Solana (SOL), one of the biggest Ethereum competitors, has been one of the fastest cryptocurrencies to respond to BTC price increases this year. However, it failed to perform as expected during the recent $64,000 rally. Although the SOL Coin price has surpassed $130, it is still not at the level it should be when compared to previous price movements.

Solana (SOL)

SOL Coin pushed its highest level of 2024 even higher, reaching a 23-month peak. On a weekly basis, the popular altcoin increased by 34.5%, continuing its full-throttle competition with BNB in terms of market value.

The price did not gain as much as desired after February 23. The double-digit gains of the last week are related to the recovery from the recent dip. Looking at the price difference between February 23 and today, we see a modest gain of 2%. When we make the same comparison for Ethereum (ETH), the difference is 25%, and for Tron (TRX), it is 31.5%.

In summary, despite the activity in the SOL Coin ecosystem, which we are accustomed to seeing positive divergence, it is achieving weak gains. While Bonk (BONK) recorded an increase of 110% since February 23, DogWifHat (WIF) experienced a significant rally of 250% in the same period. The price of DOGE and SHIB, on the other hand, increased by 50%.

SOL Coin Price Prediction

From the first section, we should understand that “SOL Coin has not delivered as expected compared to the last few months” and has strong rally potential. The total value locked in the network has risen to $2.5 billion since November 2022. Just a few months ago, it was debatable whether the $1 billion threshold could be crossed, but now we see a different picture. Considering the peak was $10 billion (previous bull period), there is still significant room for growth.

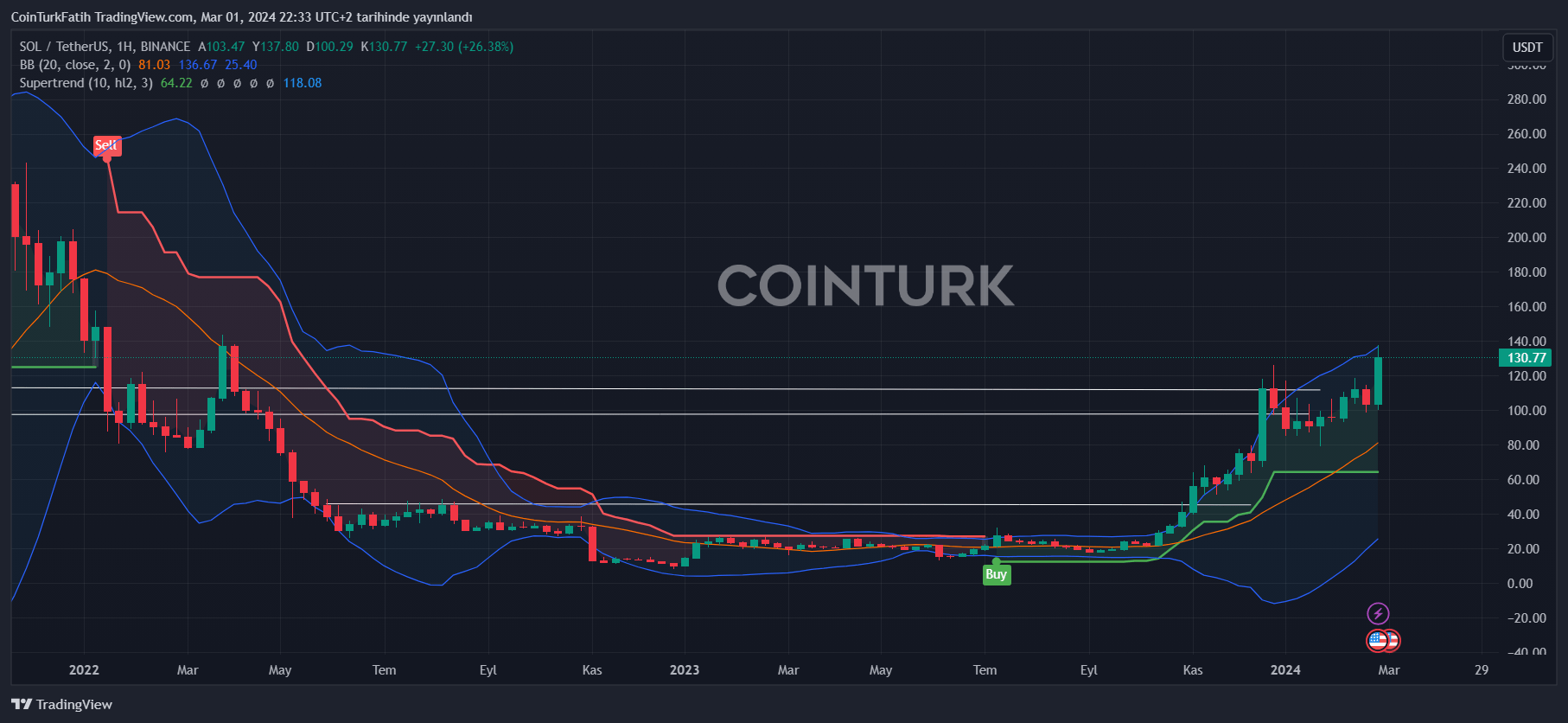

SOL Coin price reclaimed the support from the rise that started in December. This situation indicates the potential continuation of a parabolic rally, while closings above the parallel channel resistance are motivating. Now, we should expect closings above $125 to turn the $138 resistance into support.

The price had turned from $143 in mid-2022 and the decline had continued down to $8 prices. For the bulls, the real possibility starts beyond the $138 and $143 barriers. Here, the target should be the challenging psychological resistance level of $200 after $158 and $175.

Türkçe

Türkçe Español

Español