According to the reports from popular analytics firm Santiment, the price surge of SOL resulted from the market‘s acceptance that the token does not need a strong correlation with Bitcoin (BTC) or Ethereum (ETH). As a result, discussions around Solana, as evidenced by social dominance, continue to reach new highs. Similarly, the funding rate has also increased, indicating an increased bullish sentiment among investors.

Santiment’s Report on Solana

The combination of increased social dominance and funding rates may indicate that a cryptocurrency’s price has reached a local peak. Often, this can also mean a slowdown in buying orders. However, Solana seems to be breaking this rule. Chain data from Santiment supports the idea that SOL is in a bullish opportunity zone.

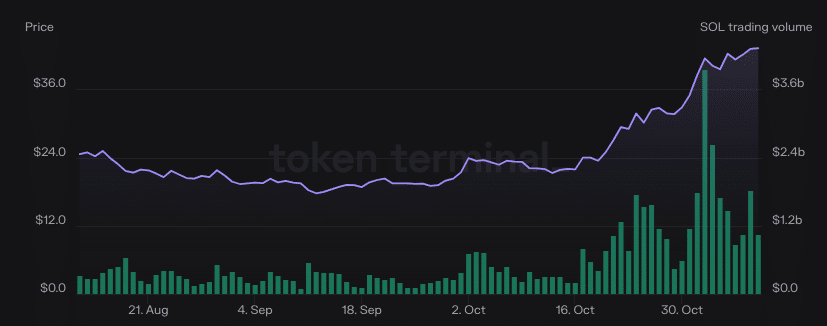

Furthermore, experts have analyzed the trading volume to determine if it is still the right time to buy SOL. According to Token Terminal data, Solana’s trading volume was around $1.48 billion at the time of writing. The value of the trading volume, like price movement, represents an 18.29% increase in the last 24 hours. Increased volume, along with increasing prices, can indicate growing momentum.

Targeting $60 for SOL

According to experts, it is possible for Solana to surpass $55 and move towards $60 in the coming days. This can be possible if the volume remains the same and there is enough buying pressure to keep the price upward. Analysis of SOL’s price on the 4-hour time frame may indicate that the subunit is in price discovery mode. Price discovery, largely driven by demand and supply, can show how the value of a cryptocurrency is determined by buyers and sellers.

Additionally, the 0.382 Fibonacci retracement level was around $43.44. This can indicate that the fear in the market has subsided and the price has jumped into an uptrend. Then, a strong support formed at $44.81, supported by the 0.236 Fib level. In case of a pullback in SOL, there is a high probability of finding a good buying position at or above this price. Furthermore, the relative strength index (RSI) indicated that SOL was overbought.

Türkçe

Türkçe Español

Español