As anticipation continues in the cryptocurrency market, competition within blockchain ecosystems is reflected in the data. According to data provided by the blockchain data analysis platform DefiLlama, Solana has managed to surpass Ethereum in daily DEX trading volume with $1.148 billion compared to Ethereum’s $745 million.

What Is Happening in the Solana Ecosystem?

Solana-based Raydium, Meteora, Orca, Phoenix, and Lifinity are among the top 10 DEXs by daily trading volume. Uniswap and PancakeSwap continue to maintain their leadership during this period. As Patrick Scott, the founder of Dynamo DeFi, also noted, Solana’s DEX volume dominance is increasing. In fact, it is on track to exceed 25% for the first time this June.

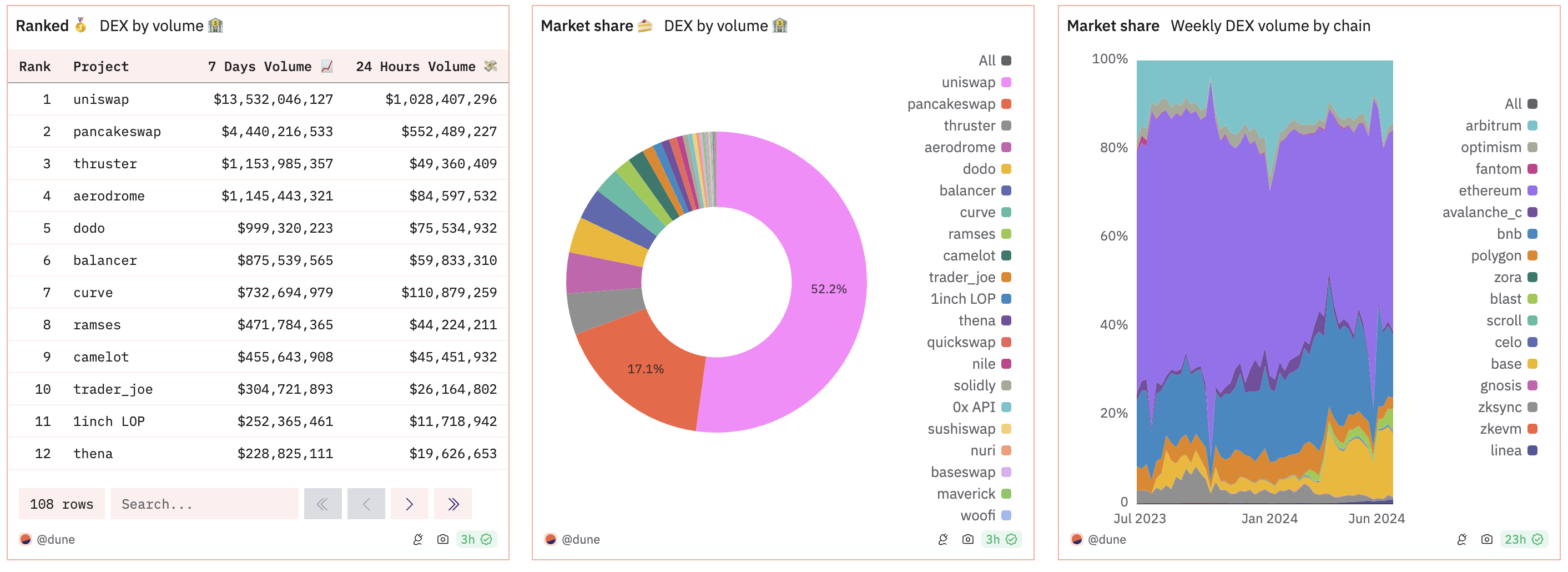

According to data provided by another blockchain data analysis platform, Dune Analytics, overall DEX volume reached $26 billion in the last seven days. Earlier this year, trading volume on Solana-based DEXs increased, particularly due to the rising popularity of memecoin projects.

ETF Space and Solana

Along with all these developments, the Ethereum Killer has entered a period where it benefits from increasing ETF interest. According to recent developments, the New York-based investment company VanEck applied to launch an ETF for Solana on June 27; 21Shares also made a similar application for the popular altcoin on June 28.

However, those expecting this ETF fund to see the light of day in the near future need to temper their expectations. According to leading analysts in the field, the product is expected to be approved within this year. After initially seeing a sharp price increase due to ETF excitement, the SOL price is currently facing selling pressure and has decreased by 0.2% in the last two weeks.

According to data provided by CoinGecko, the popular altcoin is currently valued at $65.2 billion, placing it fifth in market value behind Bitcoin, Ethereum, Tether, and BNB.

Türkçe

Türkçe Español

Español