Solana (SOL) may be in the midst of an unprecedented uptrend since April 2022. However, the price surge has followed the continuation of the previous downtrend. Is a repetition of the same scenario possible?

The Impact of FTX Move on SOL

The news that FTX will remove an additional 1.6 million SOL in holdings could mean a blow to the uptrend and lead to a major price correction. According to experts, it is uncertain whether investors can expect such a drop as the leading cryptocurrency, Bitcoin (BTC), has managed to stay above $33,000 and could rise further.

A daily chart showed that the uptrend is still dominant. RSI continued to move in the overbought zone above 70, and On-Balance Volume showed an increase, indicating an increase in buying volume and a strong upward momentum.

Higher time frame charts indicated a clear signal that further gains could come above $27 to $30. It did so, and SOL reached $46.9 on November 1. A return to previous highs around the $27 level would be a long-term ideal buying opportunity.

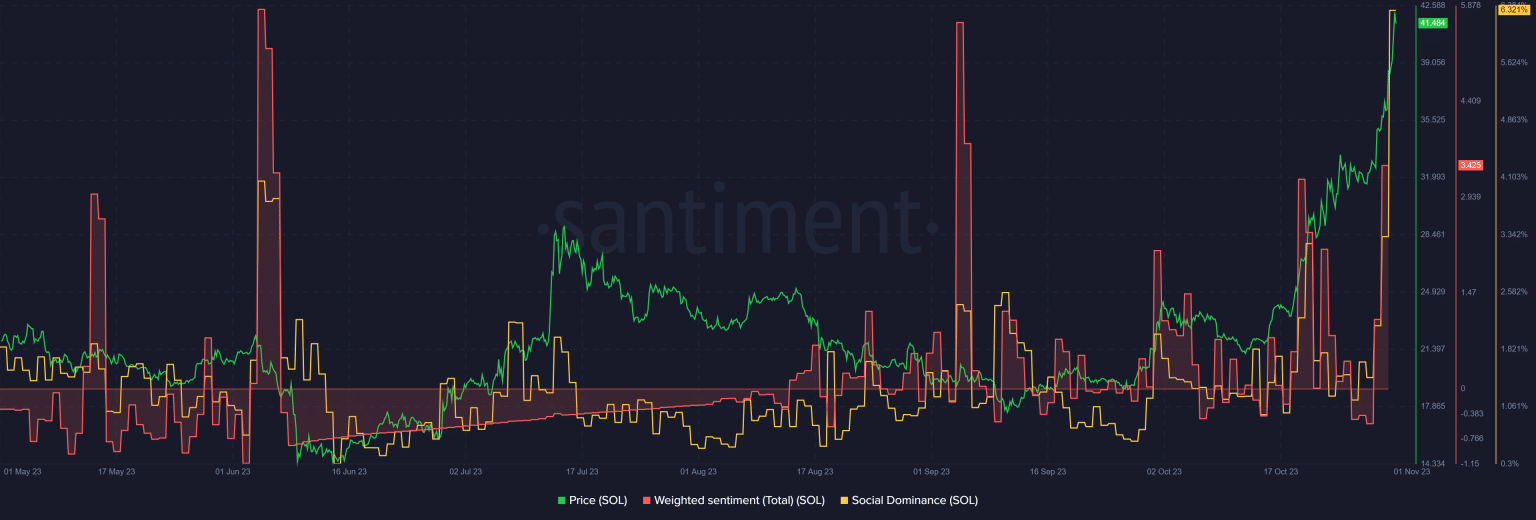

According to analysts, Fibonacci levels at $44.08 and $51.46 showed levels where bulls could take profits and expect a pullback. Another important metric, Weighted Sentiment, has risen along with price increases in recent days. Additionally, social dominance has shown an increase, rising to 6.32%. These measurements can underline the perception that the bullish sentiment for SOL is strong in the eyes of the majority. However, social metrics alone may not postpone the possibility of a pullback.

Analytical Company Report on Solana

Coinalyze data shows that SOL has been in a steady uptrend since October 19, with a price of $23. This indicates the demand for the token. The rise has also been followed by an increasing open interest (OI), which is an indicator of strong bullish sentiment.

The weekly chart revealed that the $38-50 range, which acted as resistance in August 2022, could once again pose a problem for buyers. According to experts, if the token turns the $50 support into a support level, SOL could potentially rise to $80 and then $105.