Solana’s position at the beginning of the year, especially considering the decentralized finance (DeFi) sector’s performance over the past month, could hardly be described as anything short of spectacular. On Christmas Day last week, the number of daily transactions on the network soared to 9.25 million, marking a significant milestone. This figure is astounding when compared to Ethereum’s 135,000 transactions on the same day.

Cryptocurrency and Swapping

Crypto swaps, a process that allows for the exchange of one cryptocurrency for another without converting to a stablecoin, continue to hold an important place in the DeFi sector. The growth of a protocol has become more noticeable recently with the increase in usage for these swaps.

Solana’s significant transaction volume in this area is evidence of the increasing trust and demand for DeFi protocols, including decentralized exchanges (DEXs). This increase is not just a number; it represents a shift in the DeFi landscape and demonstrates Solana’s growing strength.

Solana’s DEX Performance

A closer and more detailed examination of the performance of Solana-based DEXs reveals that the growth experienced is not only in price but also in investor interest.

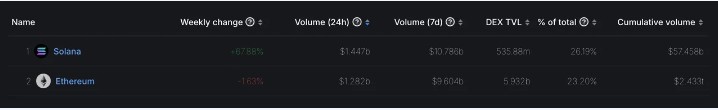

According to data shared by DeFiLlama, DEXs saw a staggering $10.74 billion in transaction volume last week, marking the first time Solana has surpassed Ethereum since its inception.

Additionally, the month of December saw a record-breaking month for DEX activity linked to Solana, with transactions exceeding $24 billion.

Even when compared to November, this represents a threefold increase, reflecting a significant rise in activity and interest in Solana’s DeFi offerings among investors.

TVL and Market Trends

Aside from the frenzy in DEXs at the end of the year, there has also been a notable increase in the USD value of cryptocurrencies locked in Solana’s DeFi projects. Last month, the Total Value Locked (TVL) in Solana more than doubled, reaching $2.19 billion.

This growth cannot solely be attributed to the price of SOL. There was also a noteworthy increase of 5.6% in TVL denominated in SOL over the week.

Before the end of the year, there is a price pullback occurring within 24 hours, likely due to investors taking profits. SOL, having had a fantastic year-end, continues to meet investors’ positive expectations with an 87% gain over the past month.

Türkçe

Türkçe Español

Español