Last year, cryptocurrencies, including Solana (SOL), showcased impressive price performances, leading many to consider it a major architect of the market’s recovery. After surpassing $100, SOL’s price is challenging the $120 level again, leaving investors wondering whether it will drop to $90 or rise to $125 in February.

The Future of Solana (SOL)

While the general market continues to experience volatile price movements, Solana’s price has maintained strong resistance above the $106 level, earning investor admiration.

The formation of a morning star candlestick pattern at this horizontal level indicates the presence of sufficient demand pressure for the price to continue its recovery trend. However, if Bitcoin‘s price undergoes a correction from $52,000, it remains to be seen whether SOL can maintain this price level.

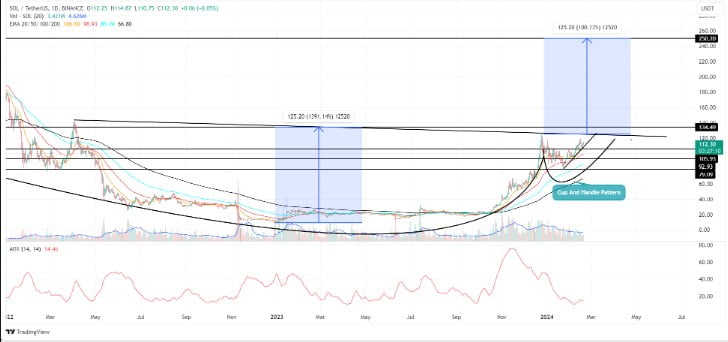

Upon examining Solana’s daily chart, it’s clear that the altcoin has experienced a swift recovery following the latest correction, with buyers fully regaining control at the $79 support level.

The V-shaped formation on the charts could be interpreted as a sign of aggressive price movement, during which SOL’s price saw a 42% increase within a month.

Looking at the recent recovery, buyers have managed to reclaim 50% of the losses from the last decline due to their strong pressure.

On February 17th, SOL’s price showed a recovery from the support trend line and the region indicating the slope of the 20-day EMA, marked by a morning star candlestick formation.

If the momentum from the recovery continues, a 13% price increase is possible with buyer pressure, potentially reaching the $125 neckline resistance of the cup-and-handle formation.

Patterns Indicate a Recovery

As seen in the charts, the current rise in SOL’s price suggests the formation of the handle part of a cup and handle pattern. This retracement could be the last correction SOL faces before buyers initiate a significant upward price movement.

A breakthrough to $125 on the resistance trend line seen in the charts could accelerate the price recovery. If investor enthusiasm continues, the price could aim for a potential $250 target. Conversely, a decline from the lower support trend line could push SOL’s price below the $90 level.