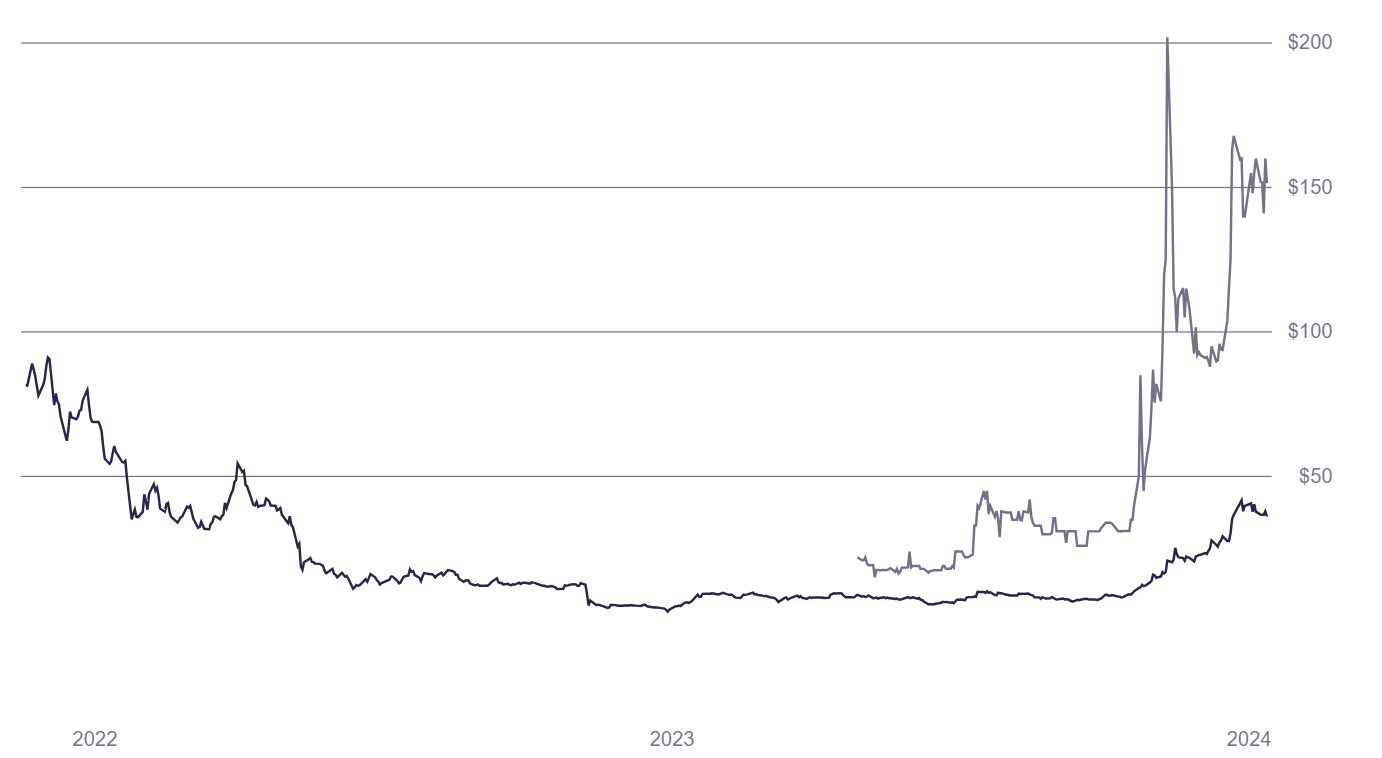

At the time of writing, one of Ethereum’s biggest competitors, Solana (SOL), was trying to exceed $100 again. Today was a classic weekend, and we saw a continuation of weakness in altcoins with declining volumes. However, SOL Coin has accelerated its recovery a few hours ago, continuing the day with a 7% gain at $99.6.

Solana (SOL)

After the collapse of FTX, SOL Coin, which has completely recovered its losses, has made significant gains in the past few months with the GSOL connection due to revived institutional demand. GSOL, which reached its all-time high in November, created a leverage effect for investors and caused a massive demand on the spot side.

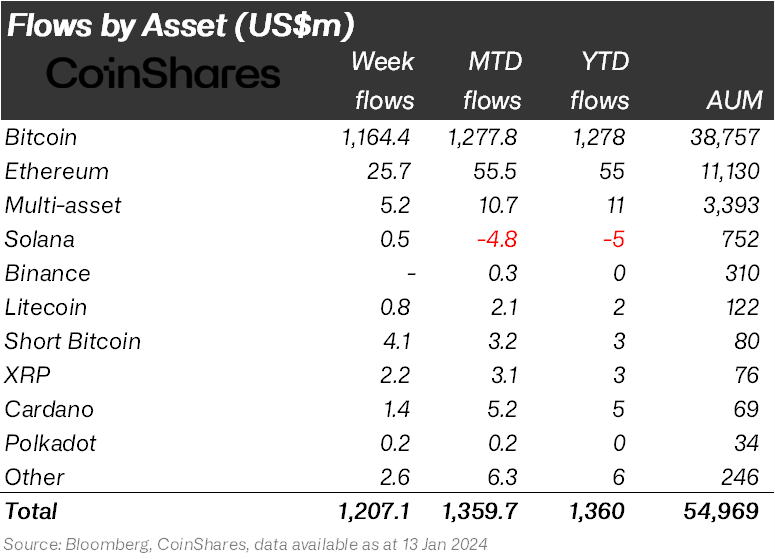

However, as confirmed by the past week and the weeks before, inflows into SOL Coin funds have slowed down. Since interest has shifted to spot BTC ETFs and the speculative relationship between GSOL and the spot price has become even more noticeable, a rise may not be triggered from this channel for a while at least.

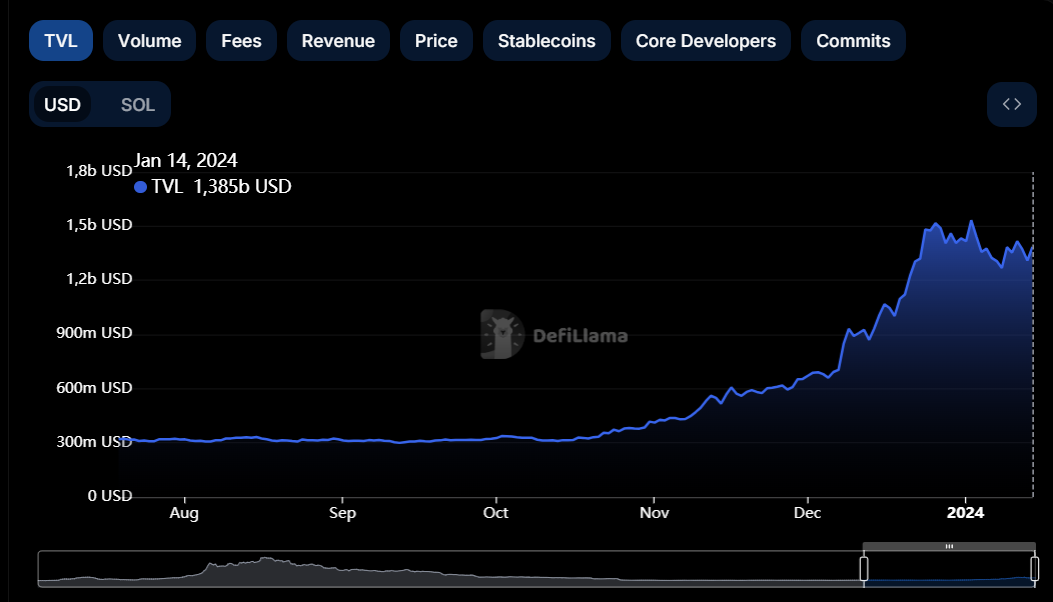

However, the positive sentiment in the overall market suggests that the Solana network, by maintaining over $1.3 billion in TVL, could see new peaks in 2024. For this to happen, the price of ETH needs to exceed $3,500, significantly breaking BTC’s market dominance and opening up space for altcoins.

Considering that the total locked value in the Solana network has come from levels of $300 million, we can say that the recovery is not only in the price but also in the Solana ecosystem in general. Of course, the benefits brought by supporters like BONK and JTO should not be overlooked. Perhaps the Solana network should focus more on airdrops in the coming months to attract more users.

SOL Coin Price Predictions

The price seems to be rising from the ascending trend line for now, turning the $97.67 barrier into support. The recovery could continue with the current positive mood up to the resistance at the $112 region. However, since the US markets are closed tomorrow, what will happen is uncertain. There aren’t any major developments on the macro front throughout the week, but we are approaching the Fed meeting at the end of the month.

Markets generally prefer to be cautious during Fed meetings. If we see the same caution following inflation and employment data, it will be justified. Although the target for the year is $200, the short-term barriers of $112-126 are not an easy feat.

Türkçe

Türkçe Español

Español