Solana experienced a 9% drop on January 18, falling to $91.40. Over the past 15 days, Solana has consistently retreated from the $100 level. However, considering that the total cryptocurrency market value could not maintain levels above $1.6 trillion throughout 2024, this should not be alarming.

Noteworthy Details in the Solana Ecosystem

The Solana rally in December 2023 occurred after Solana SPL token airdrop events involving Jito (JTO), BONK, and Dogwifhat (WIF) were well received by users. Some projects aimed to offer special deals to these users, which increased demand for the Solana Saga Phone. However, BONK faced a 15% correction between January 17 and 18, while JTO experienced a 19% drop during the same period.

Another factor contributing to the recent correction in Solana was the excessive optimism caused by airdrop expectations. While some launches took longer than expected, other events provided only temporary short-term support to their decentralized applications (DApps) and faded after the related airdrop announcement. Analysts and influencers compiled lists of the most promising opportunities, but nearly none of the tokens reached reasonable values and volumes.

In a post dated December 12, 2023, on the X social network, ‘IcedKnife’ highlighted some of the anticipated Solana ecosystem launches, including Kamino, Drift, Tensor, Jupiter, Parcl, Marginfi, and other platforms. A significant source of optimism for Solana’s performance is the growth in deposits within the decentralized finance (DeFi) industry on the Solana Network.

Continued Increase in TVL Value

Solana‘s Total Value Locked (TVL), measured in Solana, reached a peak of 15.4 million on December 19, 2023, indicating a 60% growth compared to the previous month. However, it has since stabilized around 14 million. In addition to the TVL growth on the Jito and Marinade Finance platforms, Kamino, Orca, and Solend DeFi applications each managed to exceed $150 million in deposits.

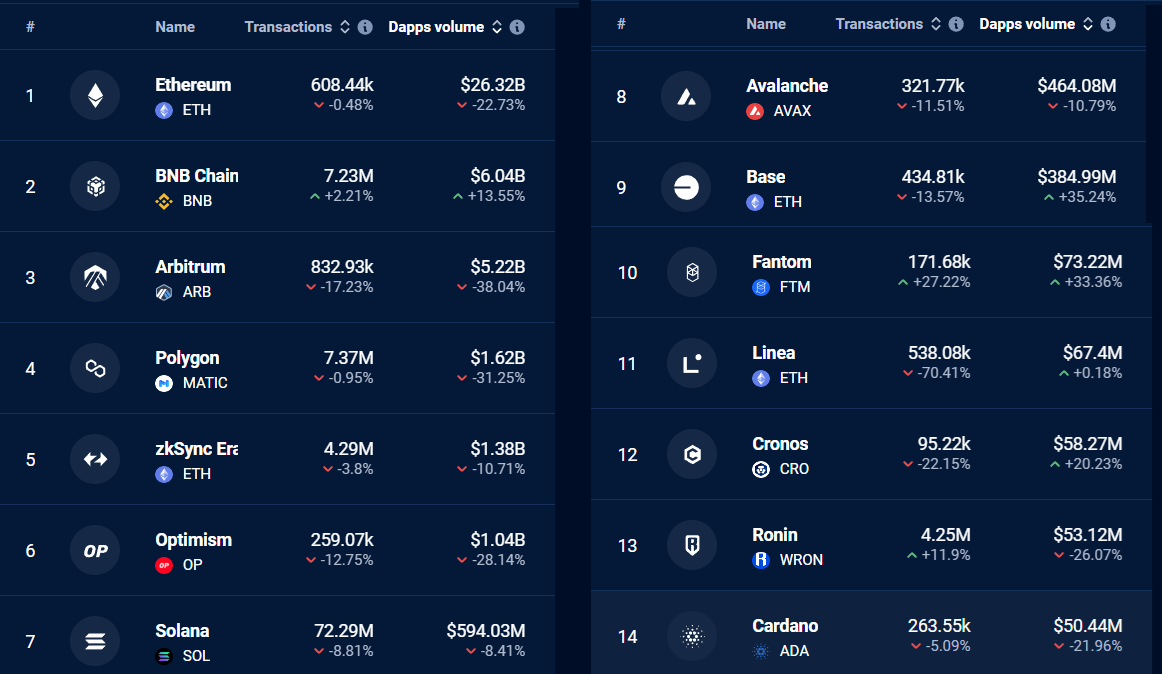

Solana saw an 8.5% decrease in transactions and active DApps user numbers over the last 7 days. Nonetheless, Solana’s total DApps volume of $594 million during this period was significantly smaller compared to BNB Chain’s $6 billion volume and Polygon’s $1.6 billion volume. On the positive side, Solana leads with an absolute transaction count of 72.3 million, which can partly be attributed to its lower costs.

Türkçe

Türkçe Español

Español