Solana price increased by 6% on July 26, aiming to surpass the $200 resistance before August. In the US, this week saw volatility after the launch of Ethereum ETF funds. After retesting the $165 support, SOL instantly changed direction, surpassing the $170 resistance before rising to $178 during US trading hours.

What’s Happening with Solana?

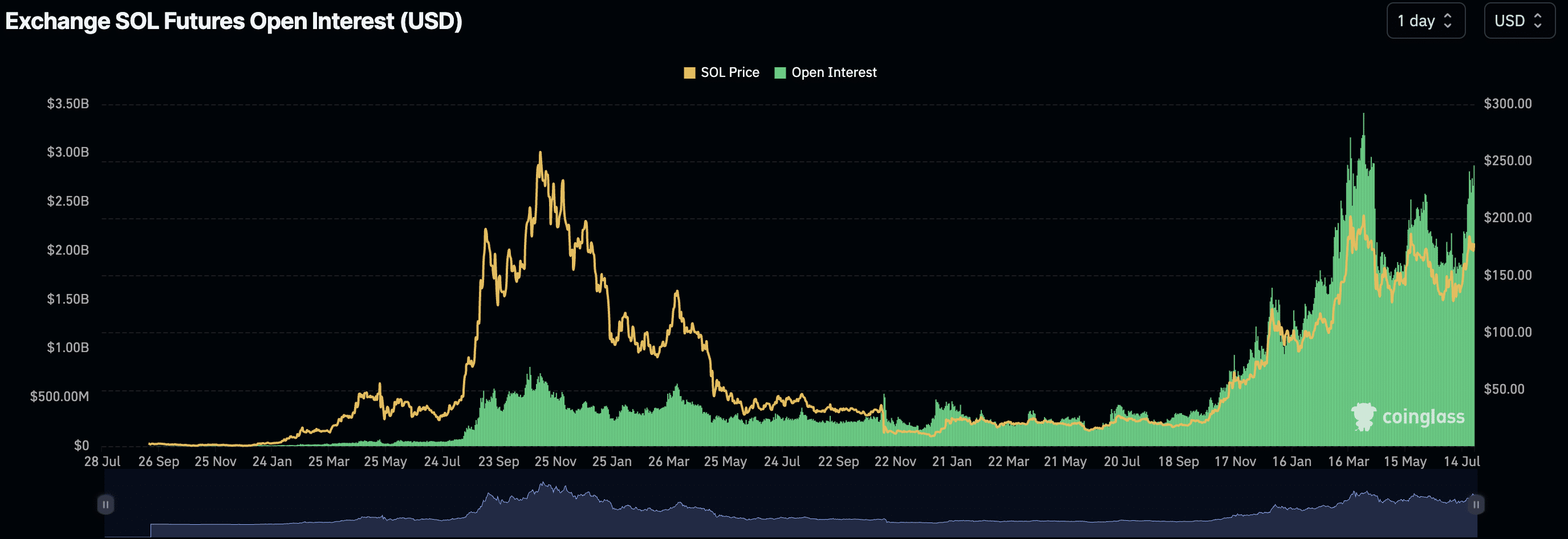

Various factors, including the open interest in the futures market, are expected to influence Solana’s movements as it recovers from the sharp drop earlier this month. Inflation, particularly its steady downward trend in recent months, is another crucial factor for investors to watch.

Solana’s competitive decentralized finance (DeFi) sector has made commendable progress after a significant correction from the $4.97 billion peak in May to the $4.02 billion low in July. Solana’s TVL value rose by 15% in July to $5.34 billion, highlighting the improving sentiment towards the smart contract token’s future.

As more people lock Solana into smart contracts within the ecosystem, the price’s chance to reach new highs significantly increases. This data is used as a long-term trend indicator. Additionally, Solana’s futures open interest (OI) increased by 9% in the last 24 hours on Coinglass, reaching $2.7 billion. An asset’s OI data represents the total number of outstanding futures contracts that have not yet been settled.

Solana Chart Analysis

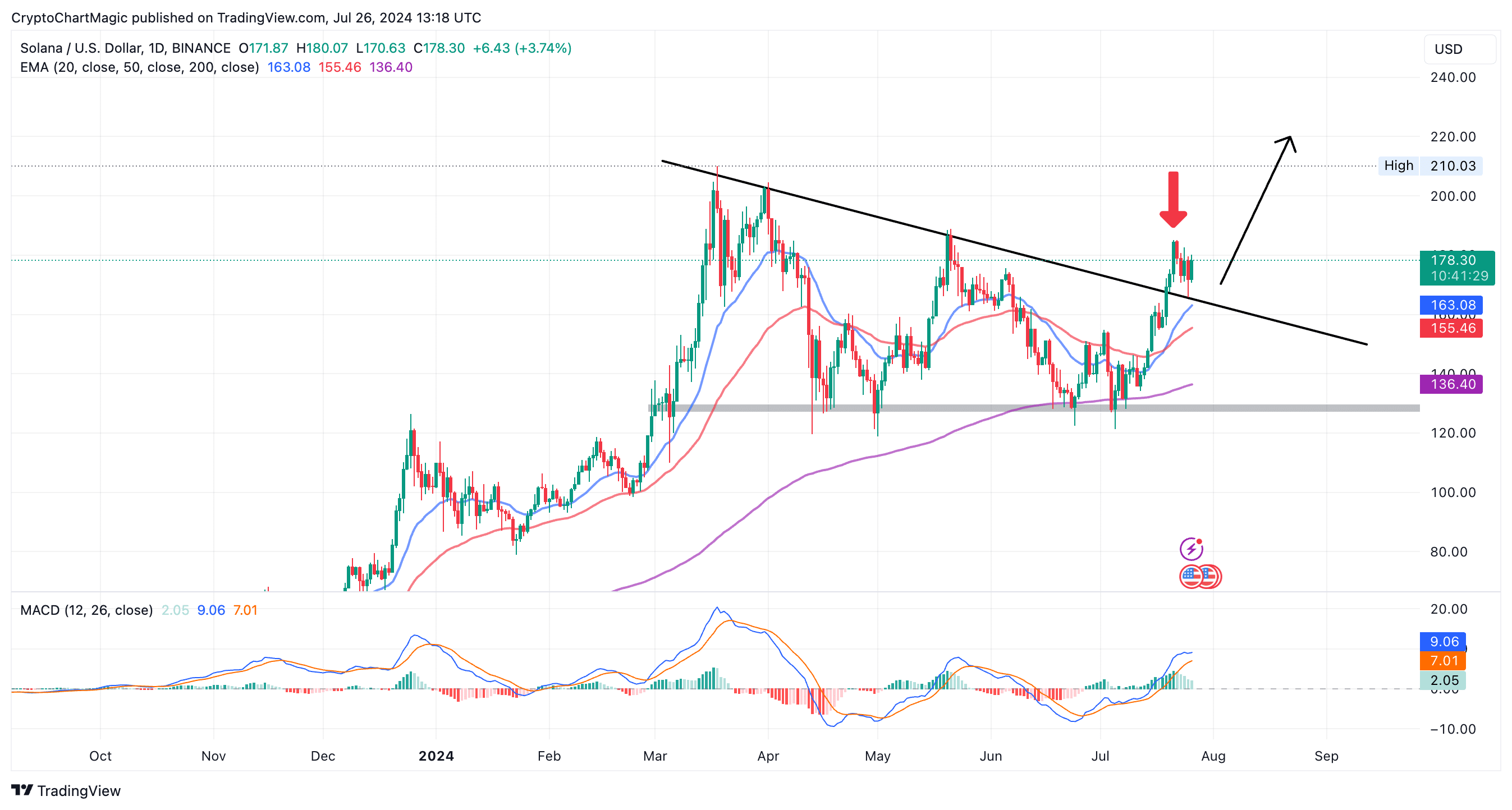

Solana price rising from the $165 support to $178 was supported by a buy signal from the MACD. On the daily timeframe, a golden cross further revived interest in SOL’s trend revision. Solana’s current position above the descending trend line drawn on the chart indicates a bullish period, with bulls aiming to push the price above $200 this weekend.

A previous SOL price prediction revealed that surpassing the $180 resistance could encourage FOMO as investors add open buy orders. As volume increases, Solana’s price could reach $220 before hitting the previous all-time high of $260.

Türkçe

Türkçe Español

Español