all-time high for daily volume.

This surge in trading activity coincides with the timeline of increased onchain transactions that potentially caused the current congestion on the Solana network. The increase in activity causing congestion also highlights the growing investor interest in the Solana ecosystem.

Commenting on the issue, Binance drew attention to the events of March 6 and announced that Solana withdrawal transactions had been periodically suspended for several days.

SOL Price Movement

Despite the price uncertainty in Bitcoin, things seem to be going well for Solana (SOL). SOL’s price movement continues to paint a positive picture despite the interruptions.

Currently trading at $136, SOL faces a tough resistance at $140, which if breached, could trigger a new rally. On the other hand, support levels are found at $115 and $104, which have served as potential bounce points in the past.

Additionally, the upward price movements in SOL are accompanied by significant transaction volumes that indicate high investor interest and support a positive outlook.

As larger changes occur in the market, Solana’s potential to move upward seems increasingly promising.

Investors have been seeking alternatives to Ethereum‘s high gas fees, and despite its congestion issues, Solana is seen as one of the main competitors to ETH and is often referred to as the “ETH killer.” How this will evolve in the future is a matter of curiosity.

Türkçe

Türkçe Español

Español