Japanese technology giant Sony’s financial arm, Sony Bank, is considering issuing a yen-backed stablecoin as a payment tool for businesses utilizing intellectual property (IP) within the company. This move follows the stablecoin initiative announced by Ripple yesterday. Let’s delve into the details of this development.

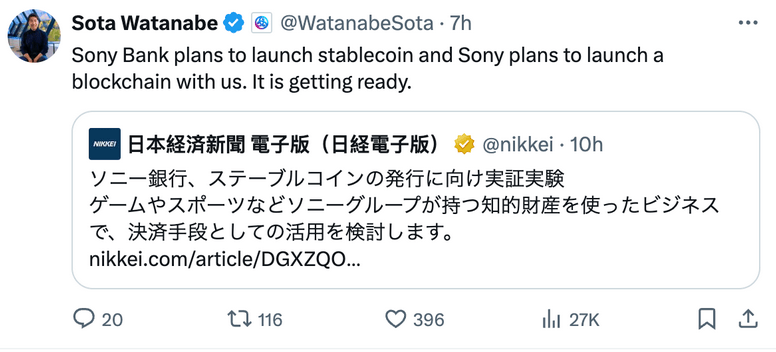

Sony’s Major Move into Stablecoins

Sony Bank has started testing this yen-backed stablecoin, targeting IP payments in gaming and sports within the Sony Group.

According to the development, this trial will be conducted on the Polygon Blockchain, and it was also emphasized that the step was taken in collaboration with the Belgium-based Blockchain company SettleMint.

Sony Network Communications’ President and Representative Director Jun Watanabe confirmed in a post on X that during this trial, Sony Bank will also assess the legal issues that may arise from the transfer of the yen-backed stablecoin.

Widespread Use of Stablecoins

Officials at Sony Bank stated that the use of stablecoins could potentially enable individuals to transfer money with lower fees. They also indicated that this payment method could be considered an option for businesses using Sony Group’s IP.

Sony’s efforts to integrate Web3 technologies into its operations are not limited to this project alone. In March 2023, the company took innovative steps by establishing a framework for the use of NFTs on gaming platforms.

Sony Aims to Establish Its Own Blockchain Network

Sony Network Communications aims to establish its own Blockchain network through a partnership with Singapore-based Web3 infrastructure developer Startale Labs. This move reflects the company’s vision to strengthen the global Web3 infrastructure.

Japanese tech giant Sony’s steps indicate an increasing interest in Web3 technologies within Japan. Last year, Japan’s Ministry of Economy, Trade, and Industry (METI) took strategic steps to encourage domestic investments in Web3 ventures.

Sony Bank’s trial of the yen-backed stablecoin seems to be opening the doors to a new era in financial technology. The company’s steps could lead to significant changes in the management of digital payments and intellectual property rights in the future. Considering Ripple‘s stablecoin move yesterday, the upcoming period could see a preference for stablecoins due to fast and inexpensive transactions.

Türkçe

Türkçe Español

Español