The popular altcoin, Solana (SOL), surpassing the $170 level has caught the attention of cryptocurrency enthusiasts worldwide. The price reaching such a significant milestone after a long period, especially following a drop to $8 in 2022, coincides with the overall upward trend observed in the cryptocurrency market during the same period.

The Drivers Behind the Rise

One of the key factors driving Solana’s upward price movement, as highlighted by data from a platform that tracks significant blockchain movements, Whale Alert, is the recent increase in whale activity surrounding SOL. The rise in on-chain whale activity indicates growing confidence among Solana’s large investors, paralleling the altcoin’s notable price increase.

Additionally, derivative data provided by Coinglass shows a significant rise in open interest (OI) and trading volume, revealing that investors are on a notable upward trend with SOL. This influx of capital and high market activity further strengthens SOL’s bullish outlook, leading to positive sentiment among traders and investors.

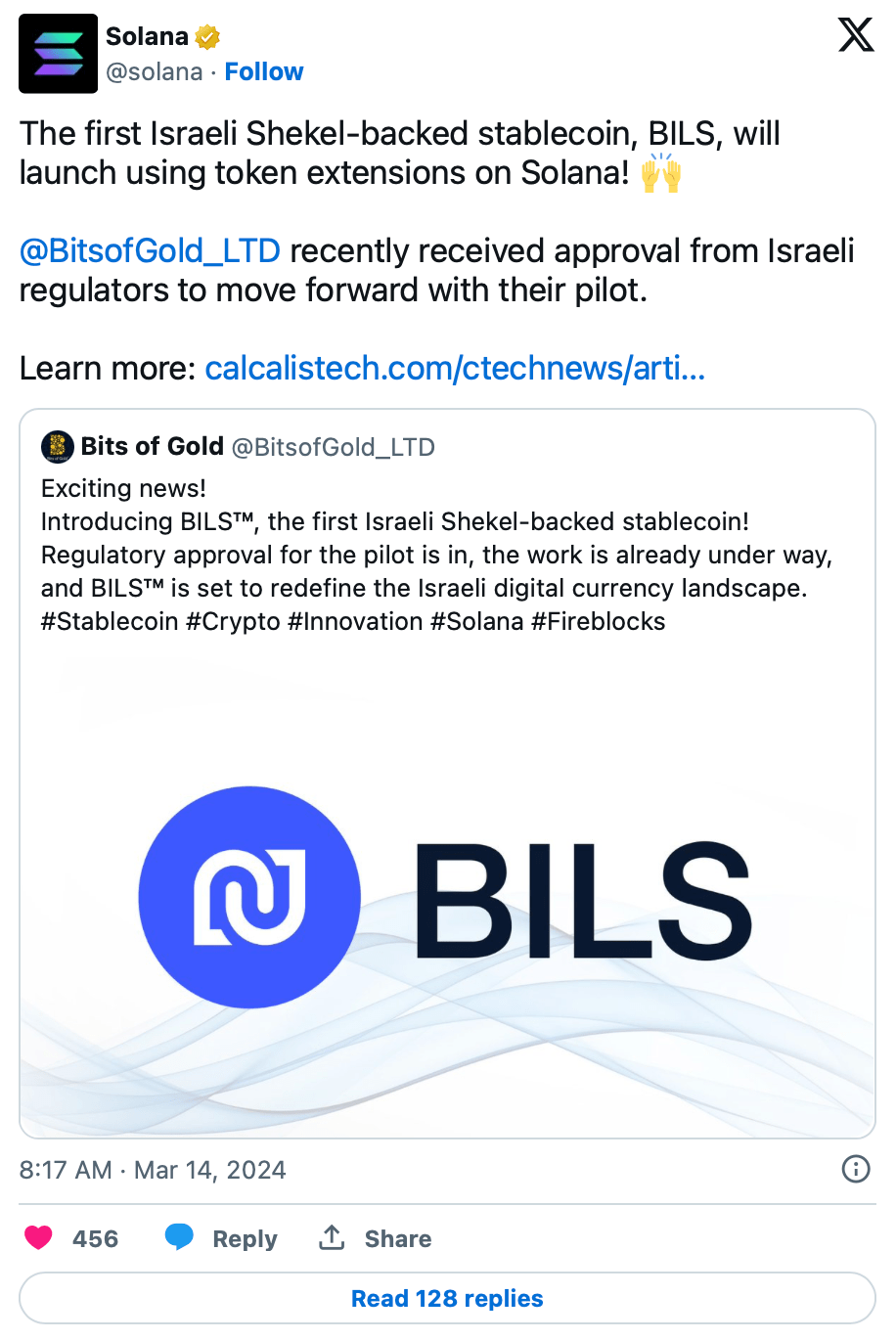

Moreover, recent developments in the Solana ecosystem, such as the launch of the first Israeli shekel-indexed stablecoin BILS using Solana’s token extensions, have contributed to the altcoin’s upward trend. Furthermore, regulatory approval from Israeli regulators has strengthened Solana’s position in the cryptocurrency world.

RSI Signals Overbought Conditions

At the time this article was prepared, SOL’s price has seen a 12.50% increase in the last 24 hours, trading at $171.63. This upward movement is accompanied by a notable increase in market value and trading volume, reinforcing Solana’s bullish trend.

However, while technical indicators point to strong buying sentiment in the market, the Relative Strength Index (RSI), a leading technical indicator, is signaling overbought conditions. This signal suggests that the altcoin may face a potential pullback, possibly followed by a consolidation period.