Cryptocurrency world, including Solana, continues to show dynamic movements. Solana drew attention by climbing above $150 for the first time since January 2022. However, it experienced a slight pullback, dropping from $152 to about $143. Fortunately, the markets quickly recovered, and it is currently trading around $150.

Are Bitcoin and Ethereum Being Followed?

The rise was influenced by major players like Bitcoin and Ethereum, which also showed similar increases. Bitcoin reached a historic peak above $70,000, while Ethereum approached the $4,000 level for the first time since 2021. Alongside these major cryptocurrencies, Solana’s rise indicates a general recovery and uptrend in the crypto market.

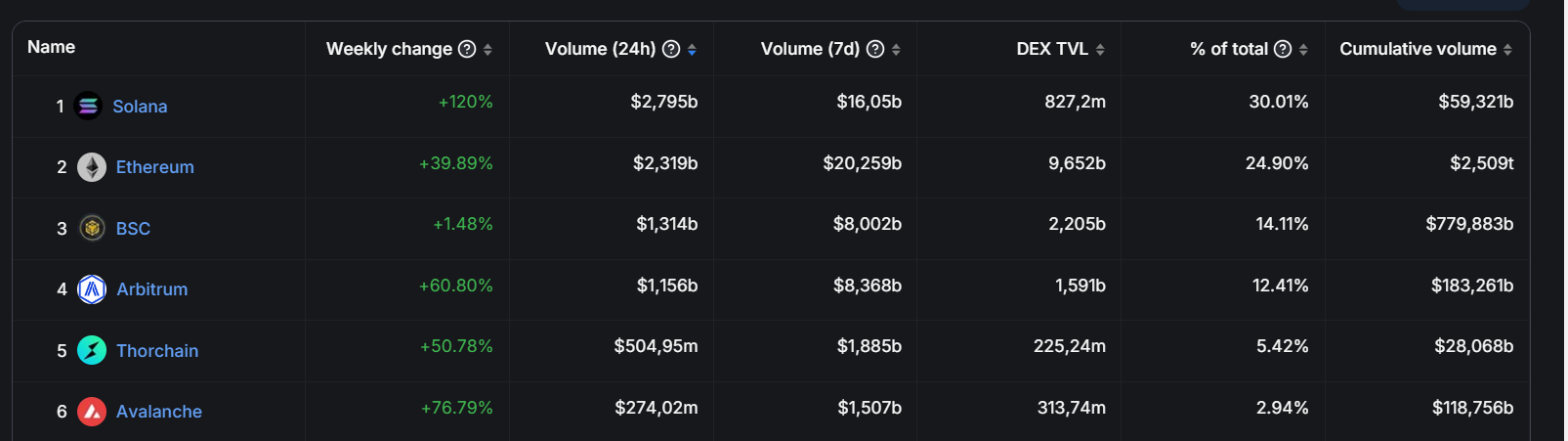

Particularly notable is the record increase in transaction volume on Solana-based decentralized exchanges (DEXs). According to data compiled by Defi Llama, more than $11.19 billion in transactions took place on Solana DEXs between February 24 and March 2. This figure represents a 154% increase compared to the previous seven-day period.

Solana is still far from its all-time high price compared to other major cryptocurrencies like Bitcoin and Ethereum. Compared to its peak in November 2021, Solana is currently trading at 42% lower levels.

Behind Solana’s Rise

What is the main reason behind this rise? Certainly, factors such as Solana’s DeFi transaction volume and the recent surge in Solana-based meme coins play a role, considering Bitcoin’s usual influence on market fluctuations. The popularity of new meme coins like “Jeo Boden” among investors is particularly striking. This makes Solana an attractive destination for those wanting to invest in such meme coins.

The impact of Solana’s DeFi protocols cannot be ignored. With over $3.1 billion in total locked value, Solana’s DeFi protocols demonstrate their influence in this space. It’s noted that low fees on Solana encourage meme coin trading, leading to significant growth in recent months.

Despite all these rises, Solana is still far from its peak in November 2021. However, considering the significant drop in Ethereum’s TVL, the impact and potential of Solana in the DeFi space should be taken into account.