Solana price has surged due to the buying frenzy in the cryptocurrency market. On March 14th, the SOL price saw an approximate 6.70% increase, reaching its highest level since January 2022 at $174. In doing so, the cryptocurrency outperformed the general crypto market, which saw a 0.25% decline on the same day. However, at the time of writing, SOL was trading at $166.

Why Is Solana Rising?

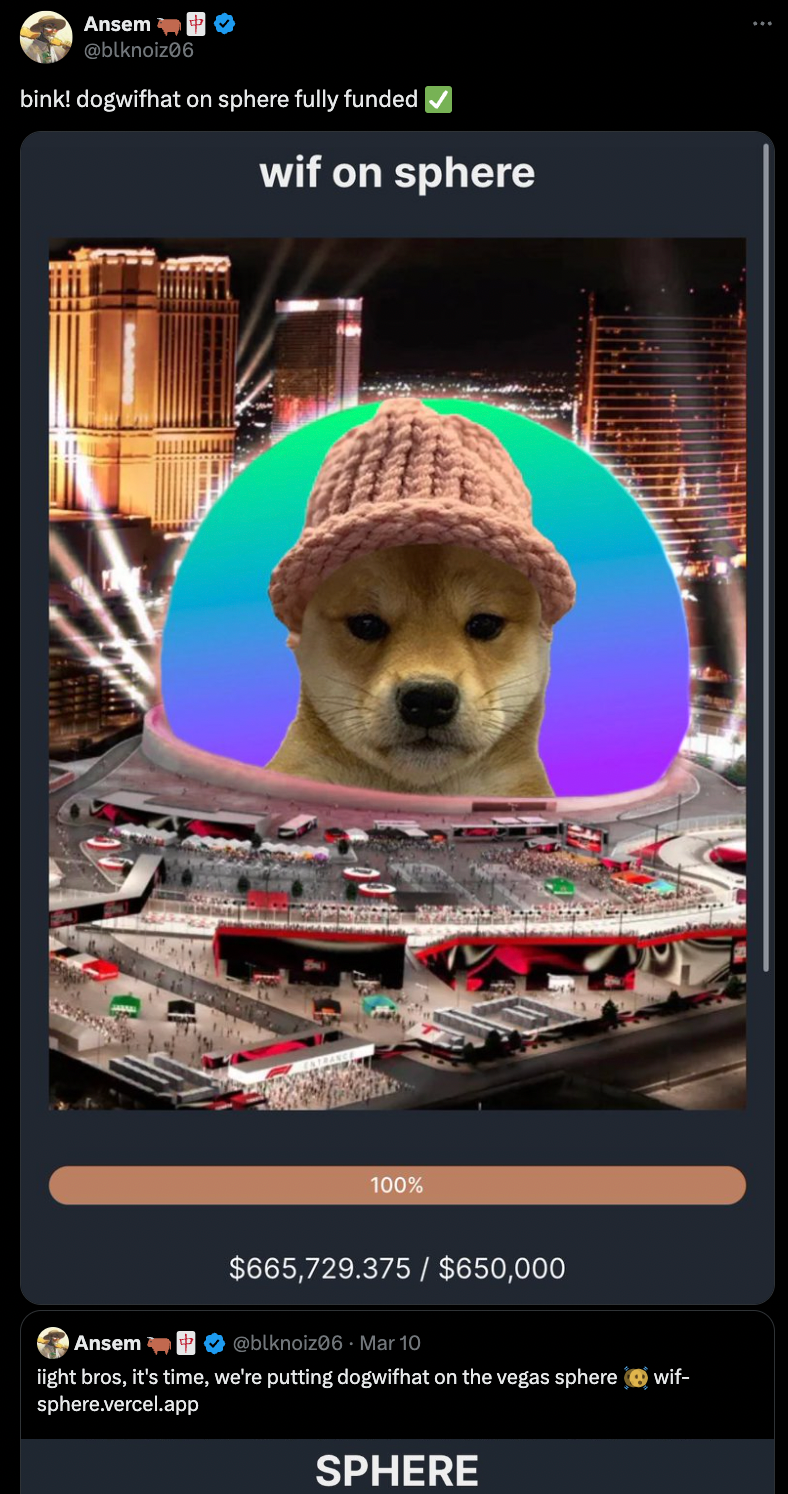

The recent increase in Solana’s value and the notable gains from the past day coincide with the process created by the associated memecoin project Dogewhatif (WIF). Specifically, WIF supporters successfully funded $50,000 against their $700,000 goal. The community used the funds raised to highlight the token logo in the Las Vegas sphere. Dogwifhat’s (WIF) price increased by 25%, reaching a new peak above $3 and achieving a market value of $3 billion after the campaign.

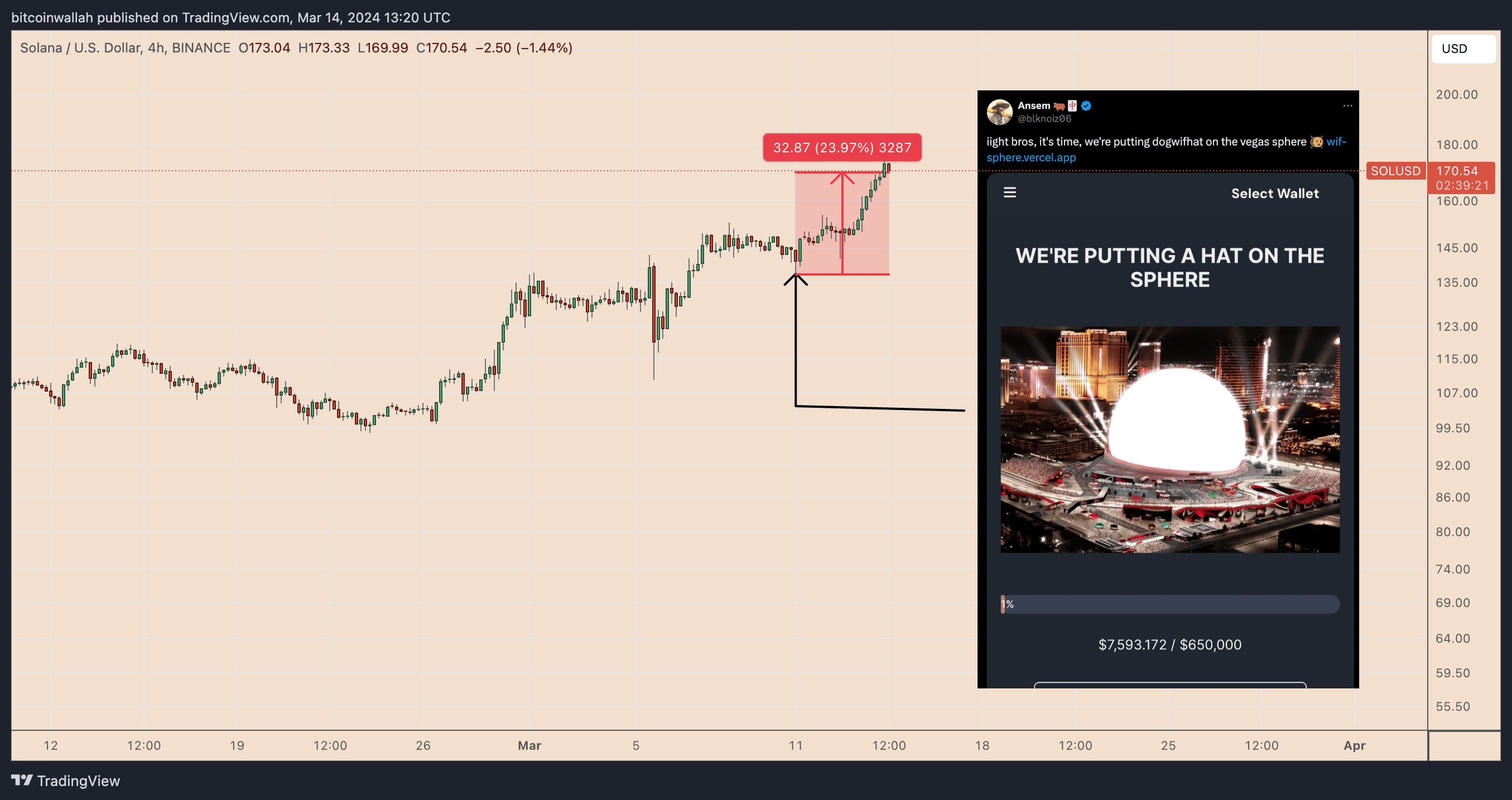

Interestingly, Solana’s price began to rise shortly after the Dogwifhat campaign was announced on March 10th. Since then, SOL’s price has increased by more than 24% and gained momentum particularly after the successful WIF crowdfunding.

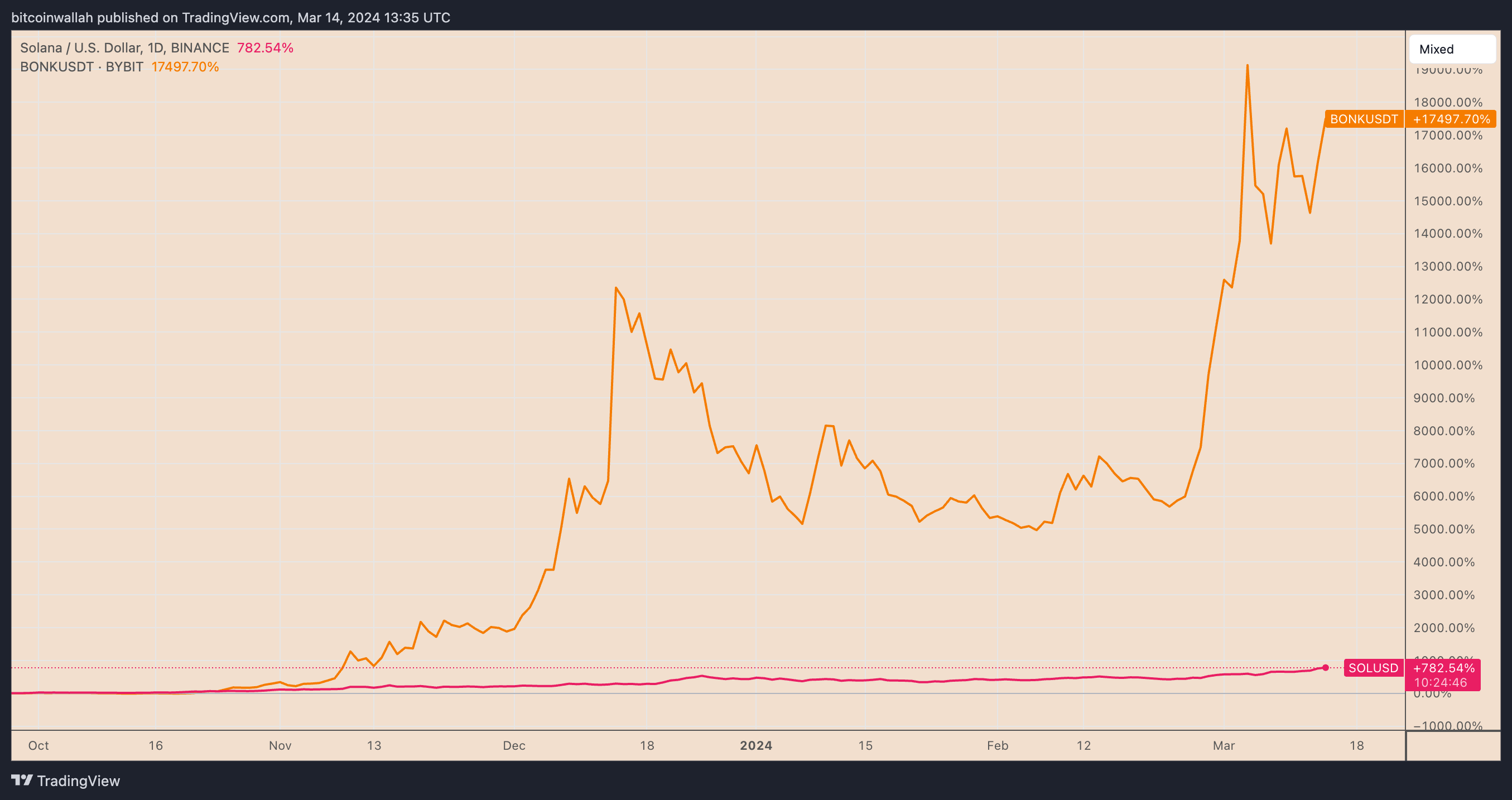

Solana bulls have recently responded positively to the launch of memecoin projects within the blockchain ecosystem, and a recent Franklin Templeton study noted that during the same period when the network’s popular memecoin project BONK saw a price increase in the fourth quarter of 2023, it captured a significant percentage of all active addresses’ activities.

Such events contribute to speculation around the potential for increased SOL demand due to more activity with decentralized applications (DApps) and transactions on the Solana platform. The latest figures for Solana show an increase in network activity. As of March 14th, the total locked value in the Solana network reached its highest level since December 2022, with 23.07 million SOL.

Bitcoin and Solana

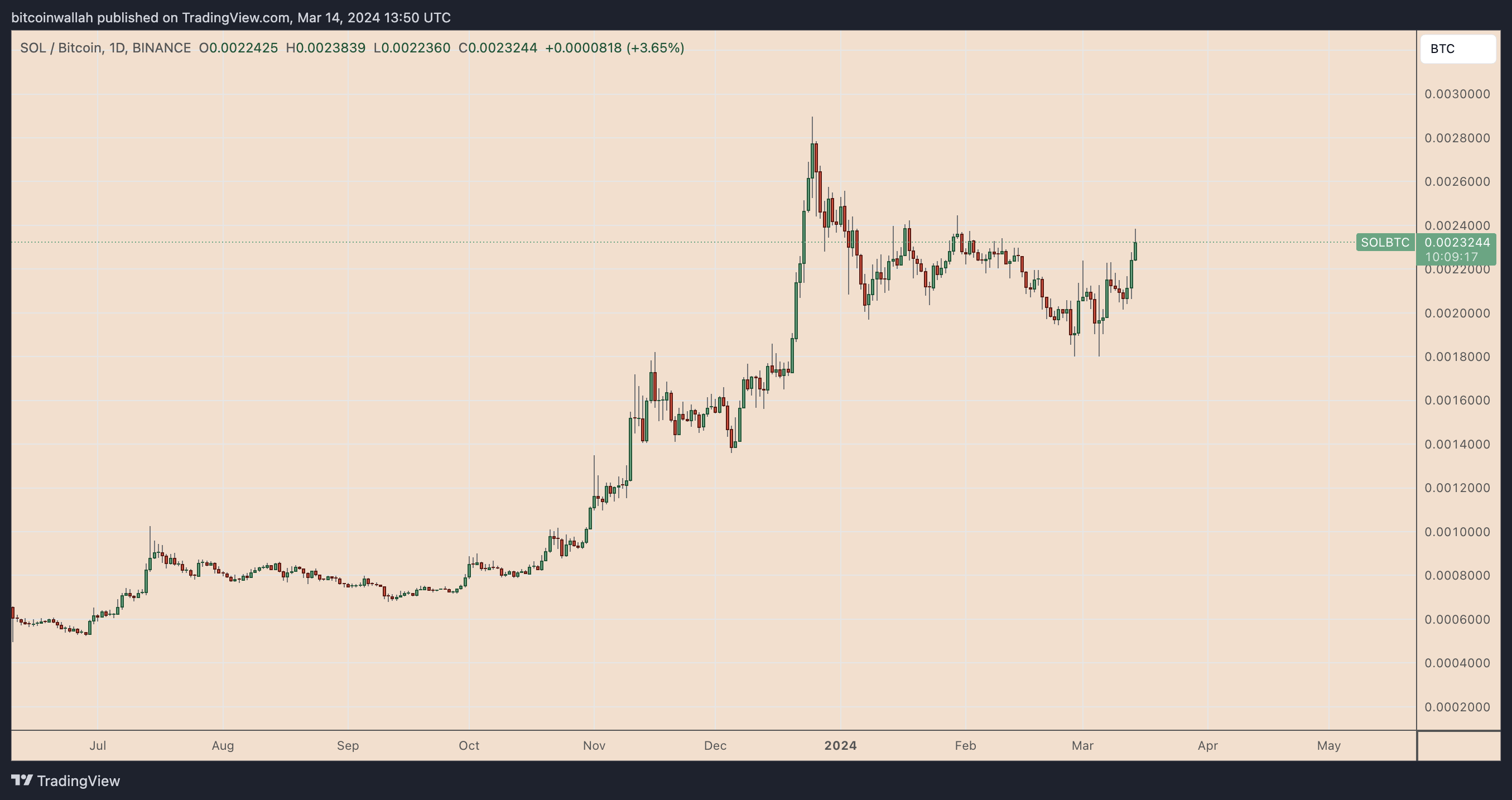

Solana’s current price increase is part of the prevailing recovery movement against Bitcoin. Particularly, the SOL/BTC pair has increased by 32.45% after reaching a local low of 0.0017 BTC earlier this month. This includes a 6.60% increase on March 14th, indicating that investors were moving their capital from the Bitcoin market into Solana.

Bitcoin has shown a 65% increase so far this year, and the daily Relative Strength Index (RSI) indicates overbought conditions. Investors may see altcoins that have not yet caught up with Bitcoin as riskier at this point. Conversely, altcoins like Solana and XRP have recently exhibited relatively lower RSI values, suggesting a more balanced market sentiment for these assets.

Türkçe

Türkçe Español

Español